Mohawk Jumps 28% in Past 3 Months: How Should You Play the Stock?

Mohawk Industries, Inc. MHK has jumped 28.1% in the past three months, outperforming the Zacks Textile - Home Furnishing industry, the Zacks Consumer Discretionary sector, and the S&P 500 Index’s rise of 26.3%, 2.1% and 6.6%, respectively.

Image Source: Zacks Investment Research

Improving new residential construction trends and commercial business channels has been supporting MHK’s prospects. With potential rate cuts in the second half of 2024 or 2025, the company expects its demand to increase. Mohawk’s focus on several general restructuring initiatives has been benefiting to keep the increasing cost structure at bay, given the ongoing inflationary scenario.

Mohawk, which is a global manufacturer of flooring products, is quite efficient in using its shareholder’s funds. Its trailing 12-month return on equity (ROE) is indicative of its growth potential. ROE for the trailing 12 months is 8.1%, higher than the industry’s 3.1%.

Factors Driving the MHK Stock

Favorable Market Scenario: The improving new residential construction trends and stable demand across commercial business channels are favoring Mohawk’s prospects despite ongoing market softness around the globe. With the expectations of upcoming rate cuts, the demand trend in the United States is expected to move up in the forthcoming quarters.

Under MHK’s Global Ceramic segment, favorable demand in commercial channels and housing constructions across various of its geographies have been encouraging. In the Flooring North America segment, the commercial channels, including hospitality, government and education, are driving the outperformance. Mohawk is optimistic that the long-term demand patterns for its products are strong as the economy is beginning to normalize.

Restructuring Initiatives: To achieve productivity gains and improve its profitability, Mohawk has been undertaking various initiatives. Recently, the company mentioned undertaking several updated restructuring and productive initiatives to improve volumes across its product categories alongside the existing ones. Mohawk believes that the updated restructuring initiatives, along with the previously announced ones, will reduce costs by $60 million in 2024.

Under the Global Ceramic segment, MHK will optimize manufacturing by idling a few of the less-productive operations and aligning production to increase efficiency. Also, the company aims to reduce product complexity further and leverage technology to lower administrative costs across regional warehouses. Under its Flooring North America segment, Mohawk expects to rationalize some of the manufacturing to enhance plant utilization, retire less efficient equipment and simplify its offerings.

Under the Flooring Rest of World segment, the company is looking forward to lowering its administrative and operating costs, streamlining the product portfolio and distribution, and decommissioning inefficient assets. The execution timeline of these newly crafted initiatives is likely to extend through 2025 to 2026, given the type of the project.

Lower Input Costs: MHK has been favored by low input costs amid the ongoing inflationary environment. In the first half of 2024, lower input costs, along with productivity gains, have helped the company achieve operating margin expansion, especially in the Flooring North America segment.

In the first six months of 2024, operating profit increased to $360.6 million from $278.8 million reported a year ago. The metric under the Flooring North America segment increased to $123.3 million from $35.2 million in the year-ago period.

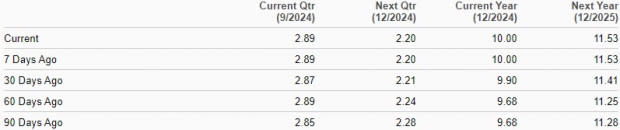

Estimate Trend Favors MHK

The Zacks Consensus Estimate for Mohawk’s 2024 earnings per share (EPS) has increased to $10.00 from $9.90 over the past 30 days. The estimated figure indicates 8.8% growth from the year-ago quarter’s reported figure. Over the said time frame, the consensus estimate for third-quarter 2024 EPS has trended upward to $2.89 from $2.87, indicating 6.3% year-over-year growth.

EPS Trend

Image Source: Zacks Investment Research

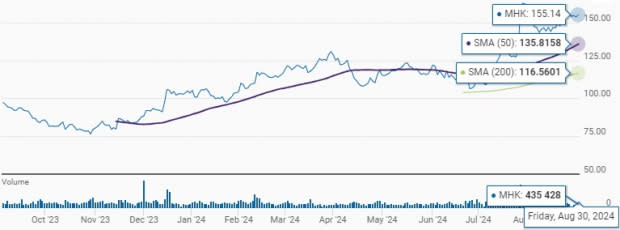

MHK Trades Above 50 & 200-Day SMA

Technical indicators suggest a continued strong performance for Mohawk. From the graphical representation given below, it can be observed that the MHK stock is riding above both the 50-day simple moving average (SMA) and 200-day SMA, signaling a bullish trend. The technical strength underscores positive market sentiment and confidence in MHK’s financial health and prospects.

50 & 200-day Moving Average

Image Source: Zacks Investment Research

Can MHK Continue Its Momentum?

Mohawk is indeed surviving in the uncertain economy due to the aforementioned tailwinds. However, the positives are partially offset by headwinds in the forms of price and mix pressures, and a weak residential remodeling demand trend.

Unfavorable Price & Mix: For the first half of 2024, Mohawk’s top line has trended downward due to the unfavorable net impacts of price and product mix of approximately $300 million. This unfavorable aspect has affected all reportable segments of the company, in turn, driving down the top line. MHK expects this headwind to continue throughout the second half of 2024, if not in the same extremity.

Softness in Residential Remodeling: Due to the uncertainties in the economy and ongoing inflationary scenario, consumers are deferring undertaking heavy discretionary spending. This behavioral trait is directly hurting the residential remodeling business of Mohawk, which is trailing behind its other notable businesses.

Flooring remodeling is mainly influenced by housing turnover rates, which are under pressure due to elevated mortgage rates, high home prices and the locked-in effect on homeowners. The current market condition is expected to linger until there are any signs of rate cuts.

MHK Trades at a Premium

Mohawk is currently trading at a premium to the industry peers on a forward 12-month price-to-earnings (P/E) ratio basis. MHK’s forward 12-month P/E ratio stands at 14.07, higher than the industry’s ratio of 10.8.

Image Source: Zacks Investment Research

Is it Profitable to Add MHK to Your Portfolio Now?

The MHK stock has outperformed industry players like Floor & Decor Holdings, Inc. FND, Tempur Sealy International, Inc. TPX and Interface, Inc. TILE in the past three months. In the said time frame, TILE and TPX have rallied 20% and 2.4%, respectively, while FND has lost 3.2%.

Banking on the above discussion, it can be concluded that Mohawk is benefiting from a favorable market backdrop of improving residential construction and a stable commercial business demand. These aspects, along with the refurbished restructuring initiatives and lower input costs, are further encouraging the uptrend. Although MHK’s ongoing execution and investments in restricting and cost-control initiatives bode well, they are not enough to entirely subdue the negative impacts of the ongoing inflationary costs and expense structure. The expectations of increasing freight and labor costs, along with the softness in the residential remodeling business, are concerning.

Based on the overall discussion and the trends of technical indicators, it is suggested to the existing investors to hold on to this Zacks Rank #3 (Hold) company’s shares for now, whereas new investors might want to wait for a more favorable entry point.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tempur Sealy International, Inc. (TPX) : Free Stock Analysis Report

Mohawk Industries, Inc. (MHK) : Free Stock Analysis Report

Interface, Inc. (TILE) : Free Stock Analysis Report

Floor & Decor Holdings, Inc. (FND) : Free Stock Analysis Report