How Should You Play J&J (JNJ) Stock After Q2 Earnings Beat?

Southwest Gas Corporation depends on interstate pipeline transportation capacity to meet customer demands and any disruption in the pipeline services can adversely impact its operations. If the cash flow of its operating subsidiaries is lower than expected, it will affect the company’s performance. Additional expenses due to inflationary pressure might lower profitability. Still-high interest rate is a concern. Our model predicts SWX’s operating expenses to increase during 2025-2026. Shares of the company have underperformed the industry in the past three months. However, the company makes investments to strengthen infrastructure and accretive acquisitions will boost its performance. It rewards its shareholders through dividend hikes and share buybacks. It is also gaining from improvements in economic conditions in its service areas.

Southwest Gas Corporation, incorporated in March 1931, is a regulated utility that provides natural gas services and has a wholly owned subsidiary, the Paiute Pipeline Company, through which it operates a pipeline transmission system.

In April 2024, the company completed its split of one of its business segments, Centuri Group, Inc. The company executed an initial public offering ("IPO") of 14,260,000 shares of Centuri's common stock at a price to the public of $21 per share. SWX retained nearly 81% interest in Centuri Holdings stock.

Southwest Gas Holdings, Inc. is an energy holding company based in Las Vegas, NV. The company makes deliveries of natural gas under a priority system established by state regulatory commissions, which aims the higher-priority customers, primarily residential customers and while other customers who use 500 therms or less of gas per day are given greater importance.

Residential and Small Commercial customers contributed 85% to the operating margin in 2023. Other sales customers and Transportation contributed 4% and 11%, respectively.

Demand for natural gas during the winter months is generally higher than the summer months. The company systematically acquires and arranges delivery of natural gas to its system in sufficient quantities to meet customers’ needs. Southwest acquires natural gas from a wide variety of sources with a mix of purchase provisions, which include spot market and firm supplies. During 2023, Southwest acquired natural gas from 48 suppliers with the objective to ensure adequate supply of natural gas at a reasonable price.

As of Dec 31, 2023, the company purchased and distributed natural gas to 2,226,000 customers in Arizona, Nevada and California.

Southwest Gas strategically plans its investment to meet the growing demand for safe, reliable and affordable energy solutions. The company expects a capital investment of $2.4 billion during 2024-2026. In 2023, it made capital investments of $750 million, up 6% from the 2022 level. The capital expenditure for 2024 is expected to be $830 million to support customer growth, system improvements and pipe replacement programs.

A substantial amount of the planned investment will be utilized for pipeline replacement activities, allowing it to serve its expanding customer base efficiently. In the past six months, SWX’s shares have risen 21.4% compared with the industry’s growth of 3.4%.

The company’s natural gas operations have a diversified and growing customer base in the three states, namely Arizona, Nevada and California. Owing to strong economic growth across its service areas, the company installed 40,000 first-time meter sets during the last twelve months as of March 2024. The ongoing increase in the customer base will drive demand and performance for the company. Owing to strong performance and refreshed rate structures, the company expects adjusted net income to grow 10-12% during 2024-2026.

Residential and small commercial customers account for more than 99% of the company’s total customer base. Improvements in economic conditions, strong demographics, the continued expansion of its customer base and the decoupled rate structure in all three states where the company operates are going to drive its performance. The company expects rate base growth of 6.5-7.5% over the next three years. Owing to strong economic conditions in Southwest and increased demand, our model predicts SWX’s total operating revenues to increase 0.2%, 4% and 4.1% in 2024, 2025 and 2026, respectively.

On Mar 1, 2022, the company’s board of directors announced to separate Centuri from Southwest Gas Holdings to become a fully regulated natural gas business with a continued focus to offer robust, consistent risk-adjusted total returns, including a competitive dividend. This spinoff will further improve capital allocation opportunities, reduce future equity financing needs of the company and provide strategic flexibility to lead to the energy transition to reduce transportation emissions.

On Apr 22, 2024, Southwest Gas closed the IPO of Centuri of 14,260,000 shares of Centuri's common stock at a price to the public of $21 per share, including the underwriters' full exercise of their option to purchase 1,860,000 shares to cover over-allotments. Shares of Centuri's common stock are trading on the New York Stock Exchange under the symbol "CTRI". Post IPO, Southwest Gas continues to own nearly 81% interest in Centuri Holdings stock.

The consistent performance of the company enabled it to reward its shareholders through annual dividend rate hikes and increase the value for shareholders. Currently, its quarterly dividend is 62 cents per share, resulting in an annualized rate of $2.48 per share.

The utility has been paying dividends since 1956 and has raised its dividend consecutively since 2007. Also, it targets a steady dividend payout ratio of 55-65% in the long term. The company’s current dividend yield of 3.35%, which is better than the Zacks S&P 500 composite’s yield of 1.27%.

Cash and cash equivalents as of Mar 31, 2024 were $457.9 million compared with $106.5 million as of Dec 31, 2023. The current ratio of Southwest Gas was 1.04 at the end of the first quarter of 2024. The financial flexibility of the company will allow it to meet its near-term debt obligations handily.

The company’s strategic investment plans and consistent customer additions to its natural gas segment will further boost its financials. Also, its regular dividend hike acts as a tailwind.

Southwest Gas depends on access to interstate pipelines’ transportation capacity, which, if unavailable, could impact its ability to meet customers’ requirements. It needs to have both sufficient natural gas supplies and an interstate pipeline capacity to meet demand. A prolonged interruption or reduction of interstate pipeline service during the peak demand seasons could reduce cash flow and earnings.In the past three months, SWX’s shares have declined 1.6% against the industry’s growth of 8.4%.

The utility’s operations are subject to cyber-based security risk. Any disruptive action or breaches may interrupt the company’s operations, causing property damages and theft of sensitive customer information. Thus, the utility might experience a loss of revenues, a hike in operating costs to repair damaged equipment or increased legal costs along with a tainted reputation. If these costs are not recoverable in customer rates or there are delays in recoverability due to regulatory lags, it can have a negative impact on the utility’s operating and financial results. Our model projects operating expenses in 2025 and 2026 will increase by 2.1% and 3.6% year-over-over respectively.

Southwest Gas does not own any significant assets other than the stock of operating subsidiaries, thus making it dependent on its units to meet its financial needs. Also, the company’s ability to pay dividends depends on its units’ net income and cash flows.

The company is also exposed to the risk of changing interest rates. Still-high interest rates will increase SWX’s borrowing cost and can also have an adverse effect on the company's operating and financial results.

As inflation persists, Southwest Gas’ Utility Infrastructure segment has faced significant inflationary pressures and customer supply-chain challenges in the past and may continue to do so in the future. This might lead to an increase in other operating, general and administrative expenses and lower profitability.

Dependence on interstate pipelines’ transportation capacity and still-high interest rates acts as a headwind. Also, its operations are subject to cyber-based security risks.

Southwest Gas depends on access to interstate pipelines’ transportation capacity, which, if unavailable, could impact its ability to meet customers’ requirements. It needs to have both sufficient natural gas supplies and an interstate pipeline capacity to meet demand. A prolonged interruption or reduction of interstate pipeline service during the peak demand seasons could reduce cash flow and earnings.

The utility’s operations are subject to cyber-based security risk. Any disruptive action or breaches may interrupt the company’s operations, causing property damages and theft of sensitive customer information. Thus, the utility might experience a loss of revenues, a hike in operating costs to repair damaged equipment or increased legal costs along with a tainted reputation. If these costs are not recoverable in customer rates or there are delays in recoverability due to regulatory lags, it can have a negative impact on the utility’s operating and financial results.

Southwest Gas does not own any significant assets other than the stock of operating subsidiaries, thus making it dependent on its units to meet its financial needs. Also, the company’s ability to pay dividends depends on its units’ net income and cash flows.

The company is also exposed to the risk of changing interest rates. An increasing interest rate will increase SWX’s borrowing cost and can also have an adverse effect on the company's operating and financial results.Southwest Gas’ Utility Infrastructure segment had to face significant inflationary pressures and customer supply chain challenges. The inflationary cost increases in fuel and subcontractors, along with some unanticipated project-specific job site conditions, adversely impacted productivity.

Southwest Gas Q1 Earnings Miss Estimates, Sales Beat

Southwest Gas Holdings Inc. recorded first-quarter 2024 operating earnings of $1.37 per share, which missed the Zacks Consensus Estimate of $1.70 by 19.4%. The bottom line also decreased 22.6% from the year-ago quarter’s figure of $1.77.

Total Revenues

Operating revenues totaled $1.581 billion in the quarter, which surpassed the Zacks Consensus Estimate of $1.578 billion by 0.2%. However, the top line decreased 1.4% from $1.603 billion in the prior-year quarter.

Highlights of the Release

Utility infrastructure services expenses were $515.6 million, down 14.6% from the year-ago quarter’s level of $603.7 million.

The total operating loss was $21.9 million against the income of $11.7 million in the year-ago quarter.

Total system throughput in the first quarter was 76.8 million dekatherms, down 13.1% year over year.

On Apr 22, 2024, Southwest Gas announced the closing of Centuri's initial public offering (IPO) of 14,260,000 shares of Centuri's common stock, including shares issued as part of the full exercise of the underwriters' over-allotment option, at an IPO price of $21 per share.

Financial Highlights

Cash and cash equivalents, as of Mar 31, 2024, were $457.9 million compared with $106.5 million as of Dec 31, 2023.

The long-term debt, less current maturities, amounted to $4.65 billion as of Mar 31, 2024 compared with $4.61 billion as of Dec 31, 2023.

Southwest Gas’ net cash provided by operating activities in the first three months of 2024 was $543.7 million against cash used of $185.7 million in the year-ago period.

2024 Guidance

Southwest Gas’ guidance for the Natural Gas Distribution segment’s net income in 2024 is in the range of $228-$238 million. The 2024 capital expenditure is expected to be $830 million to support customer growth, system improvements and pipe replacement programs.

Capital expenditure is expected to be $2.4 billion for 2024-2026. The utility rate base is projected to witness a CAGR in the range of 6.5-7.5%.

On Apr 8, 2024, Southwest Gas Holdings announced that its unit, Centuri, is seeking to raise as much as $315 million in an initial public offering and concurrent private placement. Centuri plans to offer 12.4 million shares for $18-$21 each.

The unit has been approved to list its shares on the New York Stock Exchange under the ticker symbol "CTRI." After the completion of the IPO, Southwest Gas will continue to own approximately 82.7% of Centuri's outstanding common shares.

Southwest Gas shares are up 24.2% in the past six months period and up 10.8% over the trailing 12-month period. Stocks in the Zacks sub-industry is up 12.9% and the Zacks Utilities sector is down 9.3% in the past six months period. Over the past year, the Zacks sub-industry is up 0.6%, whereas the sector is down by 2.3%.

The S&P 500 index is up 11.1% in the past six months period and up 19.6% in the past year.

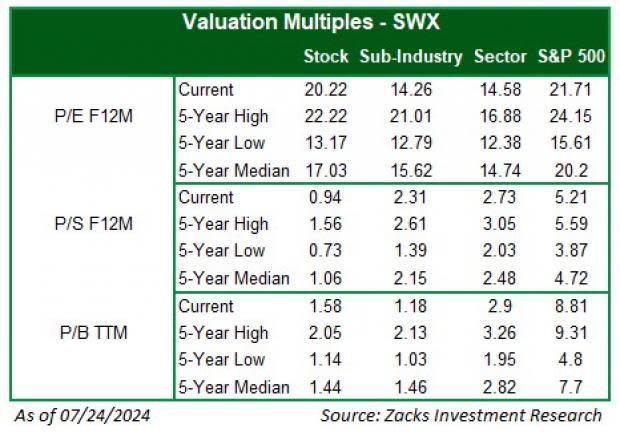

The stock is currently trading at 20.22X forward 12-months earnings, which compares with 14.26X for the Zacks sub-industry, 14.58X for the Zacks sector and 21.71X for the S&P 500 index.

Over the past five years, the stock has traded as high as 22.22X and as low as 13.17X, with a 5-year median of 17.03X.

Our Underperform recommendation indicates that the stock will perform worse than the market. Our $63 price target reflects 17.26X forward 12-months earnings.

The table below shows summary valuation data for SWX.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Moderna, Inc. (MRNA) : Free Stock Analysis Report

Kenvue Inc. (KVUE) : Free Stock Analysis Report