Previewing the Q3 Earnings Season

Costco COST shares were down following the company’s mixed quarterly release where it narrowly missed on the top-line even as it handily beat bottom-line estimates. Other than the modest revenue miss, there is not a whole lot in the report that Costco shareholders can complain about, as the company continues to deliver impressive results in a consumer spending backdrop that many of its peers are finding challenging.

Costco’s quarterly earnings were up +6.1% on +1% higher revenues, with comparable same-store sales up +5.3% and +5.5% in the U.S. and Canada, respectively. Costco continues to outperform with double-digit gains in discretionary categories like jewelry, furniture, tires, etc., and is seeing strong momentum on the digital side where comps were up +19.5%.

The pullback in Costco shares following the release is primarily a function of the stock’s premium valuation following an impressive year-to-date run. The stock has handily outperformed the Zacks Retail sector and the broader market in the year-to-date period, up +34.7% vs. +20.3% for the Zacks Retail sector and +20.5% for the S&P 500 index.

Costco shares are trading at 50.8X forward 12-month consensus EPS estimates, which compares to a 5-year low of 29.5X, high of 55.8X, and median of 35.9X. Such a premium valuation could be justified given Costco's high-income consumer base and operating excellence, but it nevertheless requires spotless results. Costco’s results were good, but they weren’t spotless, as the revenue miss shows.

The Costco report was for its fiscal fourth quarter that ended on September 1st, which we and other data vendors consider part of the Q3 tally. The results in recent days from FedEx FDX, Oracle ORCL, and others were also for the companies’ fiscal quarters ending in August and, therefore, get counted as part of our overall 2024 Q3 earnings season tally. As we have noted in this space before, the Oracle report was really impressive while the FedEx release represented the opposite.

Including Costco, FedEx, Oracle, and others, we now have such Q3 results from 14 S&P 500 members, with another 6 index members on deck to report results this week. The notable companies reporting this week include Nike, Conagra, Constellation Brands, and others.

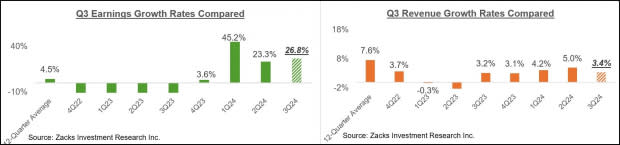

Total Q3 earnings for these 14 index members that have reported already are up +26.8% from the same period last year on +3.4% higher revenues, with 71.4% beating EPS estimates and 78.6% beating revenue estimates.

The comparison charts below put the Q3 earnings and revenue growth rates for these 14 index members in a historical context.

Image Source: Zacks Investment Research

The comparison charts below put the Q3 EPS and revenue beats percentages for these 14 index members in a historical context.

Image Source: Zacks Investment Research

Given how small and unrepresentative the sample size is, it is premature to look for any trends at this early stage in the reporting cycle. But it is nevertheless a good enough start.

The Earnings Big Picture

Total Q3 earnings for the S&P 500 index are expected to be up +3.34% from the same period last year on +4.5% higher revenues. This would follow the +10% earnings growth for the index in the preceding period on +5.5% higher revenues.

Regular readers of our earnings commentary are familiar with our sanguine view on corporate profitability; the earnings picture isn’t great, but it isn’t bad either.

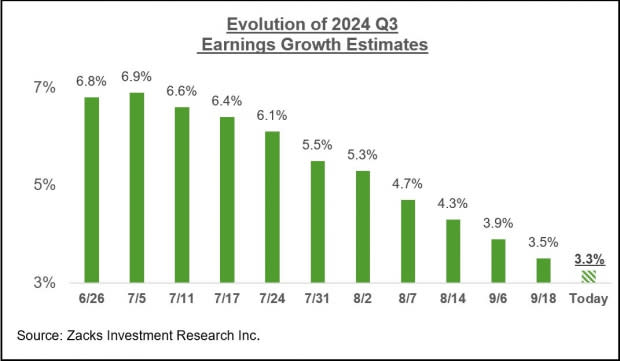

The one recent negative development on this front is the reversal of the earlier favorable revisions trend that we have regularly flagged in our commentary. This negative revisions trend is particularly notable with respect to expectations for 2024 Q3, with earnings estimates for the period getting revised down a lot more than we had seen in other recent periods. You can see this in the chart below that tracks the evolution of Q3 earnings growth expectations over the last couple of months.

Image Source: Zacks Investment Research

Not only is the magnitude of cuts to Q3 estimates bigger than what we saw in the comparable periods for the last three quarters, but it is also widespread and not concentrated in one or a few sectors.

Of the 16 Zacks sectors, estimates have been revised down for 14 sectors, with the Transportation, Energy, Business Services, and Aerospace sectors suffering the biggest declines. The Tech and Finance sectors are the only sectors whose estimates have modestly risen since the period got underway.

The chart below shows the Q3 earnings and revenue growth expectations in the context of what we saw in actual results over the preceding four quarters and what is expected over the following three quarters.

Image Source: Zacks Investment Research

Notwithstanding the aforementioned negative revisions trend, the expectation is for an accelerating growth trend over the coming periods. Also, the aggregate earnings total for the period is expected to be a new all-time quarterly record, as the chart below shows.

Image Source: Zacks Investment Research

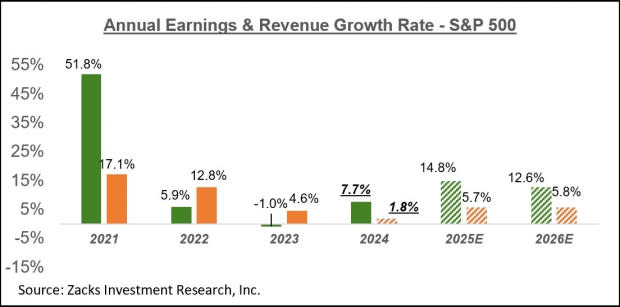

The chart below shows the overall earnings picture on a calendar-year basis, with the +7.7% earnings growth this year followed by double-digit gains in 2025 and 2026.

Image Source: Zacks Investment Research

Please note that this year’s +7.7% earnings growth improves to +9.6% on an ex-Energy basis.

Expectations for the Magnificent 7 and the Tech Sector

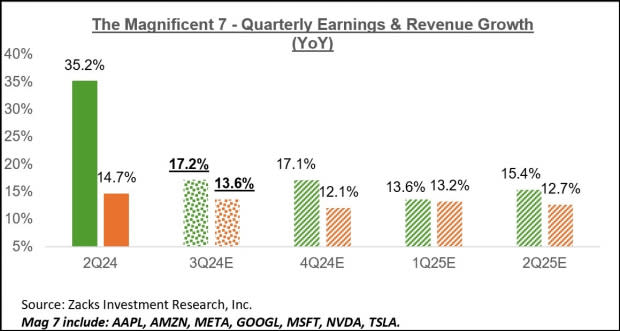

Tesla will be the first Mag 7 company to report Q3 results on October 16th, with most of its peers in the elite grouping reporting in the following two weeks.

For Q3, Mag 7 earnings are expected to be up +17.2% from the same period last year on +13.6% higher revenues. The chart below shows the group’s Q3 earnings and revenue growth expectations in the context of what we saw in the preceding period and what is expected in the coming three quarters.

Image Source: Zacks Investment Research

Q3 earnings from the Mag 7 will account for 21.4% of all S&P 500 earnings in the quarter. Excluding the Mag 7 contribution, Q3 earnings for the rest of the index would be essentially flat from the year-earlier period.

On an annual basis, Mag 7 earnings are expected to be up +30.7% this year on +10% higher revenues, with earnings expected to be up +16.4% in 2025 and +17.9% in 2026.

Excluding the Mag 7, 2024 earnings for the rest of the S&P 500 index would be up +2.6% (+7.7% otherwise).

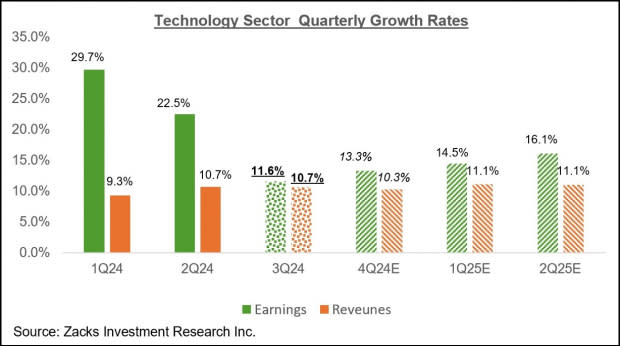

For the Zacks Tech sector, Q3 earnings are expected to be up +11.6% from the same period last year on +10.7% higher revenues. The chart below shows the sector’s earnings and revenue growth expectations on a quarterly basis.

Image Source: Zacks Investment Research

The chart below shows the sector’s earnings growth on an annual basis.

Image Source: Zacks Investment Research

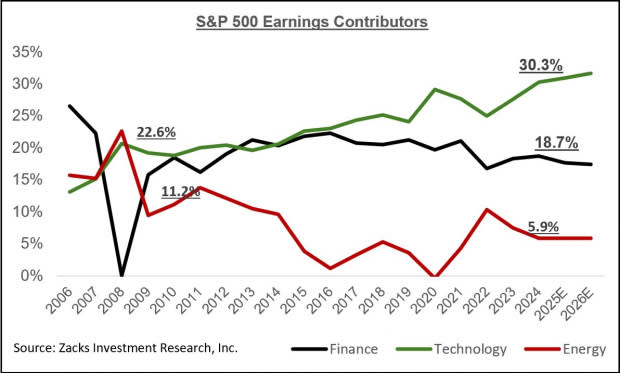

The U.S. stock market is unique within the OECD group, as the Tech sector accounts for 39.4% of the S&P 500 index (by market capitalization). The sector is not only very profitable but also enjoying robust and sustainable growth momentum.

The chart below shows the earnings contribution of the Zacks Tech sector relative to the same by the Zacks Finance and Energy sectors.

Image Source: Zacks Investment Research

For a detailed look at the overall earnings picture, including expectations for the coming periods, please check out our weekly Earnings Trends report >>>> Q3 Earnings Season: A Look Ahead

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Oracle Corporation (ORCL) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

FedEx Corporation (FDX) : Free Stock Analysis Report