In This Article:

Pacific Biosciences of California PACB reported second-quarter adjusted loss of 17 cents per share, which is in line with the Zacks Consensus Estimate. The company reported loss of 26 cents in the year-ago quarter.

Pacific Biosciences carries a Zacks Rank #2 (Buy).

The Menlo Park, CA-based manufacturer of sequencing systems posted revenues of $21.6 million, which missed the Zacks Consensus Estimate of $24 million. Revenues increased7.5% from the year-ago quarter’s tally.

Segmental Analysis

Product revenues totaled $18.5 million, up11.7% from the prior-year quarter’s tally.

Meanwhile, service and other revenues came in at $3.1 million, down 12.3% year over year.

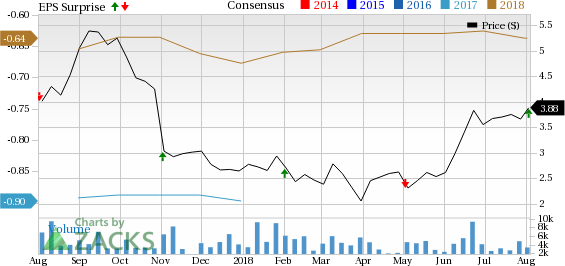

Pacific Biosciences of California, Inc. Price, Consensus and EPS Surprise

Pacific Biosciences of California, Inc. Price, Consensus and EPS Surprise | Pacific Biosciences of California, Inc. Quote

Furthermore, instrument revenues totaled $8.5 million, up from $7.1 million in the year-ago quarter.

Consumable revenues came in at $10 million, up from the year-ago quarter’s $9.5 million.

Sequel Update

Per management, Sequel instrument bookings were impressive in the second quarter. Sequel SMRT Cell usage was up more than90%.However, RS II SMRT cell usage declined by over 50%.

By the end of the quarter under review, Pacific Biosciences had approximately 275 Sequel instruments installed worldwide and roughly 30% of those are located in China.

The growth in the business partially offset decline in the RS II Smart Cell usage.

Margin Analysis

Gross profit in the second quarter of 2018 was $8.9 million, up10.6% on a year-over-year basis.Gross margin was 41.1% of total revenues, up 120 basis points (bps) year over year.

Research and Development expenses fell 7.2% to $15.7 million in the quarter. Sales, general and administrative expenses declined 3.6% to $14.9 million. Operating expenses totaled $30.6 million, down from $32.4 million in the prior-year quarter.

In Conclusion

Pacific Biosciences exited the second quarter on a dreary note. Product and service revenues fell on a year-over-year basis due to lower instrument revenues. However, this was partially offset by a strong Sequel performance, which witnessed record bookings in the quarter.

Constant instrument orders from BGI and China are encouraging. Furthermore, the company is well poised on expansion of SMRT Sequencing and product development activities.

On the flipside, dull performance in the service and other revenue segment stemming from lower instrument revenues is a headwind. The DNA sequencing market is rife with competition. Sales in Europe declined considerably. Also, higher operating expenses are likely to mar prospects.