In This Article:

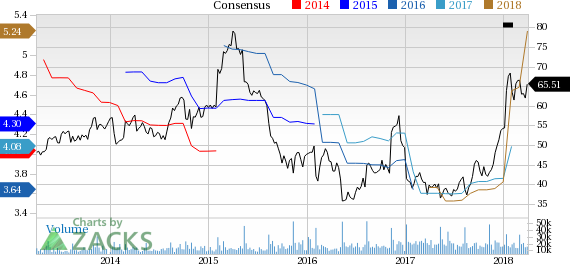

It has been about a month since the last earnings report for Kohl's Corporation KSS. Shares have added about 4.4% in that time frame.

Will the recent positive trend continue leading up to its next earnings release, or is KSS due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important drivers.

Kohl's Q4 Earnings & Sales Beat Estimates, Increase Y/Y

Kohl’s posted fourth-quarter fiscal 2017 results, with the top and bottom line improving year over year and beating the Zacks Consensus Estimate. While this marked Kohl’s third consecutive sales beat, earnings reverted to the positive surprise track after delivering a miss in the previous quarter.

Adjusted earnings per share of $1.87 surpassed the Zacks Consensus Estimate of $1.77 and jumped 29.9% from $1.44 recorded in the year-ago period. Including the impact of state tax settlement, earnings soared about 38% to $1.99 per share. On a reported basis, earnings jumped considerably to $2.81 per share.

The bottom line was backed by solid sales and enhanced gross margin. Also, earnings gained from an additional week in the fourth quarter of this fiscal year.

Sales and Margins

Fourth-quarter net sales came in at $6,776 million, which beat the Zacks Consensus Estimate of $6,737 million and advanced 9.2% year over year. Sales benefited from an additional week, wherein the company generated roughly $170 million in total sales.

Further, comparable store sales (comps) rose 6.3% against a 2.2% dip recorded in the year-ago period. It looks like the company’s strategic initiative, Greatness Agenda, is yielding results. The initiative, which commenced in first-quarter 2014, was designed to drive transactions per store and sales.

Gross margin expanded 43 bps to 33.8% in the reported quarter. Selling, general and administrative expenses increased 7.3% to $1,459 million.

However, management is pleased with its improved merchandise margins, which in turn was a result of efficient inventory management and better promotional and permanent markdowns. Notably, the company ended fiscal 2017 with inventory down 7% year over year. Also, expenses were managed well across all business areas.

Other Financial Details

Kohl’s ended the quarter with cash and cash equivalents of $1,308 million, long-term debt of $2,797 million and shareholders’ equity of $5,426 million. Cash flow from operations amounted to $1,691 million during the fiscal.