In This Article:

McDonald's Corporation MCD reported fourth-quarter 2021 results, wherein both earnings and revenues missed the Zacks Consensus Estimate. Both the metrics lagged the consensus mark after beating the same in the trailing three quarters. However, both top and bottom lines improved year over year. Following the results, the company’s shares are down 2.2% in pre-market trading session.

Robust drive-thru presence, and its investments in delivery and digitization over the past few years have aided the company amid the pandemic. Robust digitalization will continue to help it in driving long-term growth and capturing market share.

McDonald's president and CEO, Chris Kempczinski, said, “We enter this new year with a clear focus on creating seamless and memorable customer experiences and harnessing our momentum to drive long-term, sustainable growth for all of our stakeholders.”

The company reported adjusted earnings of $2.23 per share, which lagged the Zacks Consensus Estimate of $2.31. However, the bottom line improved 31% year over year.

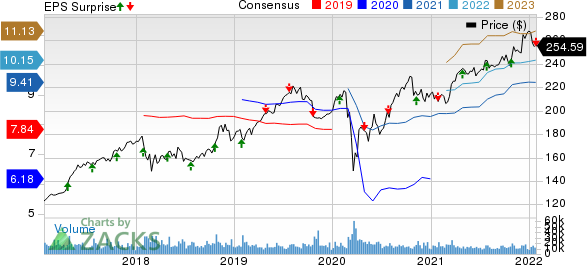

McDonald's Corporation Price, Consensus and EPS Surprise

McDonald's Corporation price-consensus-eps-surprise-chart | McDonald's Corporation Quote

Revenues & Comps Discussio

For the fourth quarter, revenues amounted to $6,009.1 million, which missed the Zacks Consensus Estimate of $6,032 million. The figure advanced 13% year over year. The top line benefited from an increase in global comparable sales.

At company-operated restaurants, sales were $2,538.8 million, up 14% year over year. The same at franchise-operated restaurants were $3,391.6 million, up 14% year over year.

For the quarter under review, global comps advanced 12.3% against a decline of 1.3% in the prior-year quarter. This marks the fourth consecutive quarter of comps growth, after reporting a decline in the preceding four quarters.

Solid Comps Across Segments

U.S.: Comps at this segment rose 7.5% for the fourth quarter compared with a gain of 5.5% in the prior-year period. The company’s comps for the quarter benefited from robust average check growth.

International Operated Markets: Comps at this segment surged 16.8% year over year against a decline of 7.4% in the year-ago quarter.

International Developmental Licensed Segment: The segment’s comparable sales increased 14.2% for the fourth quarter. In the prior-year quarter, the segment’s comps declined 1.3%.

Other Information

Cash and cash equivalents at the end of 2021 was $4,709.2 million, compared with $3,449.1 million at the end of 2020. Long-term debt as of Dec 31, 2021 was $35,622.7 million, compared with $35,196.8 million at the end of 2020.