Options Point to Gains in Market That’s ‘Like a Beach Ball’

(Bloomberg) -- Trading in stock options shows that investors are positioning for gains following the August wobble.

Most Read from Bloomberg

The S&P 500 Index’s call skew, a measure of how much traders are willing to pay for bullish exposure, is steepening fast, suggesting some urgency in grabbing bullish options after Federal Reserve Chair Jay Powell’s dovish Jackson Hole speech, said Charlie McElligott, a Nomura cross-asset strategist.

Should there be no hiccups — most notably from Nvidia Corp.’s earnings report later Wednesday — the US stocks gauge might gravitate toward 5,750 points by the end of September, or up 2.4% from Monday’s close, he added.

The market keeps “trading like a beach ball you’re trying to hold underwater,” McElligott wrote in a note, pointing to demand for right-tail hedging that outweighs the remaining forced risk management from the volatility event in early August. That’s why, despite some impulse selling at times, equity indexes “keep grinding back,” he said.

The S&P 500 has regained almost all of its losses and is less than 1% away from its July peak on optimism that the Fed will cut interest rates fast enough to avoid a US recession. At the same time, the Cboe Volatility Index has dropped 60% from its Aug. 5 spike.

“It’s hard to get down on equities besides feeling rationally uncomfortable,” McElligott wrote. The probability for a soft landing is rising, falling volatility is seeding the ground for mechanical re-allocation of systematic investors and corporate buybacks are surging before the quarterly blackout window on Sept. 13, he explained.

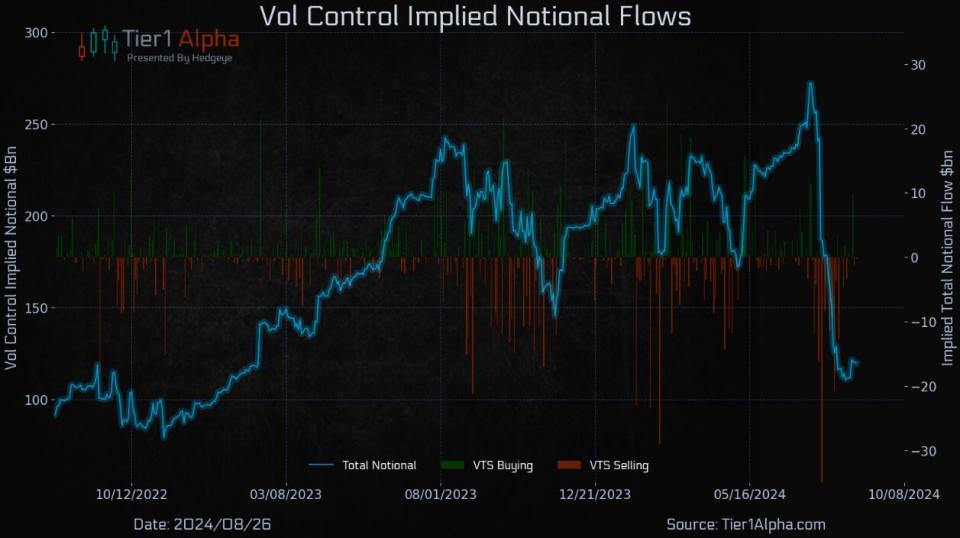

Moreover, the army of volatility sellers is back, “helping insulate and stabilize against larger moves,” the strategist said. If sustained, that will lead to further compressing of trading ranges, lower volatility and eventually more equity buying, especially from investors who apply volatility-control methods and have considerably reduced their exposure this month, he said.

To decide whether to buy or sell stocks, these investors often look at short-term realized volatility, which hasn’t started to fall yet but might soon.

“We’re not quite there yet, but if dealers can continue to hold long gamma positions, then there is a much higher probability of the inflows being realized,” according to strategists at Tier 1 Alpha.

Most Read from Bloomberg Businessweek

Hong Kong’s Old Airport Becomes Symbol of City’s Property Pain

Far-Right ‘Terrorgram’ Chatrooms Are Fueling a Wave of Power Grid Attacks

Losing Your Job Used to Be Shameful. Now It’s a Whole Identity

FOMO Frenzy Fuels Taiwan Home Prices Despite Threat of China Invasion

©2024 Bloomberg L.P.