Market Valuations in 2024: Bubble Concerns and Opportunities

The stock market rally that began in 2023 has pushed valuations higher. The S&P 500, after surging 24% last year, is up more than 8% this year. A key feature of this strong performance has been the rise of the Magnificent Seven, a group of tech stocks that includes Alphabet Inc. (GOOG), Amazon.com, Inc. (NASDAQ:AMZN), Apple Inc. (NASDAQ:AAPL), Meta Platforms Inc. (NASDAQ:META), Microsoft Corp. (NASDAQ:MSFT), Nvidia Corp. (NASDAQ:NVDA) and Tesla Inc. (NASDAQ:TSLA). Collectively, these stocks have contributed to the bulk of the S&P 500 gains since the beginning of 2023. Recent stock market gains, which pushed the S&P 500 index to an all-time high of close to 5,670 in July, have led to some market tension today, with investors questioning the sustainability of this rally.

The findings of this analysis reveal the stock market is not as overpriced as it may initially seem, but investors need to be cautious about betting on the frontrunners of this rally.

A comparison with the dot-com bubble

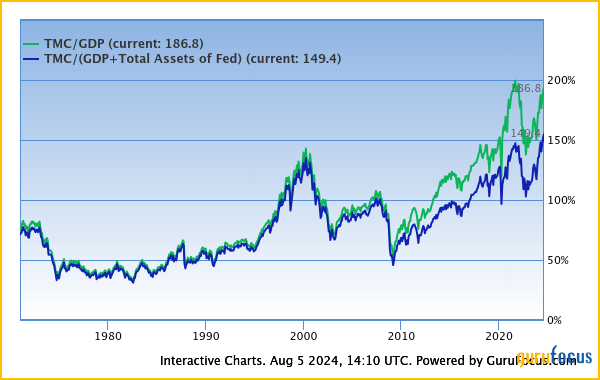

Traditional market indicators suggest stocks are expensively valued today. For instance, the Buffett Indicator, which derives stock market valuation levels based on the total market capitalization and the gross domestic product, is flashing warning signs today at a reading of 186.80. As illustrated below, the ratio of market cap to GDP at the time of writing is substantially higher than what was observed preceding the dot-com bubble and the global financial crisis.

Exhibit 1: The ratio of market capitalization to GDP

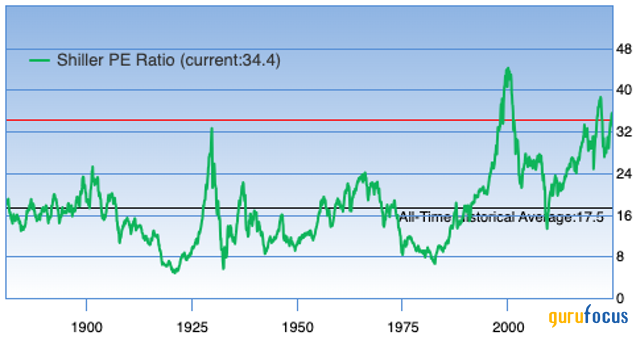

The Shiller P/E, which is commonly used to gauge a measure of market valuation, is also flashing red signs at a reading of 34.40 compared to the 20-year average of just 26.60. As illustrated below, the only instance in which the Shiller P/E reached a higher value was just before the dot-com bubble burst in 2000.

Exhibit 2: Historical Shiller P/E

Although these indicators point to an overvalued market, as investors, it is important to dive deeper to understand the differences and similarities between the current stock market rally and historical market crashes. Since today's market rally is dominated by the tech sector, it makes sense to compare the rally with the dot-com bubble to identify potential inflection points.

A careful evaluation of data leading up to the market rout on Aug. 5 reveals that stocks are significantly less expensive compared to the dot-com bubble era. For instance, the median price-earnings ratio of the top 10 companies by market capitalization was over 60 in 2000, but today's top 10 largest companies by market cap have a median price-earnings of just 27. This suggests stocks are in a much better place today compared to the dot-com bubble despite delivering eye-popping returns since the beginning of 2023.

Tom Hancock, Ty Cobb and Anthony Hene, portfolio managers of the Focused Equity team at Jeremy Grantham (Trades, Portfolio)'s GMO Capital, also believe stocks are cheaper compared to the dot-com era despite rising fears among investors. In a note to clients last week, the fund managers wrote:

"Implicitly, investors expect less from the megacaps now than they did in 2000. In a real sense, the stakes are lower today. We are pointing out that in an important way the stars have aligned differently this time around, even if the market is superficially similar from a technical perspective. In the short term, it's anyone's guess. But looking further out, whether today's megacaps turn out to be great or less-than-great investments will be a result of the evolution of their fundamentals and the consequent impact on their valuation multiples."

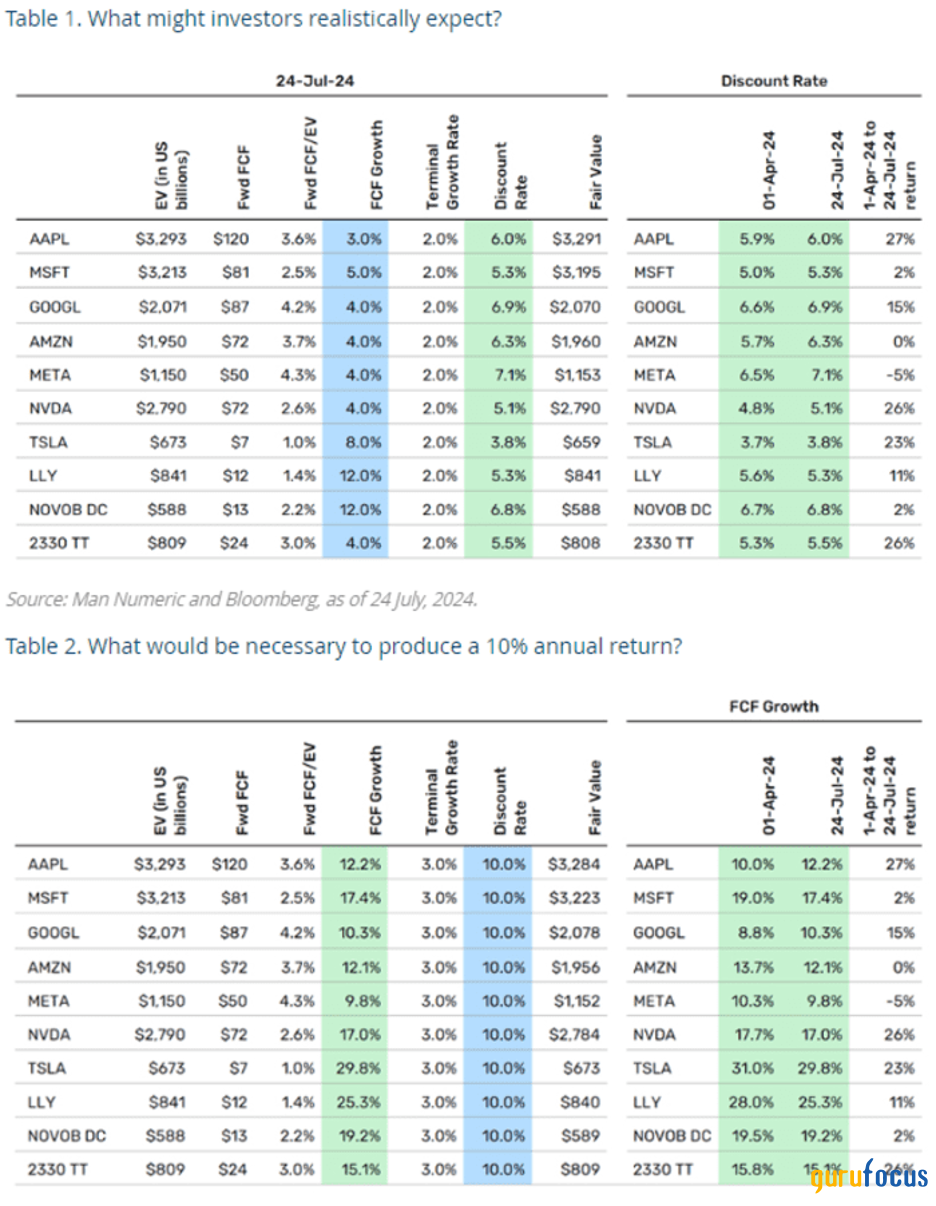

Another analysis conducted by Man Group found that Magnificent Seven companies are not cheap, but they are not outrageously valued either, evident from the mid-single-digit returns implied in their current valuation.

Exhibit 3: Return expectations from Magnificent Seven companies

Source: Man Group/MarketWatch

During the dot-com bubble era, investors were overly optimistic about the prospects for every Internet company that debuted on the stock market. The current market rally is centered on the promising prospects for artificial intelligence technology. For this reason, it makes sense to compare how AI giants fair with some of the companies that saw substantial gains during the dot-com bubble before it burst and hurt investors.

Table 1: Financial and valuation metrics for major winners during the dotcom bubble

Company | 1999 revenue | 1999 net profit (loss) | P/E ratio in 1999 | Expected revenue growth next year |

Amazon | $1.64 billion | ($720 million) | N/A | 100% |

Yahoo! | $588.6 million | $61.1 million | 500+ | 50% |

Pets.com | $5.8 million | ($61.8 million) | N/A | This was a speculative company with no reasonable growth expectations. |

Table 2: Financial and valuation metrics for major winners of the AI market rally

Company | 2023/2024 revenue | 2023 net profit | P/E ratio | Expected revenue growth next year |

Nvidia | $60.9 billion | $29.76 billion | 58 | 37% |

Microsoft | $245.1 billion | $88.13 billion | 36 | 12% |

Alphabet | $307.39 billion | $73.79 billion | 24 | 17% |

Source: Eikon

Based on the above data, it seems reasonable to reach a few conclusions.

First, compared to the dot-com bubble era, today's market leaders are highly profitable.

Second, the dot-com bubble formed as company valuations reached unsustainable highs purely based on expectations, whereas today, valuations are more grounded on what the frontrunners of the AI rally have achieved so far.

Finally, compared to the dot-com era, AI winners are more mature companies with proven business models. Speculation does not play a big role in the valuation of these companies.

Caution is warranted, but there are opportunities

Peter Lynch, commenting on the futile nature of market timing, once said, "I can't recall ever once having seen the name of a market timer on Forbes' annual list of the richest people in the world. If it were truly possible to predict corrections, you'd think somebody would have made billions by doing it."

Time and again, staying invested in stocks has proven to be the right long-term strategy even in the face of recession risks and market crashes. There is no reason to believe things will be any different in the future. Investors may have to be cautious about betting on high-flying AI stocks, but there are corners of the market that remain deeply undervalued and out of the radar of common investors.

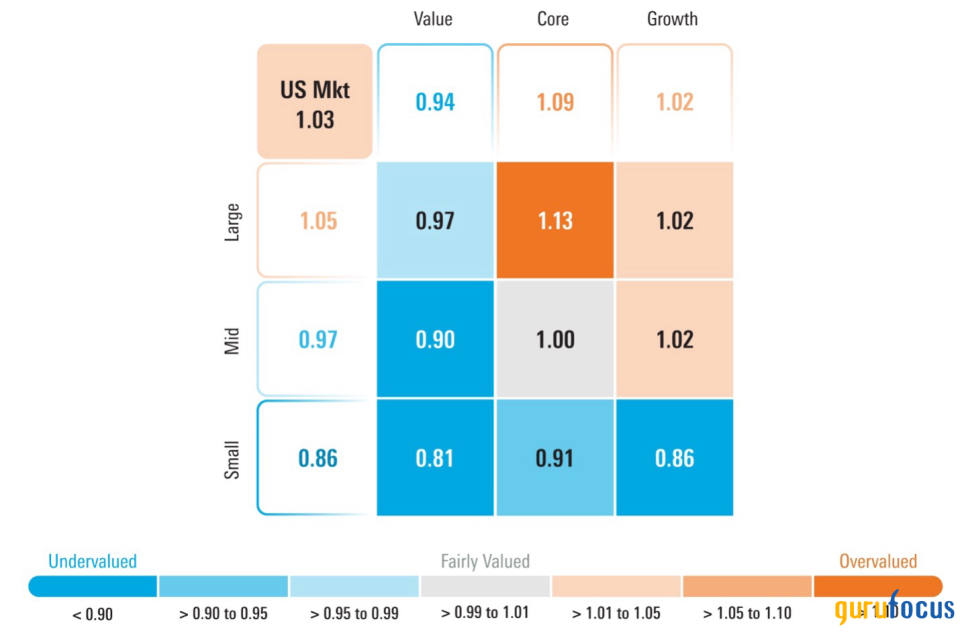

Small-cap stocks still offer attractive opportunities for prudent investors. According to Morningstar, as of July, small-cap value was the most undervalued style box category in U.S. markets.

Exhibit 4: Price-fair value by Morningstar style box category

Source: Morningstar

A deeper dive into sector valuation levels reveals that the utility sector is home to some of the most undervalued companies today. With the Federal Reserve expected to cut rates in September, utility stocks are likely to see a major improvement in investor sentiment given these companies incur substantial interest expenses every year as they carry billions of dollars in debt on their balance sheets. The expected rate cut is likely to be a catalyst for these companies to see higher stock prices.

Investors will have to monitor recession risks more carefully in the coming months to identify potential inflection points in the market. According to Goldman Sachs chief equity strategist Peter Oppenheimer, valuations remain stretched even after the market rout on Monday.

Takeaway

Stocks are not cheap by historical standards today, but there are opportunities for investors who look for them in undervalued, under-covered sectors. Although some investors are fearful of a repetition of a dot-com bubble burst in the coming months, a deeper dive reveals today's market leaders are far more attractive and cheap compared to the dot-com bubble era. Being cautiously optimistic about stocks while building a diversified portfolio with a high exposure to small-cap value stocks seems like the winning strategy in the coming years as a style rotation has begun to favor these stocks in the foreseeable future.

This article first appeared on GuruFocus.