Peacock's $110 Million NFL Playoff Gamble Pays Off, Tripled Subscriber Growth in Q1 While Still Cutting Losses

We knew NBCUniversal's decision to pay the NFL $110 million for the rights to an exclusive playoff game on Peacock drew a big audience and a lot of signups, but was it worth it in the end?

The answer seems to be yes, after NBCU parent company Comcast reported a tripling of Peacock Q1 signups amid an overall reduction in first-quarter losses for the subscription streaming platform.

Also read: Comcast Earnings Flat as Video, Broadband Subscriber Losses Continue

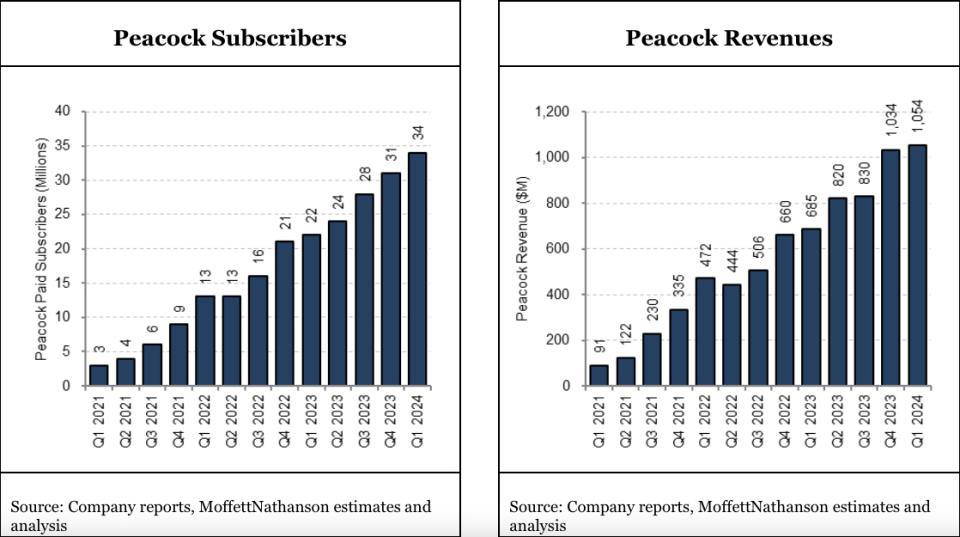

Peacock added 3 million subscribers from January - March to finish the quarter with 34 million subscribers. It added only 1 million customers in the first quarter of 2023.

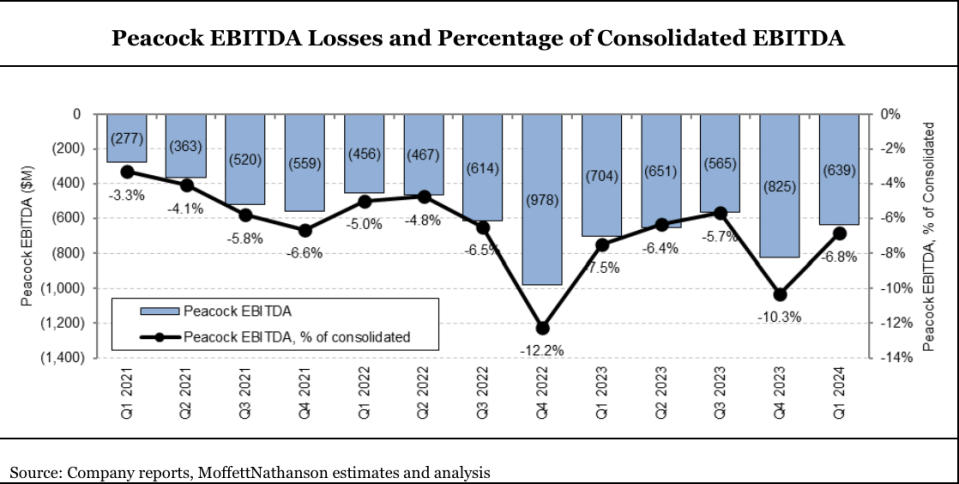

Meanwhile, despite the huge nine-figure outlay, Peacock lost less money in Q1 than it did in the first quarter of last year, experiencing an EBITDA loss of $639 million from January - March vs. $704 million for the same period of 2023.

Peacock revenue in the quarter was only up year over year by 54% to $1.054 billion, a performance that surpassed the typically strongest fourth quarter.

NBCU declared the Peacock exclusive presentation of the Jan. 13 Wild Card game, played in freezing conditions, the "biggest live-streamed event in U.S. history."

In a note to investors Thursday, equity analyst Craig Moffett argued that Peacock is still "sub-scale" at only 34,000 users. And losses "remain stubbornly high."

But Comcast, he added, has the balance sheet that gives it something streaming competitors including Warner Bros. Discovery do not have -- time.

"If Comcast really wants to pursue an own-the-customer DTC strategy, they can afford to wait to see what opportunities arise," Moffett wrote.