Nvidia Could Be Worth Nearly $50 Trillion In A Decade, Says Early Tesla, Amazon Investor: Nearly 2X That Of US Or 3X Of China's Current GDP

A prominent tech investor predicted that NVIDIA Corp. (NASDAQ:NVDA) could achieve a market capitalization of nearly $50 trillion within the next decade.

What Happened: James Anderson, an early investor in companies like Tesla Inc (NASDAQ:TSLA) and Amazon.com Inc (NASDAQ:AMZN), expressed his bullish outlook on Nvidia’s future potential, reported the Financial Times on Sunday. He suggested that the chipmaker’s market cap could potentially surpass the combined value of the current S&P 500.

Don't Miss:

America's construction sites are desperate for Robots — here’s how to invest in a house-printing startup who’s making them and be a part of a $16 trillion industry.

General Motors and other leaders revealed to be investing in this revolutionary lithium start-up — allowing easy entry by launching at just $9.50 per share.

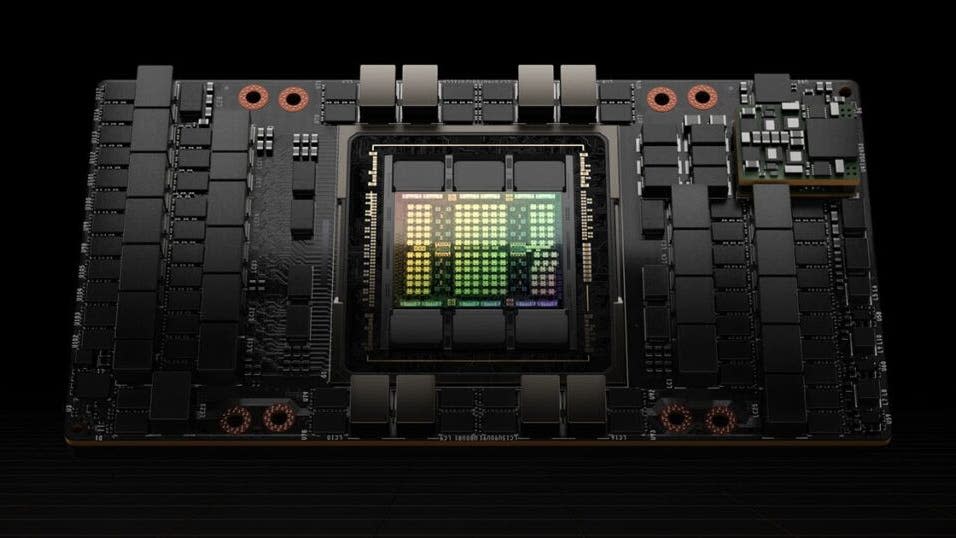

Anderson’s optimism stems from Nvidia’s role in the burgeoning demand for AI chips, which are crucial for training and running advanced generative AI models. This demand has propelled Nvidia’s shares to soar by 168% since the beginning of the year, pushing its market value above $3 trillion.

"The potential scale of Nvidia in the most optimistic outcome is both way higher than I've ever seen before and could lead to a market cap of double-digit trillions. This isn't a prediction but a possibility if artificial intelligence works for customers and Nvidia's lead is intact," Anderson said.

For context, Anderson’s prediction of Nvidia hitting $50 trillion market capitalization would be nearly twice as much as the U.S.’s current gross domestic product (GDP), which stands at $27.36 trillion, or nearly thrice as much as China’s GDP of $17.79 trillion, according to data from the World Bank.

Despite this remarkable growth, Anderson views Nvidia’s potential as even greater, provided that artificial intelligence continues to deliver for customers and Nvidia maintains its lead in the industry.

Anderson, who now runs a $650 million fund at Lingotto Investment Management, believes that Nvidia’s “persistent exponential progress, the competitive advantages in hardware and software, and the culture and leadership are exactly what we look for.”

He also acknowledged that the path to this potential valuation would be volatile, with possible drawdowns of 35-40%. However, he expressed confidence in Nvidia’s long-term prospects, stating that the company is at the forefront of solving serious problems in areas like autonomous driving, robotics, and drug discovery.

Anderson projected that the actual growth in demand for data center AI chips was currently around 60% annually. Looking forward over the next decade, he estimated that sustained 60% growth in data center revenue alone, with unchanged margins, could lead to earnings of $1,350 per share and free cash flow of approximately $1,000 per share.

Trending: Commercial real estate has historically outperformed the stock market, and this platform allows individuals to invest in commercial real estate with as little as $5,000 offering a 12% target yield.

Assuming a 5% free cash flow yield, this analysis suggests that Nvidia shares could potentially be valued at $20,000 in 10 years, implying a market capitalization of $49 trillion. Anderson assigned a probability of 10-15% to achieve this scenario, according to the report.

Why It Matters: The prediction from Anderson comes amid a broader context of excitement and caution in the market. The U.S. stock market has experienced a significant rally, largely driven by the promise of AI. This surge has drawn comparisons to the dot-com bubble of the late 1990s, with the S&P 500 index hitting new highs and the Nasdaq Composite index rising by 70% since the end of 2022.

See Also: This Income Stock Has Outperformed The S&P 500 For Over A Decade

However, not everyone is optimistic. Craig Johnson, a managing director and chief market technician at Piper Sandler, has pointed out “warning flags” in the market, suggesting that Nvidia might be in “bubble-ish territory” and hinting at a potential market pullback.

Even Cathie Wood, CEO of ARK Invest, has acknowledged Nvidia’s exceptional performance but forecasts “short-term indigestion” for the company’s business as customers reassess their AI strategies.

Despite these concerns, some analysts remain bullish. Ray Wang, founder of Constellation Research, has a price target of $200 on Nvidia stock, citing the company’s pivotal role in the AI space.

Anderson gained prominence during his nearly four-decade tenure at Baillie Gifford. He oversaw its flagship Scottish Mortgage Investment Trust, which initially invested in Nvidia in 2016. His leadership played a pivotal role in transforming the Edinburgh-based private partnership into an unexpected standout in the tech investment sector.

Read Next:

Rory McIlroy’s mansion in Florida is worth $22 million today, doubling from 2017 — here’s how to get started investing in real estate with just $100

Gen Z and Millennial millionaires couldn't care less for stocks and bonds — Here's what they're buying instead.

"ACTIVE INVESTORS' SECRET WEAPON" Supercharge Your Stock Market Game with the #1 "news & everything else" trading tool: Benzinga Pro - Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Nvidia Could Be Worth Nearly $50 Trillion In A Decade, Says Early Tesla, Amazon Investor: Nearly 2X That Of US Or 3X Of China's Current GDP originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.