Oracle Stock Jumps as Cloud Revenue Climbs. Is It Too Late to Buy the Stock?

Once considered the after-ran of the cloud computing industry behind the big three players in the industry, Oracle (NYSE: ORCL) showed with its fiscal first-quarter results that it, too, is benefiting from the boom in artificial intelligence (AI) spending.

Let's take a close look at the company's most recent results and how it is benefiting from AI.

Cloud revenue leads the way

Oracle's overall fiscal Q1 revenue rose 7% to $13.3 billion, but it was the 21% jump in cloud service revenue to $5.6 billion that got investors excited. Within the cloud segment, cloud infrastructure revenue soared 45% to $2.2 billion in the quarter ended Aug. 31, while cloud application revenue climbed 10% to $3.5 billion. OCI (Oracle Cloud Infrastructure) consumption revenue, meanwhile, was up 56%, with the company saying demand outstripped capacity.

Meanwhile, Oracle has multi-cloud agreements in place with the big three hyperscale cloud computing providers: Microsoft, Alphabet's Google Cloud, and Amazon's Amazon Web Services. With the AWS deal just recently signed, Oracle said that its customers will soon be able to use its database technology from within every hyperscale company's cloud offering.

Oracle's 85 data centers in operation are all relatively new, and it currently has another 77 under construction. The company said it is looking into using modular nuclear reactors for power generation on one project.

Elon Musk's xAI used Oracle to train its Grok 2 large language model (LLM). However, Musk has built his own AI data center in order to train its next-generation LLM Grok 3, as Oracle could not supply as many graphics processing units (GPUs) as xAI wanted.

On the database front, the company is shifting to autonomous databases, which it says will lead to cost savings and have much higher margins. Autonomous databases use machine learning to automate routine database tasks without human intervention.

Remaining performance obligations (RPO) surged 53% to $99 billion. Oracle said cloud RPO soared more than 80%. RPO is the total amount of money invoiced for contracts that have not yet been delivered. It is an indication of future growth, although the length of contracts impacts the number.

Earnings per share (EPS), meanwhile, rose 20% to $1.03.

Oracle forecast fiscal second-quarter revenue to rise by 8% to 10%, with cloud revenue growing in a range of 24% to 26%. Adjusted EPS is expected to grow between 8% and 12%. For the full year, the company projected revenue growth in the double digits, with cloud revenue growth to be higher.

Longer-term, the company believes advancements in AI models will lead to a strong investment cycle over the next five to 10 years as customers race to stay on top in AI.

Is it too late to buy the stock?

While things are looking up for Oracle, there are a couple of notable things to watch for at the moment. One is that it is losing a pretty large customer in xAI, and the start-up was reportedly set to sign a $10 billion multiyear deal with Oracle before deciding to build its own data center.

Meanwhile, although its earnings were strong, $157 million, or $0.06 per share, of the improvement came from an accounting change increasing the useful life of its servers and networking equipment assets from five years to six. Otherwise, EPS growth would have been less than 13%. This change also reduced operating expenses by $197 million and improved the gross margin, which otherwise would have fallen due to the lower-gross-margin profile of its OCI consumption revenue.

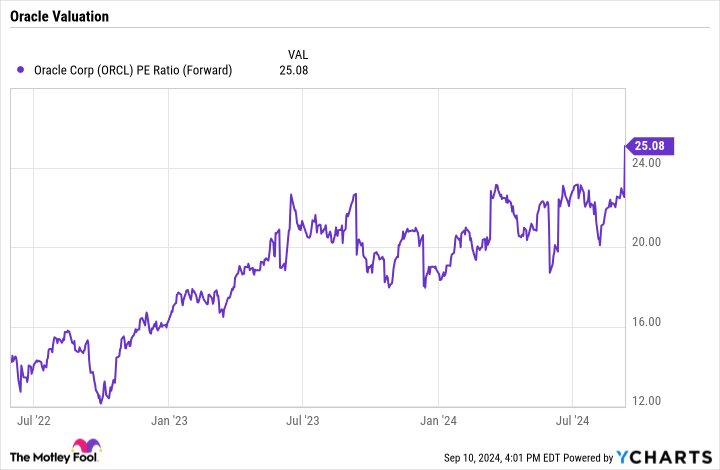

From a valuation standpoint, Oracle trades at a forward P/E of 25 based on current fiscal-year analyst estimates. Unlike many large tech companies, Oracle also carries a lot of debt. Net debt stood at around $73.6 billion at the end of fiscal Q1. Adjusting for debt, its enterprise-value-to-earnings ratio would be closer to 29 times. Given that its EPS growth was about 13% without the accounting change, I would say the stock is a bit on the pricey side.

Overall, I think Oracle is doing a lot of good things with its cloud division, but I wouldn't be chasing the stock at these levels.

Should you invest $1,000 in Oracle right now?

Before you buy stock in Oracle, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Oracle wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $716,375!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Geoffrey Seiler has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, and Oracle. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Oracle Stock Jumps as Cloud Revenue Climbs. Is It Too Late to Buy the Stock? was originally published by The Motley Fool