The Most Important Retirement Table You'll Ever See

The message isn't new: Saving for retirement is important. Yet most people still have a long way to prepare for their post-working years. The median person in their 50s has just $82,000 saved for retirement. That's a concerning statistic, considering how much living expenses have risen in recent years and may increase over the next 10 to 15 years.

I get it; life is hard. This Motley Fool writer is in his 30s, raising young children and grappling with rising bills. Still, retirement planning remains a priority that you can't toss aside. The good news for those my age, those younger than me, and those in their 40s and 50s is that it's not too late to make a big difference between now and your eventual retirement.

Some people put off retirement planning because they believe they can do it later in life or feel like they'll never retire, so they don't bother trying to save.

To that, I say nonsense. Look at this retirement table, which could be the most important one you'll ever see. It will help you understand what actions you must take to retire comfortably.

But first, why you should hitch your wagon to the S&P 500

Saving for retirement is an individual journey, so everyone's plan is unique. What type of accounts you use and the investments you pick are up to you.

However, most people should at least consider incorporating the S&P 500 into their investing strategy. The S&P 500 is arguably the most famous stock market index; it's a group of 500 of America's most prominent corporations and is often used as a stand-in term when discussing the U.S. stock market.

The great thing about the S&P 500 is that it reflects the most successful U.S. companies over time. Companies are added or removed from the S&P 500 once annually, and the larger a company's market value grows, the more weight it carries in the index. In other words, the best-performing companies generally command higher share prices over time, which rewards their stocks by increasing their representation in the index.

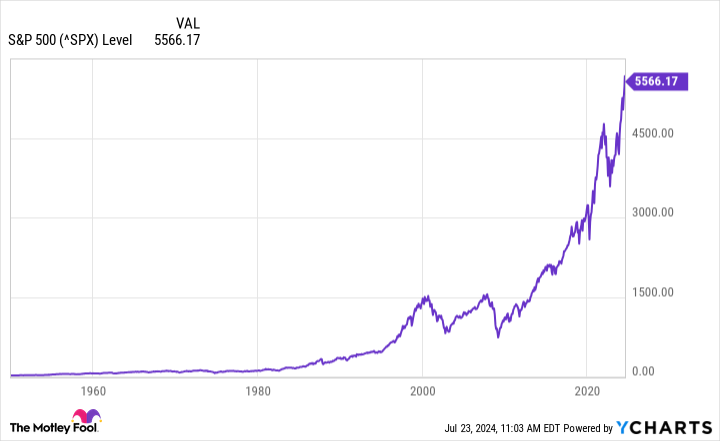

This design is why the S&P 500 has been so effective for such a long time:

The best way to invest in the S&P 500 is through an index fund that mimics it. Some popular examples include the Vanguard S&P 500 ETF or the SPDR S&P 500 ETF Trust. You can invest in them through various accounts, such as an individual retirement account or an employer retirement plan like a 401(k). Consider your investment strategy's tax implications, and consult a professional with any questions.

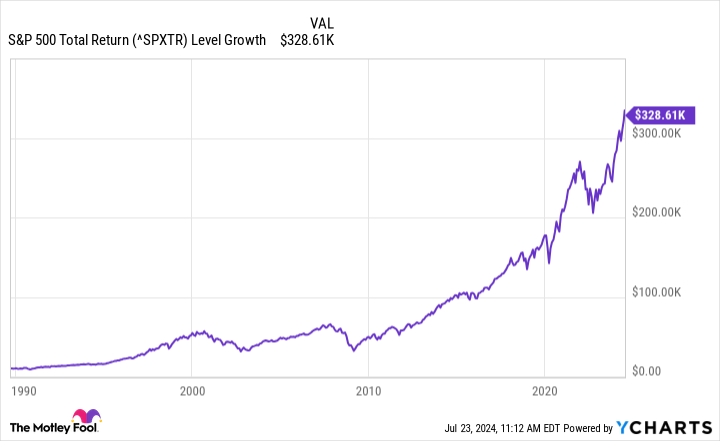

Demonstrating the S&P 500's wealth-building prowess

The catch with the S&P 500 (and stocks in general) is that the ride sometimes gets bumpy. The stock market doesn't go up in a straight line. The S&P 500 has dropped at least 10% from its high on 10 occasions over the past 20 years. So, keep in mind that volatility is normal.

Fortunately, the S&P 500 has proven remarkably resilient and has continually rebounded and soared to new heights throughout its history. War, recession, politics, and a pandemic haven't prevented American capitalism and the S&P 500 from making investors wealthy. Someone who had $10,000 invested by their 30th birthday in 1989 (35 years ago) would have generated a nearly 33-fold return without adding another dime.

The chart you've been waiting for

That brings us to the most important chart you'll ever see, which drives home an ultra-important point: The sooner you start investing, the better off you'll be.

Consider a $10,000 investment at various ages. The chart shows each final result by age 70 using the S&P 500's historical average annual return of 10%. Remember that each example includes no additional investments beyond the initial $10,000:

Original Age | Years | Final Amount |

|---|---|---|

20 | 50 | $1,173,908.53 |

30 | 40 | $452,592.56 |

40 | 30 | $174,494.02 |

50 | 20 | $67,275.00 |

60 | 10 | $25,937.42 |

Data source: The chart and calculations came from the author.

Notice how waiting 10 years between ages 20 and 30 cost investors over half a million dollars. The drop-off continues as people wait and deny the compounding process the time it needs to do its magic.

And don't give up if you're older. You must contribute more to compensate for lost time, but you can still progress. A 50-year-old contributing $500 monthly until age 70 could still retire with $426,000.

The bottom line? Start saving for retirement today.

The $22,924 Social Security bonus most retirees completely overlook

If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more... each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after. Simply click here to discover how to learn more about these strategies.

View the "Social Security secrets" ›

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

The Most Important Retirement Table You'll Ever See was originally published by The Motley Fool