PEP Q3 Earnings Beat Estimates, Subdued Category Demand Hurt Sales

PepsiCo, Inc. PEP has reported robust third-quarter 2024 results, wherein earnings surpassed the Zacks Consensus Estimate and improved year over year. However, the company’s top line missed the consensus mark and declined year over year. Top-line results have been mainly affected by subdued category demand in its convenient food business and the impacts of a product recall in the QFNA segment.

PepsiCo’s third-quarter core EPS of $2.31 beat the Zacks Consensus Estimate of $2.30 and increased 2.7% year over year. In constant currency, core earnings improved 5% from the year-ago period. The company’s bottom line benefited from effective cost controls, driven by incremental investments to improve market competitiveness. The company’s reported EPS of $2.13 declined 5% year over year in the quarter. Foreign currency impacted EPS by 2%.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

The company continued to benefit from gains in its international business, which delivered significant year-over-year volume growth and organic revenue growth of 4%. The international business also reported an expansion of 60 basis points (bps) in the core operating profit margin.

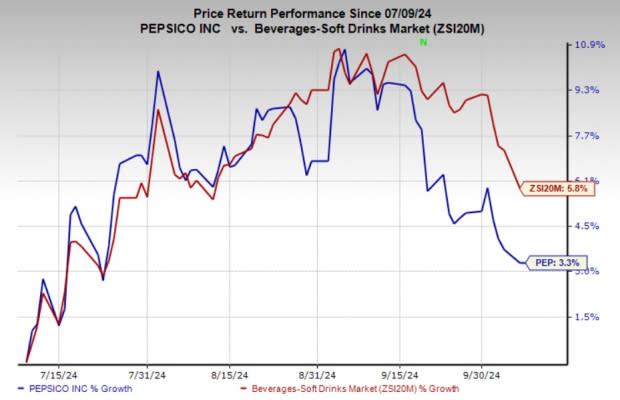

Shares of PepsiCo declined 1% in the pre-market session today, driven by continued softness in the top line and a lowered sales forecast for 2024. Shares of the Zacks Rank #3 (Hold) company have risen 3.3% in the past three months compared with the industry’s 5.8% growth.

Image Source: Zacks Investment Research

A Peek Into PEP’s Q3 Details

Net revenues of $23.3 million dipped 0.6% year over year and missed the Zacks Consensus Estimate of $23.9 billion. Revenues continued to be affected by weak category demand in its North America convenient food business, ongoing recall-related issues at QFNA and business disruptions caused by escalating geopolitical tensions in some international markets.

Unit volume was down 2% each for the convenient food business and the beverage business. Foreign currency impacted revenues by 2%.

On an organic basis, revenues grew 1.3% year over year, significantly below organic revenue growth of 8.8% in third-quarter 2023. The variance mainly resulted from a soft QFNA performance, which was impacted by certain product recalls and subdued category demand. The company’s consolidated organic volume was down 2%, while effective net pricing improved 3% in the third quarter.

Our model predicted year-over-year organic revenue growth of 3.7% for the third quarter, with a 4.6% gain from price/mix and a 0.9% decline in volume.

PepsiCo, Inc. Price, Consensus and EPS Surprise

PepsiCo, Inc. price-consensus-eps-surprise-chart | PepsiCo, Inc. Quote

On a consolidated basis, the reported gross profit increased 1.1% year over year to $12.92 billion. The core gross profit rose 1.4% year over year to $12.95 million. The reported gross margin expanded 94 bps, whereas the core gross margin expanded by 111 bps.

We anticipated the core gross margin to expand 40 bps year over year to 54.8% in the third quarter. In dollar terms, core gross profit was expected to increase 3.3% year over year.

The company reported an operating income of $3.87 billion, which declined 4% year over year. The core operating income grew 3.6% year over year to $4.02 billion. The core constant-currency operating income also improved 6% year over year. The reported operating margin contracted 51 bps from the year-ago quarter. Meanwhile, the core operating margin expanded 73 bps, driven by holistic productivity initiatives, offset by planned business investments.

Our model predicted core SG&A expenses of $9 billion, which indicated year-over-year growth of 3.2%. As a percentage of sales, core SG&A expenses were anticipated to be 37.5%, suggesting a 20-bps rise from the prior-year quarter.

We expected a core operating margin of 17.3%, implying a 10-bps increase from the year-ago quarter’s actual.

PEP’s Segmental Details

PepsiCo witnessed revenue declines on a reported basis across most of the operating segments, except for PBNA and Europe.

Revenues on a reported basis improved 7% year over year in Europe and were flat in PBNA. However, reported revenues declined 1% at FLNA, 13% at QFNA, 5% in Latin America, 4% at AMESA, and 2% at the APAC segment.

PEP’s organic revenues improved across most of the operating segments, except for FLNA, QFNA and APAC. Organic revenues rose 1% for PBNA, 3% for Latin America, and 6% each for the Europe and AMESA segments. However, organic revenues declined 1% for FLNA, 13% for QFNA and 1% for the APAC segment.

Financials of PepsiCo Show Stability

PepsiCo ended third-quarter 2024 with cash and cash equivalents of $7.3 billion, long-term debt of $38.5 billion, and shareholders’ equity (excluding non-controlling interest) of $19.5 billion.

Net cash provided in operating activities was $6.2 billion as of Sept. 7, 2024, compared with $7.6 billion as of Sept. 9, 2023.

PepsiCo’s Outlook for 2024

Driven by the subdued performance across categories, soft year-to-date results and the outlook for the fourth quarter, PepsiCo lowered its sales view for 2024. The company expects year-over-year organic revenue growth in the low-single digits for 2024 compared with the prior view of 4% growth. It reiterated its forecast of core constant-currency EPS growth of at least 8% from the year-ago period’s reported figure.

Based on the current rates, PEP expects currency headwinds to hurt revenues and the core EPS by 1 percentage point in 2024. The company expects a core effective tax rate of 20% for 2024.

Given the above assumption, PepsiCo expects a core EPS of at least $8.15 for 2024. This suggests a 7% increase from the core EPS of $7.62 reported in 2023.

PepsiCo has been committed to rewarding shareholders through dividends and share buybacks. It expects to return a value worth $8.2 billion in 2024, including $7.2 billion of dividends. Additionally, the company plans to repurchase shares worth $1 billion in 2024.

Don’t Miss These Better-Ranked Stocks

We have highlighted three better-ranked stocks from the Consumer Staple sector, namely Coca-Cola KO, Diageo DEO and The Boston Beer Company SAM.

Coca-Cola currently carries a Zacks Rank #2 (Buy). KO shares have rallied 10.1% in the past three months. The company has a trailing four-quarter earnings surprise of 4.7%, on average. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Coca-Cola’s current financial-year sales and earnings suggests growth of 0.6% and 6%, respectively, from the year-ago period’s reported figures.

Diageo currently has a Zacks Rank #2. DEO shares have risen 7.6% in the past three months.

The Zacks Consensus Estimate for Diageo’s current financial-year EPS suggests growth of 1.2% from the year-ago period’s reported figures. However, the consensus mark for 2024 sales suggests a 5.2% decline year over year.

Boston Beer currently carries a Zacks Rank #2. SAM shares have declined 6.2% in the past three months. SAM has a trailing four-quarter earnings surprise of 155.1%, on average.

The Zacks Consensus Estimate Boston Beer’s current financial-year sales and earnings suggest growth of 0.6% and 34.6%, respectively, from the year-ago period's reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CocaCola Company (The) (KO) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Diageo plc (DEO) : Free Stock Analysis Report

The Boston Beer Company, Inc. (SAM) : Free Stock Analysis Report