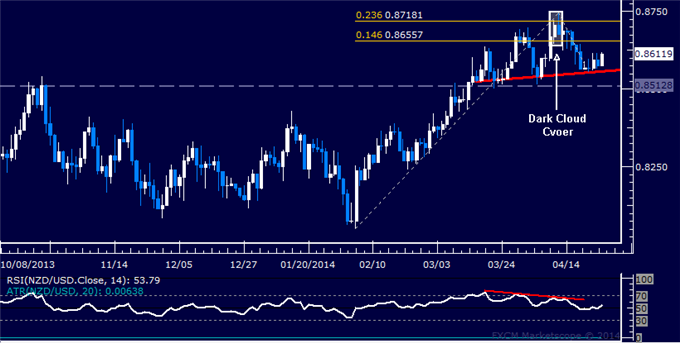

NZD/USD Technical Analysis – A Top in Place Below 0.87?

To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

NZD/USD Technical Strategy: Flat

Support: 0.8581 (23.6% Fib ret.), 0.8480-0.8513 (38% Fib ret., Oct 22 close)

Resistance: 0.8675 (Apr’13 high), 0.8745 (Apr 10 high)

The New Zealand turned lower as expected against its US counterpart after putting in a bearish Dark Cloud Cover candlestick pattern coupled with negative RSI divergence. Prices are now testing support at 0.8581, the 23.6% Fibonacci retracement, with a break below that aiming for the 0.8480-0.8513 area marked by the October 22 close and the 38.2% level. Alternatively, a reversal above the April 2013 high at 0.8675 aims for the April 10 top at 0.8745.

Prices are too close to relevant support to justify a short trade form a risk/reward perspective. We will continue to stand aside for now, looking for a more attractive entry to present itself.

Confirm your chart-based trade setups with the Technical Analyzer. New to FX? Start Here!

Daily Chart - Created Using FXCM Marketscope 2.0

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.