Missed Out on Palantir's Run-Up? Here's My Best Alternative Data Software Stock to Buy and Hold

Palantir Technologies has been a big winner in the past year and a half. Shares are up by more than 300% since the start of 2023. The data software company looks to have a bright future, but it's hard to deny that the opportunity for new investors to profit has diminished after such a run. However, another data software company lurks in Wall Street's shadows, waiting to shine.

Snowflake's (NYSE: SNOW) initial public offering (IPO) was one of the most hyped in recent memory, but the stock has disappointed. Shares have lost a quarter of their value over the past year and are nearly 70% off their 2021 high.

That said, much of the stock's struggles boil down to circumstances, and it still possesses some of the qualities that got Wall Street so excited about its IPO in the first place.

The hype got out of control.

Data is the foundation for modern tech business. Whether a company is attempting to train a complex AI model or wants to understand what its customers want, data is the critical puzzle piece. Meanwhile, businesses are steadily migrating their digital operations from on-premises systems to cloud-based systems, and migrating data to the cloud is a natural part of that.

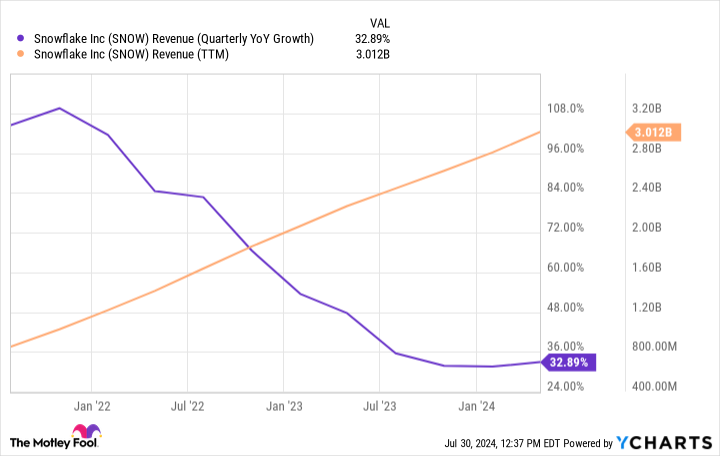

Snowflake's IPO generated a lot of hype due to its innovative core product, a data warehousing platform that enables its clients to store and query their data securely in the cloud. Snowflake is platform-agnostic, and compatible with all the major cloud infrastructure providers (Amazon Web Services, Microsoft Azure, and Google Cloud), which gives its customers flexibility instead of locking them into a specific cloud vendor. In its fiscal 2022 (which ended Jan. 31, 2022), Snowflake's revenue soared by 106% to $1.1 billion.

Even the great Warren Buffett, who is famously strict about valuations and generally avoids technology stocks, bought a stake in Snowflake at the IPO for Berkshire Hathaway.

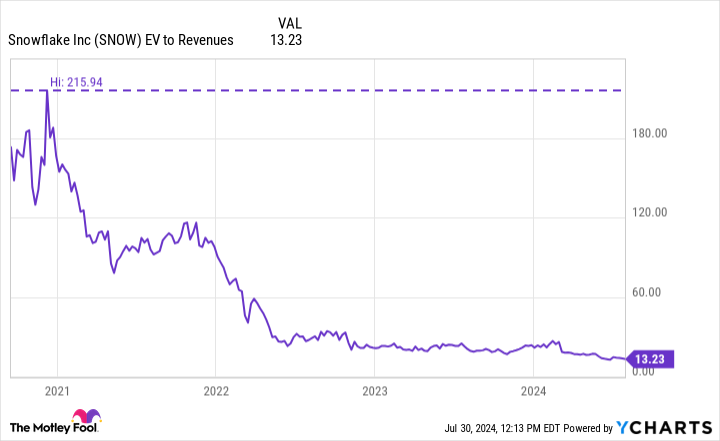

Snowflake went public in the summer of 2021, arguably the peak of euphoria for growth stocks -- the Fed's ultra-low interest rate policy at that time juiced many stocks' valuations to bubble-like levels, and Snowflake was among them. At its peak, Snowflake traded at an enterprise-value-to-sales ratio of over 215.

Do you think AI-driven excitement created a bubble in Nvidia stock this year? For comparison, Nvidia's enterprise-value-to-sales ratio peaked at just 45. That should underline just how ludicrous Snowflake's valuation had gotten. The stock was almost certainly doomed to take a painful plummet back to down Earth, regardless of what the business did.

Some self-inflicted wounds

The underlying business hasn't been perfect. Snowflake was not immune to the impact of higher interest rates on the technology sector. Snowflake's billing is usage-based, and macroeconomic conditions and fears put enough pressure on customer spending to drag the company's net revenue retention rate from 178% in fiscal 2022's Q4 to 128% in fiscal 2025's Q1.

Total revenue growth slowed from a triple-digit percentage pace to just over 30% in the most recently reported quarter.

That doesn't look good when the company's biggest competitor, a private company called Data Bricks, recently announced it was on pace for $2.4 billion in annualized revenue at 60% growth. Have higher interest rates dragged on Snowflake's growth? Sure -- but competition is causing problems, and that's arguably more concerning.

Buy and hold Snowflake? Here's why

So, why buy the stock in light of all this? It boils down to some simple facts.

First, Snowflake is poised to respond to competitive pressure. Data Bricks credits AI-related demand for its growth momentum. Snowflake promoted its VP of AI, Sridhar Ramaswamy, to CEO after Frank Slootman retired earlier this year. Time will tell how Ramaswamy performs in the role, but having leadership that is inclined to focus on AI should be a good thing.

Second, Snowflake's growth rate should stabilize and possibly improve. Its remaining performance obligation -- business that has been booked, but for which revenue has not yet been recognized -- has increased notably over the past two quarters.

And looking at the bigger picture, data grows exponentially, which builds natural growth into Snowflake's business model as its customers will need to store and query more data over time.

Third, the stock's valuation is more forgiving than it was years ago. Today, Snowflake trades at a forward enterprise-value-to-sales ratio of just over 11. That's a fraction of what it once was -- and roughly half of what Wall Street darling Palantir trades at. In other words, Snowflake has gone from an obnoxiously expensive favorite to an underdog in the bargain bin.

Snowflake is poised to grow over the coming years, especially if its new CEO can position it to be more successful in AI. With its valuation at a reasonable (arguably cheap) level, investors who buy in now could enjoy stellar returns.

Should you invest $1,000 in Snowflake right now?

Before you buy stock in Snowflake, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Snowflake wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $657,306!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway, Palantir Technologies, and Snowflake. The Motley Fool has a disclosure policy.

Missed Out on Palantir's Run-Up? Here's My Best Alternative Data Software Stock to Buy and Hold was originally published by The Motley Fool