Nvidia Dropped to $100 in the Market Sell-Off: Buy, Sell, or Hold?

Monday was a brutal day for stocks, as a global sell-off drove the S&P 500 and the Dow Jones Industrial Average to their worst performances in almost two years. The reason for the troubles? A weaker-than-expected U.S. jobs report last week and concern about the absence of interest rate cuts have investors worried about what's ahead.

And this has weighed on many of the market's best performers this year, including star chip designer Nvidia (NASDAQ: NVDA). The stock, which soared nearly 150% in the first half of the year, slid 11% in two trading sessions, closing on Monday at about $100. It's impossible to predict whether this general market sell-off will continue or to say with 100% certainty that we've reached a bottom. But in either case, the question is: Should you buy, sell, or hold Nvidia right now? Let's find out.

Nvidia's market performance

First, let's talk a bit about Nvidia's stock market performance. The shares not only advanced in the first half, but they'd been soaring for quite some time thanks to the company's triple-digit earnings growth. Nvidia dominates the artificial intelligence (AI) chip market, holding 80% share. This is a particularly big deal considering the high demand for AI products today.

Nvidia shares have advanced 2,500% over five years, prompting the company to launch a 10-for-1 stock split back in June to bring them down to earth. A stock split lowers the per-share price through the issuance of more shares to current holders. This doesn't change anything fundamental about a company, but it makes it easier for a broader range of investors to access the shares.

Since the split, when Nvidia stock opened at about $120, the stock has dropped 17%. Seeing this decline, even prior to the sell-off, investors started wondering whether the stock was starting to lose momentum. On top of this, reports of a potential delay in the launch of Nvidia's new Blackwell chip might be weighing on investors' minds.

Meanwhile, as mentioned, the overall market has stumbled over the past few days, roiled by concerns about the economy. Technology and growth stocks have led declines, as they're most vulnerable during times of economic troubles. The growth of these players generally depends on customers having the budgets to buy their products and services, and they also rely on borrowing to expand. So it's clear they could be among the first to suffer during tough times.

Should you buy Nvidia now?

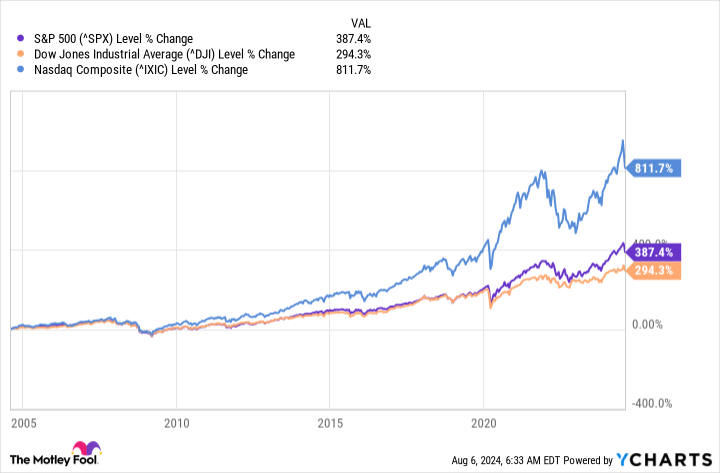

Now, let's consider what you should do about Nvidia. Even when a market environment looks uncertain, it's always important to take a long-term view of stocks and your portfolio. History shows that bull markets, bear markets, sell-offs, and any market environment are temporary situations. Highs and lows come and go, but the fantastic news is market growth has always won out. If we look at the major indexes over time, they've always gone on to gain after tough periods.

This means, if a particular company has what it takes to withstand a difficult environment and the company's long-term prospects are solid, you'll want to hang onto that player. And that's why Nvidia makes a great buy or hold today. Plus, if you're buying, you'll pick up the shares at a very reasonable level of 37 times forward-earnings estimates, down from nearly 50 times just a few weeks ago.

Nvidia is a leader in a high-growth market, AI, and this market is in the early stages of its growth story. Analysts predict that today's $200 billion AI market will reach beyond $1 trillion later this decade. Nvidia should benefit thanks to its leadership and its focus on innovation to maintain this position. That's why, during this market sell-off, Nvidia makes a fantastic stock to add to any long-term growth portfolio.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $615,516!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 6, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Nvidia Dropped to $100 in the Market Sell-Off: Buy, Sell, or Hold? was originally published by The Motley Fool