Is Palantir the Best Artificial Intelligence (AI) Stock to Buy Amid a Market Sell-Off?

Palantir (NYSE: PLTR) generated buzz as one of the best artificial intelligence (AI) stocks in the market. Although its AI software has been widely used for years, its latest product, the Artificial Intelligence Platform (AIP), has been a massive success.

AIP helps businesses incorporate AI throughout all levels of the decision-making process and can even automate some tasks. Many companies are looking for this program to take their business to the next level, but is the demand enough to take Palantir's stock to the next level?

Palantir's software has seen increased demand recently

Palantir has been selling AI software for much longer than most of its competitors, which gives it a leg up on its competition. It started off as a software program intended for government use, with the simple concept of data in and insights out. This helped guide real-time decision-making by ensuring the people making the choices had the best possible information in front of them.

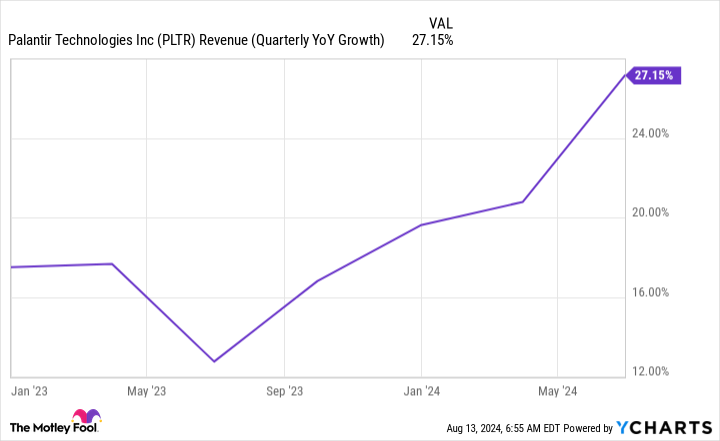

Eventually, Palantir expanded this software to the civilian side and has grown steadily since then. But it's AIP that is causing Palantir's sales to rapidly increase.

Palantir's management consistently used the word "unprecedented" when it comes to AI demand from AIP. This strength has particularly come from the U.S. commercial side, which saw customer count increase 83% year over year and revenue rise 55% year over year. However, Palantir's customer count isn't as high as many businesses. Even though its customer count nearly doubled year over year, it only has 295 U.S. commercial customers.

This shows that Palantir has a lot of growth potential, which is exciting for investors.

Still, government revenue makes up more than half of Palantir's total and rose at a 23% pace. It was powered by U.S. government revenue, which saw the highest demand since 2022.

No matter how you look at it, Palantir's Q2 results were phenomenal. However, management thinks its growth may slow in Q3. Third-quarter revenue is expected to be about $699 million, indicating growth of 25%. While that's less than Q2's growth rate, management has consistently beaten its guidance. So, I wouldn't worry about this slight projected slowdown, as it may not even happen.

As a result, I think investors can bank on growth being as good or greater than Q2. But is it enough to justify owning the stock?

Palantir's stock isn't cheap

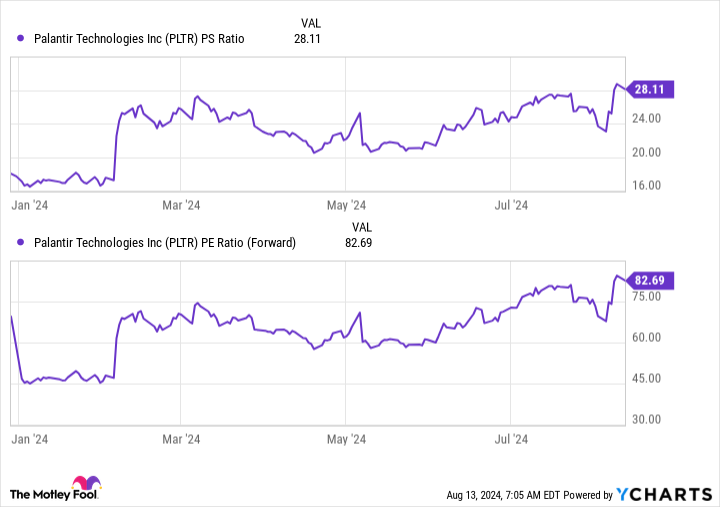

It's no secret that Palantir is a phenomenal business with strong growth. This has led to the stock being valued at a hefty premium.

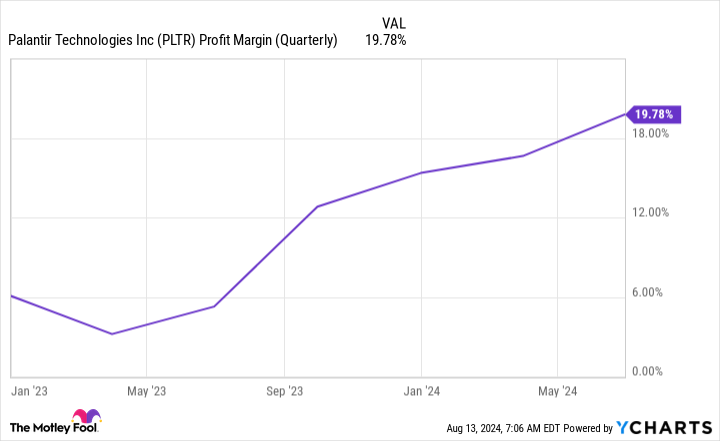

While Palantir is profitable, I'm hesitant to use an earnings-based valuation because it's still working toward full profitability.

While 20% profit margins may be fantastic for some businesses, software companies can often post much better figures, with some of the best converting 30% of revenue into profits.

Also, 28 times sales is a very pricey amount for Palantir. While it's growing quickly, anytime a stock's price-to-sales ratio is greater than its revenue growth rate, it indicates a very expensive stock. But could this still be a reasonable price to pay?

Wall Street analysts expect Palantir to grow revenue at 24% this year and 21% next year. If it meets those expectations, Palantir's revenue will be $3.34 billion by the end of 2025. If it could also achieve a 30% profit margin, it would produce $1 billion in profits. At today's $66 billion valuation, Palantir's stock would still be worth 66 times earnings even after a year and a half of growth.

That's still pricey, and Palantir will need to keep up its earnings growth for a much longer time to justify the price investors are paying today. While I believe in Palantir as a business, the stock is just too expensive for me to buy right now.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $763,374!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.

Is Palantir the Best Artificial Intelligence (AI) Stock to Buy Amid a Market Sell-Off? was originally published by The Motley Fool