October 2024's US Stocks That Might Be Trading Below Estimated Value

As of October 2024, the U.S. stock market is experiencing mixed movements with the S&P 500 and Dow Jones Industrial Average retreating from record highs, while the Nasdaq Composite sees gains driven by strong performances in technology stocks like Nvidia. Against this backdrop of fluctuating indices and economic data closely watched for Federal Reserve cues, identifying undervalued stocks can be crucial for investors looking to capitalize on potential growth opportunities amidst market volatility.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

Name | Current Price | Fair Value (Est) | Discount (Est) |

MidWestOne Financial Group (NasdaqGS:MOFG) | $28.93 | $57.32 | 49.5% |

Associated Banc-Corp (NYSE:ASB) | $22.06 | $43.80 | 49.6% |

Atlanticus Holdings (NasdaqGS:ATLC) | $36.81 | $72.49 | 49.2% |

EQT (NYSE:EQT) | $36.36 | $69.67 | 47.8% |

Avidbank Holdings (OTCPK:AVBH) | $19.73 | $37.72 | 47.7% |

EVERTEC (NYSE:EVTC) | $33.02 | $65.71 | 49.7% |

Vitesse Energy (NYSE:VTS) | $24.90 | $49.16 | 49.3% |

Fiverr International (NYSE:FVRR) | $21.86 | $42.43 | 48.5% |

Carter Bankshares (NasdaqGS:CARE) | $18.12 | $34.71 | 47.8% |

Viking Holdings (NYSE:VIK) | $38.55 | $74.38 | 48.2% |

Let's review some notable picks from our screened stocks.

Alkami Technology

Overview: Alkami Technology, Inc. provides cloud-based digital banking solutions in the United States and has a market cap of approximately $3.60 billion.

Operations: The company generates revenue from its Internet Software & Services segment, amounting to $297.36 million.

Estimated Discount To Fair Value: 13%

Alkami Technology is trading at US$38.21, below its estimated fair value of US$43.94, suggesting it may be undervalued based on cash flows. Despite recent shareholder dilution and insider selling, Alkami's revenue growth forecast of 21.4% per year surpasses the market average. Recent partnerships with credit unions enhance its digital banking platform's appeal, potentially driving future profitability as the company aims to become profitable within three years amidst improving financial metrics.

AppLovin

Overview: AppLovin Corporation operates a software-based platform designed to improve marketing and monetization for advertisers globally, with a market cap of approximately $48.54 billion.

Operations: The company's revenue is derived from two main segments: Apps, generating $1.49 billion, and the Software Platform, contributing $2.47 billion.

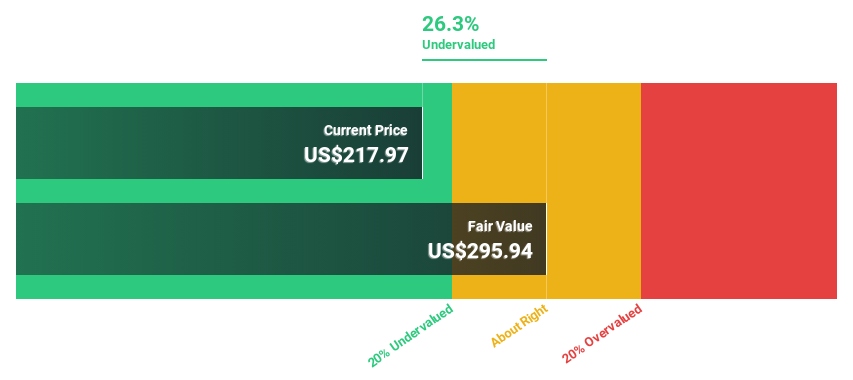

Estimated Discount To Fair Value: 29.9%

AppLovin is trading at US$158.85, significantly below its estimated fair value of US$226.47, making it highly undervalued based on cash flows. Despite a high debt level and recent insider selling, AppLovin's earnings are expected to grow significantly over the next three years, outpacing the broader market. Recent inclusion in the FTSE All-World Index and strong quarterly results with net income rising to US$309.97 million underscore its robust financial performance amidst growth challenges.

According our earnings growth report, there's an indication that AppLovin might be ready to expand.

Navigate through the intricacies of AppLovin with our comprehensive financial health report here.

Marriott International

Overview: Marriott International, Inc. operates, franchises, and licenses hotel, residential, timeshare, and other lodging properties globally with a market cap of approximately $74.77 billion.

Operations: The company's revenue segments include $3.28 billion from U.S. & Canada, with a segment adjustment of $2.28 billion.

Estimated Discount To Fair Value: 11.7%

Marriott International, trading at US$264.97, is undervalued based on cash flows with an estimated fair value of US$299.95. Despite high debt levels, its revenue is forecast to grow faster than the broader US market at 23.3% annually, though earnings growth lags behind at 6.5%. Recent strategic expansions and partnerships in China and Mexico enhance its global footprint, potentially supporting future cash flow improvements amidst a competitive hospitality landscape.

Taking Advantage

Reveal the 189 hidden gems among our Undervalued US Stocks Based On Cash Flows screener with a single click here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:ALKT NasdaqGS:APP and NasdaqGS:MAR.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com