Looking to Buy an Artificial Intelligence (AI) ETF? Buy This ETF Instead

One of the easiest and smartest moves you can make as an investor is buying exchange-traded funds (ETFs). ETFs do much of the hard work of investing for you, keeping your portfolio diversified and rebalancing its holdings according to the preferences of an active manager, or the underlying index the fund is tracking. The only real challenge is finding the best ETF for your investment goals.

There's an ETF for almost every type of investor. ETFs can be designed to follow an index fund like the S&P 500 or Nasdaq-100, or they can steer your holdings to focus on value stocks, growth stocks, dividend stocks, healthcare stocks, etc.

These days, interest in artificial intelligence (AI) ETFs has risen as the breakthrough technology has sparked a new gold rush in the tech sector. But if you're looking to invest in AI-focused ETFs, you're better off steering clear of the traditional AI ETFs and taking an alternative approach.

AI ETFs tend to not give you what you want

It's difficult to define an artificial intelligence (AI) stock right now. Just about every investor out there knows Nvidia, but beyond the AI chip leader, dozens, if not hundreds of companies are claiming various degrees of exposure to the emerging technology.

Looking at the biggest AI ETFs, you'll notice a pattern. These funds don't hold the stocks that are generally considered household names in AI. The chart below shows the top five holdings (percentage-wise) in three AI ETFs: Global X Robotics & Artificial Intelligence ETF (NASDAQ: BOTZ), Robo Global Robotics and Automation Index ETF (NYSEMKT: ROBO), and iShares Future AI & Tech ETF (NYSEMKT: ARTY).

Rank | BOTZ | ROBO | ARTY |

|---|---|---|---|

1 | Nvidia | Novanta | Lumen Technologies |

2 | ABB | Zebra Technologies | Sirius XM Holdings |

3 | Intuitive Surgical | Fanuc | Genius Sports |

4 | Keyence | Intuitive Surgical | Hello Group |

5 | SMC | ServiceNow | Pegasystems |

Source: Yahoo! Finance.

As you can see, these funds hold a wide range of stocks hailing from industries beyond tech, including industrials, healthcare, and even media. With the notable exception of Nvidia atop the Global X Robotics & AI ETF, this list likely looks a lot different from what you might expect.

It doesn't include any of the other "Magnificent Seven" stocks that are well positioned to capitalize on the AI boom, and it doesn't include any other representatives from the semiconductor sector, which have soared on high expectations for the new technology.

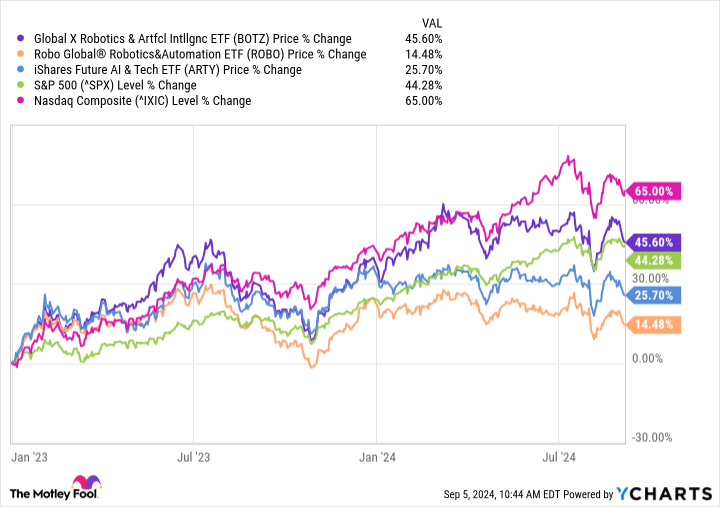

As you can see from the chart below, Global X's ETF is the only one of these three funds that has outperformed the S&P 500 since the start of 2023 when the AI boom began to pick up speed following the launch of ChatGPT in late 2023, and all three of these stocks have underperformed the Nasdaq Composite.

A better ETF to consider

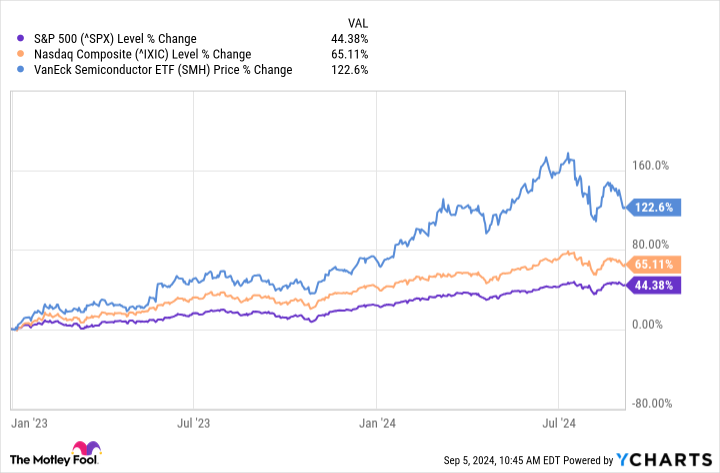

If you're looking for an ETF that will give you exposure to stocks that are benefiting from the AI boom today, a better choice is the VanEck Semiconductor ETF (NASDAQ: SMH), which invests in a wide range of top semiconductor stocks.

The VanEck Semiconductor ETF's top-five holdings are Nvidia, Taiwan Semiconductor Manufacturing, Broadcom, Texas Instruments, and Advanced Micro Devices. Together, those five stocks make up roughly 50% of the fund.

The ETF has also surged by 122% since the start of 2023, showing that it's capitalized on the AI boom more than the AI-targeted ETFs above.

Looking ahead, the semiconductor ETF also looks like a good bet to continue outperforming the alternatives above. That's because semiconductor stocks are well positioned in the AI revolution as the building blocks of the new technology. In other words, these stocks are likely to do well before companies involved in AI applications like Intuitive Surgical, ABB, or Keyence do.

Additionally, the VanEck Semiconductor ETF also seems surprisingly affordable at a price-to-earnings ratio of 19.5, making the ETF cheaper than the S&P 500 in addition to the three ETFs above.

Even as stocks like Nvidia have already soared on high expectations for the AI revolution, several chip stocks in the ETF are still surprisingly affordable. The SMH ETF offers a great way to take advantage of a discount price on the fast-growing sector.

Should you invest $1,000 in VanEck ETF Trust - VanEck Semiconductor ETF right now?

Before you buy stock in VanEck ETF Trust - VanEck Semiconductor ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and VanEck ETF Trust - VanEck Semiconductor ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $656,938!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Jeremy Bowman has positions in Broadcom. The Motley Fool has positions in and recommends Abb, Advanced Micro Devices, Genius Sports, Intuitive Surgical, Nvidia, ServiceNow, Taiwan Semiconductor Manufacturing, Texas Instruments, and Zebra Technologies. The Motley Fool recommends Broadcom, Fanuc, Hello Group, and Pegasystems. The Motley Fool has a disclosure policy.

Looking to Buy an Artificial Intelligence (AI) ETF? Buy This ETF Instead was originally published by The Motley Fool