How Microsoft's Diverse Growth Justifies Its Valuation

Microsoft Corp. (NASDAQ:MSFT) is still the second most valuable company on the planet, narrowly beaten by Apple Inc (NASDAQ:AAPL).

Among the 10 largest companies in the United States, some stand out for being traded at above-market multiples, such as the two already mentioned, but also Nvidia Corp. (NASDAQ:NVDA), Amazon.com Inc. (NASDAQ:AMZN), Eli Lilly and Co. (NYSE:LLY) and Tesla Inc (NASDAQ:TSLA).

Of all these, some require very aggressive projections or accept a low margin of safety to justify the valuation, such as Tesla, where it is necessary to consider substantial increases in fundamentals through the FSD, or Apple where the high price-to-earnings does not go well with growth prospects, but this is not really the case with Microsoft.

Even though it is trading at a forward price-to-earnings ratio very similar to Apple's, Microsoft is expected to grow faster and has very solid competitive advantages that guarantee good sustainability, and it is also possible to benefit from various opportunities since its revenue is very diversified.

Microsoft's diverse revenue streams and strong competitive moats

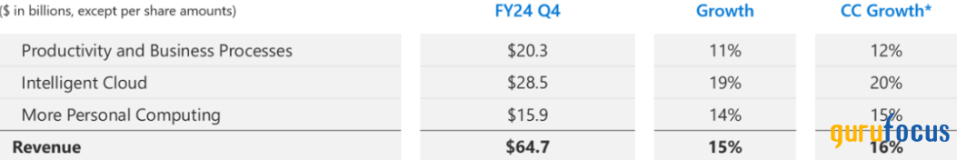

Microsoft divides its revenue sources into three main ones: Productivity and Business Processes, which is the portion that encompasses Office Commercial, Office Consumer, LinkedIn, and Dynamics business solutions, represented 31% of revenue in FYQ4; Intelligent Cloud, which encompasses server products and cloud services such as Azure, Visual Studio, GitHub and others, represented 44% of revenue in the last quarter; and finally, More Personal Computing, which corresponds to revenue generated by Windows, Gaming (Xbox and the like), search and news, represented 25% of revenue in the last quarter.

Note that even if we divide the revenues into three, there are an infinite number of sub-segments within each one, and although they have divergent perspectives, the vast majority are good businesses that manage to make significant progress in terms of revenue and still do so steadily, supported by the competitive advantages of each one.

Windows, for example, is present on more than 70% of desktops, and with this data alone, it would be possible to compile a list of competitive advantages, such as gains in scale, cross-selling power, lock-in effect, better compatibility, and so on. Not to mention Office 365 and its applications, which are used by thousands of huge companies that need to use Microsoft products on a daily basis, not only on Windows, but also on Macs and cell phones, and although there are alternatives that could threaten this market share - such as the tools from Alphabet Inc. (NASDAQ:GOOG) - the level of loyalty is very high.

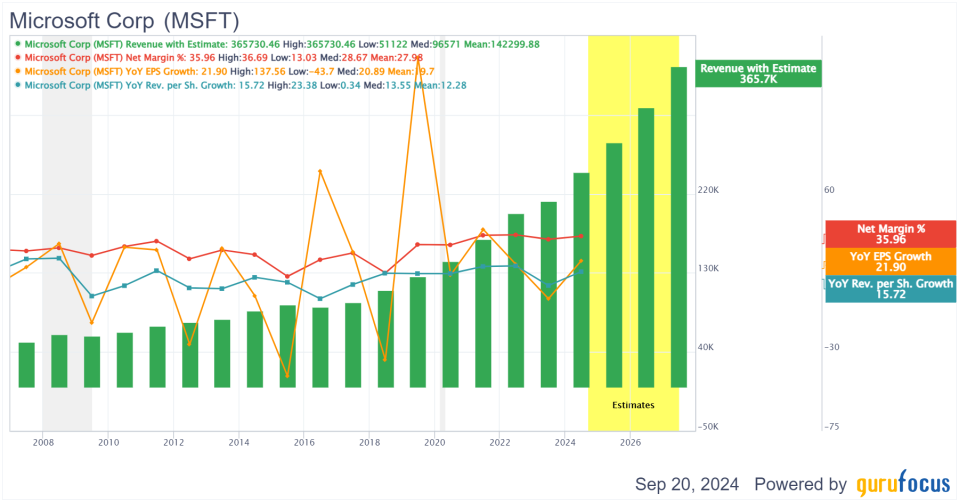

These characteristics reflect directly on Microsoft's fundamentals, with the power to improve its recurring revenue, pass on inflation to the price of its services, grow on other fronts, the company has been able to grow its revenue per share by an average of 12.2% and its EPS growth by 20.9% over the last 20 years, while in the same period, EPS growth was 20.9%, also showing the improvement in net income margin.

Source: GuruFocus

With these moats and stability, it is already possible to infer that Microsoft deserves a multiple at least in relation to the average of its market, for differing in quality.

Microsoft's pathways to future growth

In the most recent quarter (Fiscal Q4), this positive trend continued, with Microsoft growing all three of these main revenue lines by double digits, resulting in a consolidated growth of 15%. Drilling down a little further, the highlights were server products and cloud services, which increased by 21%, and Xbox content and services, which increased by 61% but were impacted by the Activision acquisition, while Office Consumer products only increased by 3%.

Source: Microsoft's presentation

For the next few years, these good figures will continue (depending on the year and the analyst, it could even be more optimistic in fact). According to the forecast, the average revenue growth for the next 3 fiscal years is ~14.3% and for EPS this is even better, with growth of just over 15% and reaching $17.98 EPS in fiscal year 2026.

Constructing a scenario where Microsoft maintains growth close to 15% is quite reasonable. I'd even say easy. Its more traditional part, Productivity and Business Processes, has the capacity to maintain price adjustments, continue acquiring new customers, and also benefit from secular trends in productivity, cybersecurity, and AI, since the trend is for Office 365 to become increasingly complete and integrated.

More personal computing should be driven by trends such as the new Copilot PCs that can help increase sales, improve the operating system update cycle, and the like. Copilot subscriptions alone could also show significant growth over the next few years, especially with a view to more widespread adoption.

The cloud division, which is already the largest part of revenue, also has secular trends and is still one of the pillars for the advance of Artificial Intelligence. In the last earnings call, it was mentioned that the Azure AI customer base reached 60,000 customers, growing 60% YoY.

Some more macro trends, such as the acquisition of customers in emerging markets and small and medium-sized businesses that don't yet have access to these products and services, could also continue to drive the growth of Microsoft's financials.

What bothers me is that while it's easy to understand scenarios where the company grows close to 15% over the next few years, it's difficult to perpetuate this for a few decades. It is possible for a company that already has revenues of close to $250bn and a net income of almost $90bn to continue growing at an accelerated rate, but this may become increasingly difficult. New ventures, for example, will need to mature more and more if they are to make any difference to annual growth, and at some point, it may become more difficult to acquire new customers around the world.

Microsoft's high valuation is justifiable

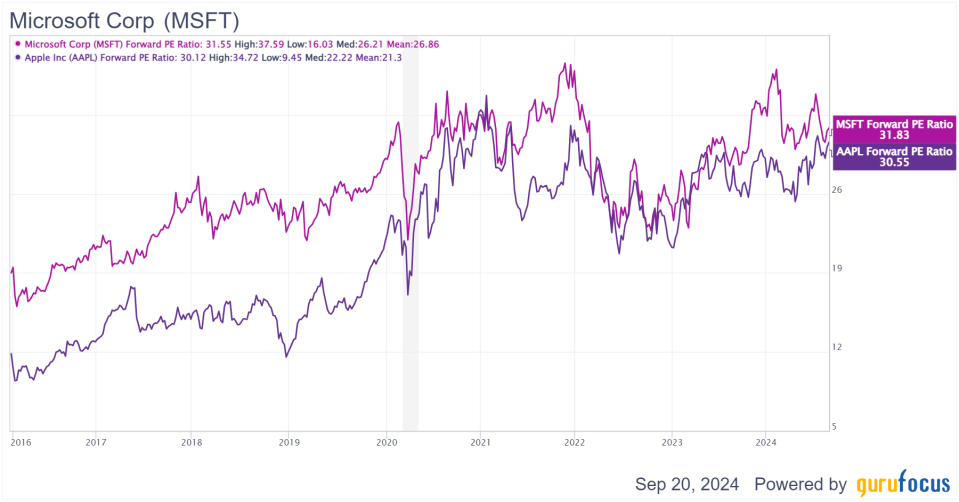

Considering the growth mentioned in the previous section, in a few years this premium would already become something closer to the index average, taking the average of the 2026 EPS estimates, the price-to-earnings would be just over 24x, a value that seems quite reasonable considering that we are talking about one of the most consolidated companies in the world and one that still has a lot to grow. Doing the same with Apple, the price-to-earnings for fiscal year 2026 would be ~27.2x, a higher level even if it is driven by large buybacks.

Historically, Microsoft has traded at a higher multiple than Apple, but in recent years this gap has been narrowing. In the latest data, Microsoft stocks were trading at 31.8x earnings, while Apple was trading at 30.5x, and although both are excellent companies with good prospects and competitive advantages, Microsoft's growth is a little more reliable (and will probably be higher at least in the short and medium term). It's also worth noting that Apple is trading at a higher premium compared to its own history since the mean of its indicator is ~21.3x while Microsoft's is 26.8x.

Source: GuruFocus

As the scenario for Microsoft's growth is clearer and the company continues to be one of the main players that will benefit from the AI trend, this premium in relation to both the market and its own history seems reasonable to me. Another factor that supports the bullish thesis is that there may be positive surprises along the way, especially considering the company's good track record of management, capital allocation, and the like.

This valuation level is even better justified considering the quality. Microsoft is a unique company and ends up being barely comparable with the market average and even with the US Treasury. Many investors may prefer to expose themselves to the 10-year treasury which is paying ~3.7% than to buy Microsoft which has an earnings/market cap ratio of ~2.7%, but it is necessary to consider that by fiscal year 2026, this earnings yield should exceed 4%.

Traditionally, a DCF should consider a more robust equity risk premium, so for Microsoft's current price to work in a DCF model, it is necessary to either consider that it will be able to maintain growth of ~15% for two decades, or discount this cash flow at a very small rate (like 5% or 6%).

In short, there isn't a huge asymmetry or bargain here, but you can still justify Microsoft's price without too much trouble.

The bottom line

In view of the information above, although Microsoft is far from undervalued, its valuation can be well justified without overly optimistic assumptions or giving up the entire margin of safety. Of course, here the investor is trading upside for quality and stability but still exposing himself to a growth company that could surprise positively in various segments over the next decade, which could then become an interesting option for adding predictability to the portfolio.

This article first appeared on GuruFocus.