In This Article:

Stocks in the airline space are flying high lately backed by improved unit revenue projections for the first quarter of 2018 provided by key sector players like United Continental Holdings, Inc. UAL, Delta Air Lines, Inc. DAL and Hawaiian Airlines — the wholly owned subsidiary of Hawaiian Holdings, Inc. HA.

Additionally, after much struggles associated with capacity overexpansion, the carriers are experiencing better days now. In fact, February load factors (% of seats filled by passengers) increased for most carriers, thus hinting at a decline in capacity-related woes in the airline space.

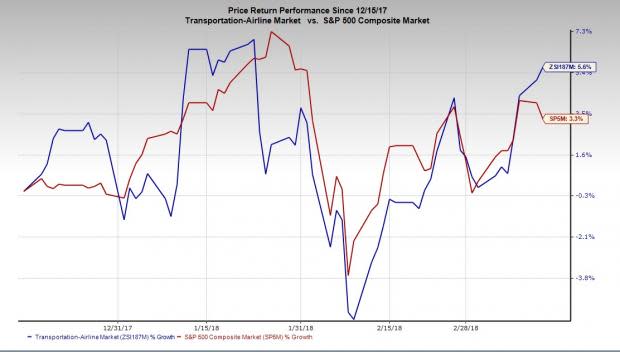

Price Performance

The positivity surrounding the industry is evident from its impressive price performance in the past three months. While the Zacks Airline Industry rallied 5.7%, the S&P 500 index gained 3.3%.

Bullish Q1 Unit Revenue Views Bode Well

Unit revenue guidance for first-quarter 2018 is impressive, highlighting the solid demand for air travel. Notably, United Continental expects current-quarter passenger revenue per available seat miles (PRASM) to grow between 1% and 3% (prior guidance: 0% to 2%). Unit revenue views have also risen at Delta Air Lines. The carrier projects total unit revenues, excluding refinery sales, to increase in the band of 4-5% compared with 2.5-4.5% projected earlier.

Hawaiian Airlines too raised its guidance for first-quarter operating revenue per available seat mile (RASM) owing to better-than-expected passenger revenue performance in each of its geographies and higher cargo demand across the network. The company now expects RASM to increase 3-5%, up from its previous prediction of a decline of 0.5% to a rise of 2.5%. Also, JetBlue Airways Corp. JBLU issued a revised RASM guidance, following its impressive traffic results last month. This low-cost carrier anticipates first-quarter 2018 RASM to improve 3.5-5.5% compared with 2.5-5.5% guided earlier.

Load Factors Rise in February

February traffic reports offer a glimmer of hope to key sector participants after continued struggles in this space. At most carriers, load factors improved as traffic growth was outpaced by capacity expansion, thus leading to packed planes.

Notably, At Delta Air Lines, load factor was up 40 basis points year over year to 81.5% in February, with traffic increasing 3.8% and capacity expanding 3.4%. Higher traffic growth in the same month led to 200 basis points, 340 basis points, 140 basis points and 190 basis points increase in load factor at Southwest Airlines Co., GOL Linhas Aereas Inteligentes S.A., United Continental and Hawaiian Airlines, respectively.

With load factors rising, air fares are expected to rise as well, thus aiding the top line of carriers. Evidently, per reports released by the Bureau of Transportation Services, airfares increased 0.6% in February compared with that in January. The trend is likely to continue in 2018 as airlines face higher fuel costs.

Dividends/Buybacks Bode Well

Currently, carriers are left with huge savings from the reduced corporate tax rate, courtesy of the new tax law. Thus, implying that more cash will be available to fund their capital expenditures, acquisitions and share repurchases, among others. This bodes well for shareholders who are anticipated to gain in the form of dividend hikes and more buybacks.

Meanwhile, the likes of Alaska Air Group, Inc. and SkyWest, Inc. have already announced hikes in their respective dividend payouts for 2018. We expect other carriers to do the same in view of the new tax law (Tax Cuts and Jobs Act).

Zacks Industry Rank Highlights the Bright Picture

The Zacks Industry Rank of 95 (of 250 plus groups) carried by the Zacks Airline Industry also emphasizes the optimistic sentiment revolving around airline stocks. This favorable rank places the companies within the top 37% slot of the Zacks industries.

We classify our entire 250-plus industries into two groups: the top half (i.e. industries with the best average Zacks Rank) and the bottom half (industries with the worst average Zacks Rank).

Using a week’s rebalance, the top half beat the bottom half by a factor of more than 2 to 1 over the last decade. Click here to know more: About Zacks Industry Rank

4 Airline Picks

Given the positive sentiment surrounding airline stocks, we believe that it is prudent to add these companies to one’s portfolio now. However, with multiple carriers present, the task of selecting the right ones for handsome returns is not an easy one. In fact, identifying a winning stock is akin to searching for a needle in a haystack for an investor, in the absence of proper guidance.

This is where the Zacks Rank, which justifies a company's strong fundamentals, can come in really handy. Markedly, the Zacks Rank is a reliable tool that helps investors to trade with confidence regardless of their trading style and risk tolerance. To learn more about how you can use this proven system for market-beating gains, visit Zacks Rank Education.

Based on favorable Zacks Ranks (#1 or 2), we have zeroed in on four airline stocks which should be present in one’s portfolio for handsome returns.

American Airlines Group Inc. AAL is a major U.S. airline headquartered in Fort Worth, TX. The company has a market capitalization of $24.03 billion and a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the last 30 days, the company has seen the Zacks Consensus Estimate for first-quarter earnings move up 5.7%. Additionally, its estimate for full-year earnings has been revised upward 1.9% over the same time frame.

Moreover, the company has a VGM Score of B. Here V stands for Value, G for Growth and M for Momentum and the score is a weighted combination of these three scores. Such a score allows you to eliminate the negative aspects of stocks and select winners. However, it is important to keep in mind that each Style Score will carry a different weight while arriving at a VGM Score.

Delta Air Lines is another major US airline with its headquarters on the northern boundary of Hartsfield-Jackson Atlanta International Airport, within the city limits of Atlanta, GA. The company has a market capitalization of $39.39 billion and a Zacks Rank of 2. Also, it exhibits a VGM Score of B.

The company has seen the Zacks Consensus Estimate for first-quarter earnings being revised upward 1.3% in the last 30 days. For the full year, the earnings estimate has been revised 6.4% northward in the same period.

International Consolidated Airlines Group SA ICAGY is a holding company for Aer Lingus, British Airways, Iberia and Vueling and is based in London, United Kingdom. The company flaunts a Zacks Rank #1 and has a market capitalization of $6.97 billion.

The company has seen the Zacks Consensus Estimate for first-quarter earnings being revised upward 17.6% in the last 60 days. The same for full-year earnings also climbed around 9% in the same time period.

LATAM Airlines Group S.A. LTM is a South American holding company offering domestic and international passenger and cargo air services. The company has a market capitalization of $7.72 billion and a Zacks Rank of 2. It also has an impressive VGM Score of B.

Can Hackers Put Money INTO Your Portfolio?

Earlier this month, credit bureau Equifax announced a massive data breach affecting 2 out of every 3 Americans. The cybersecurity industry is expanding quickly in response to this and similar events. But some stocks are better investments than others.

Zacks has just released Cybersecurity! An Investor’s Guide to help Zacks.com readers make the most of the $170 billion per year investment opportunity created by hackers and other threats. It reveals 4 stocks worth looking into right away.

Download the new report now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JetBlue Airways Corporation (JBLU) : Free Stock Analysis Report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

United Continental Holdings, Inc. (UAL) : Free Stock Analysis Report

Hawaiian Holdings, Inc. (HA) : Free Stock Analysis Report

American Airlines Group, Inc. (AAL) : Free Stock Analysis Report

International Consolidated Airlines Group SA (ICAGY) : Free Stock Analysis Report

LATAM Airlines Group S.A. (LTM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research