Missed Out on the Bull Market Recovery? 4 ETFs You Can Buy Today.

Wall Street has been in a bull market for a while now. The bull run stretches back to Oct. 23, 2023, when the S&P 500 market index ended the day at a low point of 4,117 points. Economists announced the arrival of an official bull market after a 20% increase, which fell on Feb. 2, 2024.

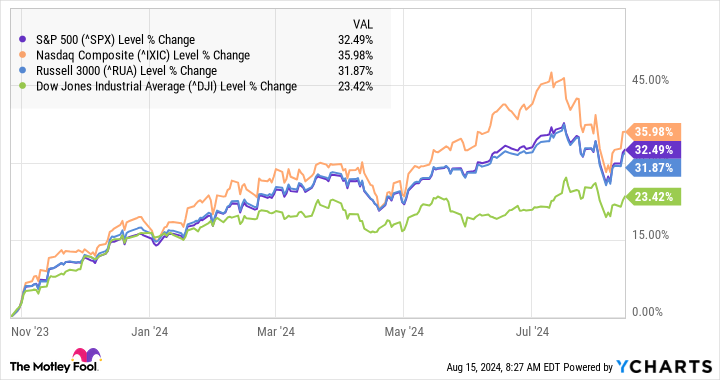

The bull has been stretching its proverbial legs since then. The S&P 500 is now up by 32% from the start of this rally. Other broad market trackers, like the Nasdaq Composite and Russell 3000, indexes have seen similar gains, with the venerable Dow Jones Industrial Average lagging behind at a still-impressive 23% gain:

You might feel like you missed the bus. The bull market recovery has gone too far already -- the surge must be running out of steam by now. It must be time to pile up cash savings instead, hoping to avoid the next bear market and put that money to work near the next low point.

Well, I've got some good news and a bit of bad news. Let's start with the unpleasant bit.

Market timing rarely works

I'm afraid you'll miss the next ultimate low point, too.

Timing the market is notoriously difficult. Master investors like Warren Buffett don't even try. "We haven't the faintest idea what the stock market is going to do when it opens on Monday," he said at a shareholder meeting in 2022. "We've not been good at timing."

For example, the S&P 500 experienced several sharp price drops followed by quick gains just before the current bull market's starting point. I count about seven of these patterns in September and October 2023. Any of them could have become the official low point, making a perfect starting point for opportunistic investors. But the downward trend continued, and none of those false starts ended up earning the bull market honors.

The power of long-term investing

On the upside, you don't have to nail every market swing with pinpoint precision.

Buffett admits that he can't do it, and he still made his Berkshire Hathaway a behemoth worth nearly a trillion dollars through decades of admittedly imperfect but also smart and patient investments.

Warren Buffett is the 93-year-old poster child for building wealth with long-term investments. His favorite holding period is "forever," unlocking the mathematical magic of compound returns over many years or even decades.

Let's say you invest $1,000 in an S&P 500 tracker, such as the SPDR S&P 500 ETF Trust (NYSEMKT: SPY), an exchange-traded fund (ETF). It has delivered a compound average growth rate (CAGR) of 10.5% in its 30-year history, looking at total returns with reinvested dividends along the way. The gains have been faster in recent years, but let's stick with the long-term averages in this example.

Though 10.5% may not sound like a lot, those fresh returns on top of earlier returns really add up. Hold on to those shares for 10 years, and you'll have $2,714 in your pocket. It will be $7,366 after another decade and $19,993 after a 30-year holding period. Just the last year alone of that three-decade span will put $1,900 in your wallet -- a 10.5% boost worth nearly twice your original investment in a single year.

Now, imagine doing that while adding more money to your investment over the years, perhaps starting with a larger stake. That's how you build long-lasting wealth in the stock market -- time, patience, and consistent investments.

Perfect market timing has no place in this winning strategy. You simply don't need it.

ETFs to consider for your portfolio

Broad market trackers like the aforementioned SPDR fund or the Vanguard S&P 500 ETF (NYSEMKT: VOO) are perfect starting points for any investor. They combine wide-ranging diversification with forgettably low annual fees, and their index-defined focus on the 500 largest American stocks adds stability to the portfolio.

But I understand if you prefer zooming in on a somewhat smaller basket of promising growth stocks. Popular examples include the Vanguard Growth ETF (NYSEMKT: VUG) fund, which focuses on large-cap stocks with fast growth in earnings and revenues. Or you could go with the Vanguard Information Technology ETF (NYSEMKT: VGT), which doubles down on about 300 stocks in the technology sector.

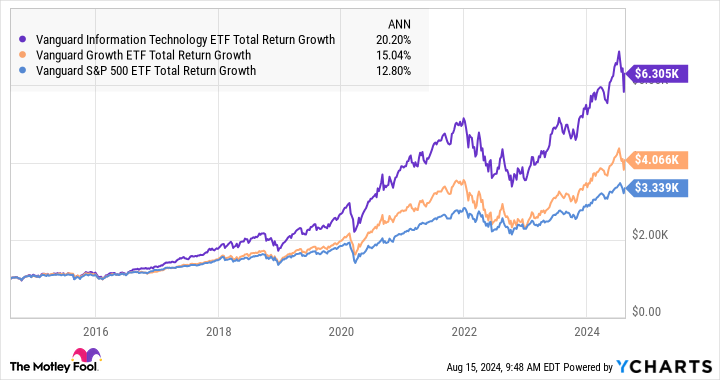

These high-quality, low-fee funds tend to beat the S&P 500 in the long run. Here's how a $1,000 investment in the three Vanguard funds I just mentioned would have worked out over the last decade:

Small differences in the average return can make a big difference to your take-home gains. The annual growth rates of these funds vary from 12.8% to 20.2%. The growth rates will vary over time, and I can't guarantee that the funds focused on tech stocks and growth stories will always outperform the broader market. Still, I like my chances of beating the S&P 500 with a proven performer like the Vanguard Information Technology ETF. I highly recommend it if you agree that technology experts should outperform the market as a whole in the long haul.

So, don't worry about missing the highest peaks and deepest valleys of this bull market. You can safely get started with investing in any of the four ETFs mentioned above -- or a combination of them -- and hold them patiently for many years. There will be good years and bad years, spiced up by the occasional crash or boom.

And on average, you'll see your wealth growing over time. That's how Buffett does it, and his buy-and-hold strategy works wonders for us mere mortals, too.

Should you invest $1,000 in Vanguard World Fund - Vanguard Information Technology ETF right now?

Before you buy stock in Vanguard World Fund - Vanguard Information Technology ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard World Fund - Vanguard Information Technology ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $763,374!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Anders Bylund has positions in Vanguard Growth ETF, Vanguard S&P 500 ETF, and Vanguard Information Technology ETF. The Motley Fool has positions in and recommends Berkshire Hathaway, Vanguard Growth ETF, and Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

Missed Out on the Bull Market Recovery? 4 ETFs You Can Buy Today. was originally published by The Motley Fool