Prediction: The S&P 500 Has Already Peaked for the Year. Here's What Investors Can Do to Keep From Falling Behind

On Tuesday, July 16, 2024, the S&P 500 closed at a new all-time high of 5,667. In my opinion, that was it right there. The top is in; the benchmark index will not close above that level again in 2024.

Here's why -- and what you can do about it.

The economy is likely headed for a recession

Recessions are inevitable -- and pretty frequent. Opinions vary, but on average, the U.S. economy enters a recession about every four to six years. And, wouldn't you know it, we're right on schedule for a downturn: The latest recession began in early 2020, brought on by the COVID pandemic.

In addition to the timing, there are many other reasons to think a recession is imminent. Leading economic indicators are flashing warning signs. The unemployment rate has sharply increased in recent months. Long-term interest rates are falling -- a sign that the bond market anticipates slower economic growth.

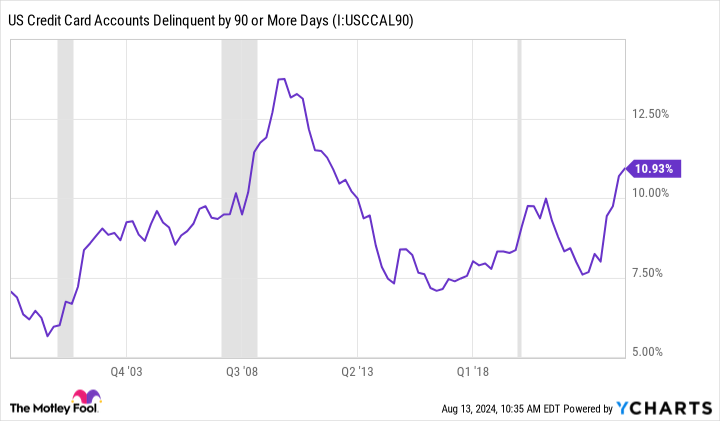

There are also signs that the financial health of the U.S. consumer is deteriorating. More borrowers are struggling to pay back what they owe. Auto loan delinquencies have risen. U.S. credit card accounts delinquent by 90 days or more hit 10.9% last month. That's the highest level in more than 10 years.

US Credit Card Accounts Delinquent by 90 or More Days data by YCharts.

In short, dark macroeconomic clouds are gathering. It doesn't mean a nasty storm is inevitable -- but many signs point to rain on the way.

Why a recession is bad news for the stock market

To put it simply, when the U.S. economy sneezes, the stock market gets a cold. The stock market is -- at its most basic level -- a barometer for the economic conditions in the American economy. As economic conditions improve, the economic health of the individual companies that make up the stock market also improves. A roaring economy means more sales and profits for American companies. That, in turn, drives up the price that investors are willing to pay for their stock.

When a recession -- or fear of an upcoming recession -- arrives, stock prices fall as investors reset their expectations for future revenue and earnings. What's more, severe recessions can lead the economy into a negative feedback loop where falling profits drive companies to cut jobs, which leads to more unemployed people, who then cut back on spending, which lowers corporate profits and leads to more job losses.

That's why recessions are often accompanied by stock market sell-offs, corrections, or, in the worst-case scenario, a stock market crash.

What investors can do about it

First things first: Don't panic.

Granted, stock market volatility is unsettling. No one wants to see their hard-earned investments lose value. Yet, successful investors focus on the long term, not the day-to-day or even month-to-month swings in the stock market. As Peter Lynch once pointed out, "Far more money has been lost by investors in preparing for corrections, or anticipating corrections, than has been lost in the corrections themselves."

His advice is sound: Keep on investing.

The stock market has always recovered from a correction -- even from crashes -- and made a new high, eventually.

By adopting disciplined investing habits -- like dollar-cost averaging -- people can continue to make wise money choices even when headlines are scary and watchlists are bleeding red.

Should you invest $1,000 in S&P 500 Index right now?

Before you buy stock in S&P 500 Index, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P 500 Index wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $763,374!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Jake Lerch has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Prediction: The S&P 500 Has Already Peaked for the Year. Here's What Investors Can Do to Keep From Falling Behind was originally published by The Motley Fool