Nasdaq Sell-Off: 1 Unstoppable Stock Down 39% to Buy on the Dip, According to Wall Street

The Nasdaq Composite (NASDAQINDEX: ^IXIC) represents almost every stock on the Nasdaq exchange. It had a dream run in the first half of 2024, gaining 20% with almost no volatility.

That changed in July, and the index is currently down 6.5% from its peak as investors digest weak economic data and a currency shock in Japan.

History shows the U.S. stock market climbs to new highs over the long term, so this dip could be a great buying opportunity. One stock that investors might want to consider is Datadog (NASDAQ: DDOG) for its unique role in the artificial intelligence (AI) revolution.

Datadog stock is down 9.5% over the past month amid the Nasdaq sell-off and now trades 39% below its all-time high, set during the tech frenzy in 2021. That hasn't deterred Wall Street because the overwhelming majority of the analysts tracked by The Wall Street Journal have assigned Datadog the highest-possible buy rating. Here's why they might be right.

Datadog's technology is crucial for modern businesses

Around 28,700 businesses use Datadog's growing portfolio of software tools, and the company is best known for its cloud monitoring platform, which helps prevent technical bugs from disrupting digital infrastructure.

In the past, for example, an e-commerce company might not have known its website was down for customers in one specific country until it saw a decline in sales. Now, Datadog can alert management instantly so the issue can be rectified before it affects customers.

That's an important tool in the digital economy because the competition is always one click away. Beyond e-commerce, Datadog is popular in industries like financial services, entertainment, gaming, and healthcare, all of which are consumer centric.

Last year, Datadog launched an AI assistant that is now embedded in its legacy products. It's called Bits AI, and it helps businesses arrive at the root cause of technical issues far more quickly.

Bits AI can also draft incident summaries that save managers countless hours that would otherwise be spent on manual investigations. And if they want to know more, they can initiate a conversation with the assistant for specific details.

Datadog recently ventured even deeper into AI by launching an observability tool for large language models (LLMs), the foundation for AI applications like chatbots and virtual assistants. That makes it crucial for LLMs to be accurate and bug-free.

The observability tool helps developers monitor costs, diagnose issues with their LLMs, and even measure their quality by tracking responses from the chatbots that they power.

AI revenue is growing rapidly

Datadog generated $645.2 million in total revenue during the second quarter (ended June 30), a 27% increase from the year-ago period that was significantly above management's forecast of $622 million.

CEO Olivier Pomel said 4% of Datadog's revenue was specifically attributable to AI-native customers in June, and while that sounds like a small number, it has doubled from 2% in just the past year.

Pomel said around 2,500 customers are now using one or more of Datadog's AI tools, which represents around 8.7% of its total customers, so uptake is happening fast.

Even more impressive, the solid growth in both its legacy and AI businesses is occurring even as the company is carefully managing costs. Operating expenses rose by only 18.5% year over year during the second quarter, compared to 31.2% a year ago, allowing more money to flow to the bottom line.

As a result, Datadog generated net income of $43.8 million, a big positive swing from the $3.9 million net loss it delivered at the same time last year.

Datadog is proving to investors that it doesn't need to burn significant cash to generate growth because there is strong organic demand for its portfolio of monitoring and observability tools.

Wall Street is bullish

The Wall Street Journal tracks 43 analysts covering Datadog, and 29 have assigned it the highest-possible buy rating. Seven others are in the overweight (bullish) camp, while the remaining seven recommend holding. No analysts recommend selling.

They have a consensus price target of $144.89 for the stock, 27% higher from where it trades today. The Street-high target is $160, implying 40% upside.

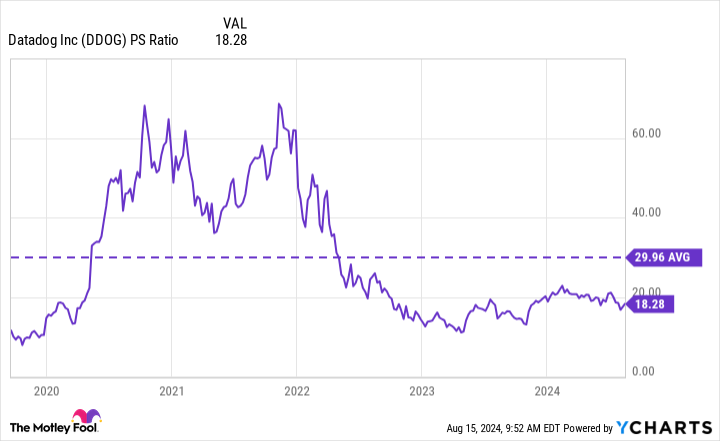

Those targets might even be conservative because they're still a long way from Datadog's all-time high of around $193, set during the tech frenzy in 2021. To be clear, the stock was heavily overvalued back then with a price-to-sales ratio (P/S) over 60.

Since then, a declining stock price and solid revenue growth have combined to bring the P/S down to 17.8, which is 40% below its average of 29.9 going back to when the company went public five years ago.

If AI becomes like the cloud in the sense that practically every business in the world will use it in some capacity, then Datadog's LLM and AI products are going to be in high demand. If so, the company's AI revenue will likely represent far more than 4% of its total revenue in the near future. Investors have an opportunity to buy the stock ahead of that shift.

Should you invest $1,000 in Datadog right now?

Before you buy stock in Datadog, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Datadog wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $763,374!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Datadog. The Motley Fool recommends Nasdaq. The Motley Fool has a disclosure policy.

Nasdaq Sell-Off: 1 Unstoppable Stock Down 39% to Buy on the Dip, According to Wall Street was originally published by The Motley Fool