Matthews (NASDAQ:MATW) Reports Sales Below Analyst Estimates In Q3 Earnings

Diversified solutions provider Matthews International (NASDAQ:MATW) fell short of analysts' expectations in Q3 CY2024, with revenue down 10.9% year on year to $427.8 million. It made a GAAP profit of $0.06 per share, down from its profit of $0.56 per share in the same quarter last year.

Is now the time to buy Matthews? Find out in our full research report.

Matthews (MATW) Q3 CY2024 Highlights:

Revenue: $427.8 million vs analyst estimates of $475.1 million (10% miss)

EPS: $0.06 vs analyst estimates of $0.51 (-$0.45 miss)

Gross Margin (GAAP): 169%, up from 32.7% in the same quarter last year

Market Capitalization: $889.1 million

Originally a death care company, Matthews International (NASDAQ:MATW) is a diversified company offering ceremonial services, brand solutions and industrial technologies.

Specialized Consumer Services

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

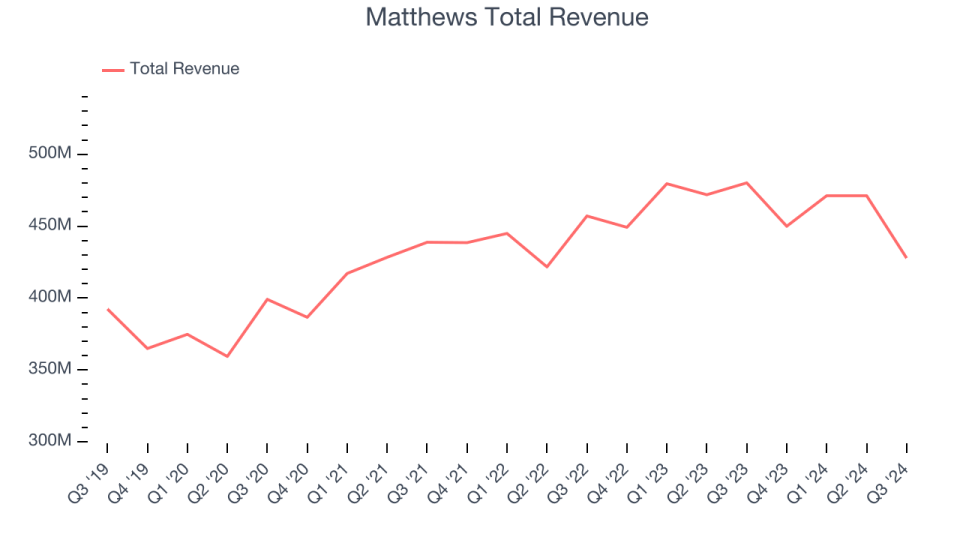

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones tend to grow for years. Over the last five years, Matthews grew its sales at a weak 3.4% compounded annual growth rate. This shows it failed to expand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. Matthews's recent history shows its demand slowed as its annualized revenue growth of 1.6% over the last two years is below its five-year trend.

This quarter, Matthews missed Wall Street's estimates and reported a rather uninspiring 10.9% year-on-year revenue decline, generating $427.8 million of revenue. We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

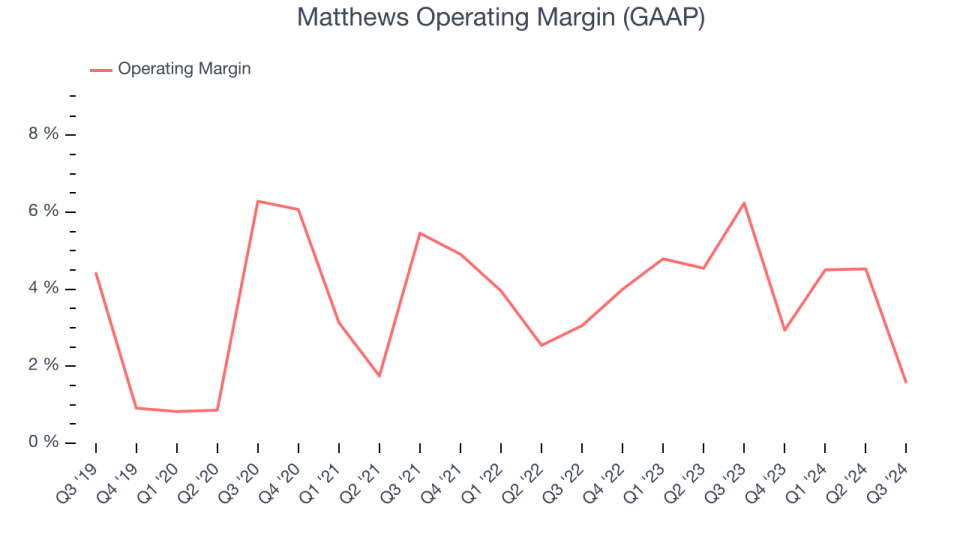

Operating Margin

Matthews's operating margin has shrunk over the last year and averaged 4.2%. The company's profitability was mediocre for a consumer discretionary business and shows it couldn't pass its higher operating expenses onto its customers.

This quarter, Matthews generated an operating profit margin of 1.6%, down 4.7 percentage points year on year. This contraction shows it was recently less efficient because its expenses increased relative to its revenue.

Key Takeaways from Matthews's Q3 Results

We struggled to find many strong positives in these results. Its revenue unfortunately missed and its EPS fell short of Wall Street's estimates. Overall, this quarter could have been better. The stock traded down 4.6% to $26.77 immediately following the results.

Matthews may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.