S&P 500 Major Bull Pattern: 3 Stocks Breaking Out Now

Listen to too much financial news media and you might think the stock market was struggling this year. The unfortunate reality of most investing news is that a bearish narrative drives more views and clicks, benefiting the publishers but not the investors. If you look at the price action of the broad market and the leading economic data, the story could not be any more bullish.

Inflation has marched back down to reasonable levels and continues to fall, the employment market remains surprisingly robust, and the Federal Reserve has just begun cutting interest rates, further accelerating and already strong economy. Additionally, the technical setup in the S&P 500 leads me to believe that another major breakout is all but imminent. In the chart below we can see a prototypical cup and handle pattern has formed on the index and is on the verge of breaking higher.

In this article I will cover three top ranked stocks that appear primed to rally along with the market. Duolingo (DUOL), Fortinet (FTNT) and PulteGroup (PHM) also enjoy solid earnings growth, sturdy business models and strong price momentum. Furthermore, each of these stocks sits in industries that are expected to benefit from long-term growth tailwinds, further bolstering growth estimates.

Image Source: TradingView

Duolingo: Top Rank and Stock Momentum

Duolingo is a popular language-learning platform that offers users a gamified approach to mastering new languages. Launched in 2012, it has grown rapidly, boasting over 100 million daily active users. The app provides lessons in a variety of languages through interactive exercises that focus on reading, writing, speaking, and listening skills. Duolingo's business model includes a freemium service, where users can access basic features for free while paying for premium features through a subscription model.

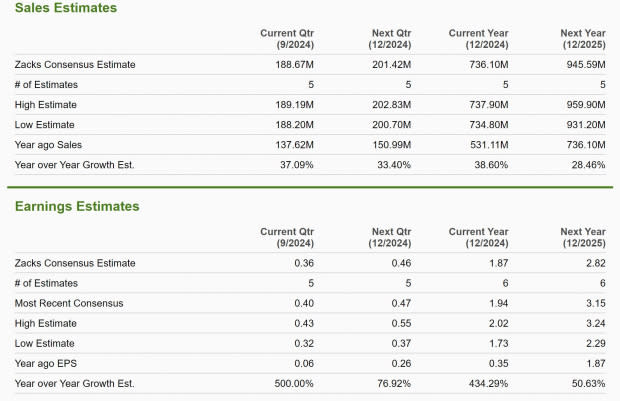

In addition to a Zacks Rank #1 (Strong Buy) rating, reflecting upward trending earnings revisions, Duolingo boasts some incredible growth forecasts for both sales and earnings. In the table below, we can see that sales are expected to climb 38.6% this year and 28.5% next year, while earnings are projected to jump 434.3% this year and 50.6% next year.

Image Source: Zacks Investment Research

DUOL stocks also looks like it is about to breakout and stage another major rally. After nearly doubling from its August lows, the price has consolidated sideways over the last two weeks forming a technical bull flag. If the stock can trade above the $288 level, it would signal a breakout and likely lead to another advance in price. Alternatively, if it loses support at the $277 level, it may be worth waiting for another opportunity.

Image Source: TradingView

Fortinet: Huge Earnings Revisions

Fortinet is a leading cybersecurity company that specializes in providing comprehensive security solutions to protect enterprises from a range of digital threats. Founded in 2000, Fortinet is best known for its FortiGate firewall products, which offer advanced features like intrusion prevention, VPN, antivirus, and web filtering. The company emphasizes a unified security platform that integrates network security, endpoint protection, and cloud security into a single solution.

Fortinet is another Zacks Rank #1 (Strong Buy) stock thanks to some significant revisions higher to its earnings estimates. Analysts have unanimously raised earnings projections across timeframes, with FY24 estimates jumping 15.3% and FY25 by 13% over the last two months. Earnings are projected to grow at a respectable 16.25% annually over the next three to five years while the company also maintains a strong balance sheet with no debt obligations and a cash position of $3.3 billion dollars.

Image Source: Zacks Investment Research

Fortinet price action paints a bullish picture as well. After breaking out of a bull flag a couple weeks ago, the stock has been consolidating above the breakout level. As long as it can hold above $76.50 level of support, I would expect the stock to continue climbing.

Image Source: TradingView

PulteGroup: Structural Tailwinds and Fair Valuation

PulteGroup is one of the largest homebuilding companies in the United States, specializing in residential construction. PulteGroup has a strong presence in key markets across the country and has benefitted from the ongoing demand for housing amid a competitive real estate landscape. In addition to new home construction, PulteGroup also engages in land development and the sale of home lots.

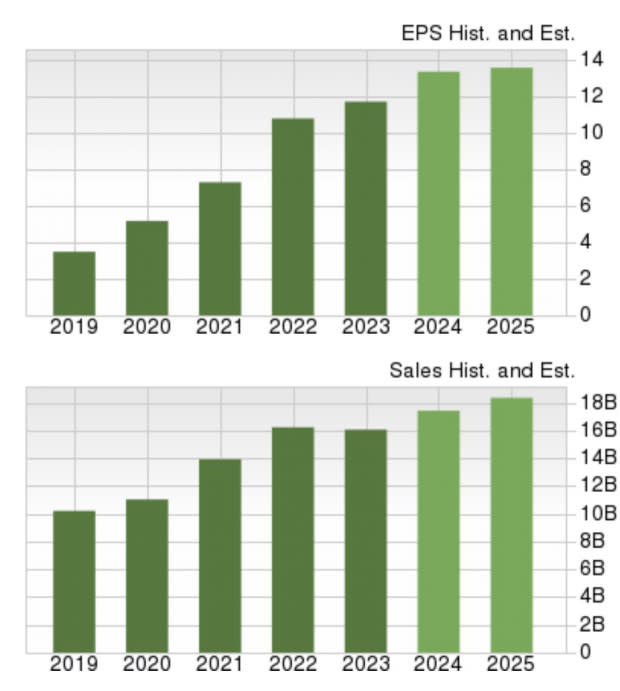

PulteGroup enjoys a Zacks Rank #2 (Buy) rating and steady growth forecasts for both sales and earnings. But even more compelling is the fundamental backdrop of the US housing market, which should benefit PulteGroup in the years to come. Home prices have seen huge appreciation in the years following the Covid-19 pandemic, but what is fascinating is how the housing market held up even as mortgage rates nearly tripled in the battle against inflation.

The sturdiness of the US housing market was no fluke either – there are significant structural factors which should keep home prices, and home builders’ profits buoyant for the foreseeable future. The driving factor of these strong home prices is the chronic shortage of housing in the country, which keeps supply tight and prices high. The market is a few million housing units short of equilibrium, so until that dynamic can change, expect the housing market and home builder stocks to remain strong.

Image Source: Zacks Investment Research

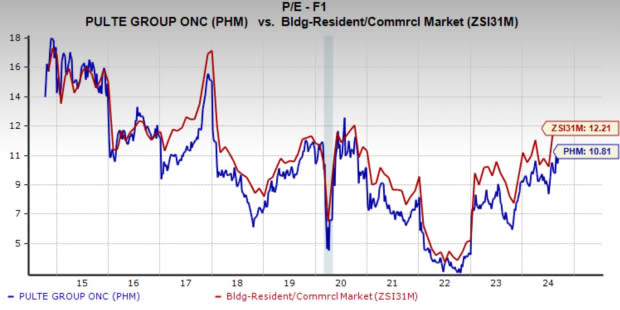

What makes PulteGroup especially appealing is its discount valuation relative to growth forecasts. PHM is trading at a one year forward earnings multiple of 10.8x, which is just above its 10-year median of 9.5x and below the industry average of 12.2x. However, with earnings projected to grow 19% annually over the next three to five years, PHM has a PEG ratio of just 0.56, a major discount based on the metric.

Image Source: Zacks Investment Research

Should Investors Buy DUOL, FTNT and PHM Shares?

As we navigate through a favorable market environment marked by a significant bullish pattern in the S&P 500, the outlook for Duolingo, Fortinet, and PulteGroup appears increasingly promising. Each of these companies benefits from robust industry trends, strong earnings growth, and favorable technical setups, making them attractive candidates for investors looking to capitalize on the market's upward momentum.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

Duolingo, Inc. (DUOL) : Free Stock Analysis Report