The Key Levels to Watch as Asia’s Top Currencies Battle Dollar

(Bloomberg) -- The rally in Asian currencies this month is bringing some key levels into view as traders wait for the Federal Reserve’s annual confab in Jackson Hole this week to cement expectations for rate cuts in the US this year.

Most Read from Bloomberg

‘Train Lovers’ Organize to Support Harris and Walz in Presidential Bid

Part of Downtown Montreal Is Flooded After Water Pipe Breaks

Bloomberg’s Asia dollar index is close to a one-year high, while a gauge of the greenback has fallen to the lowest since March. That’s because Fed rate cuts would narrow the interest-rate gap between the US and Asian economies and favor the latter’s currencies.

Bank of Japan Governor Kazuo Ueda’s speech in parliament on Friday is also on the radar as any hint of further rate hikes would not only boost the yen but could also give another leg up to regional currencies.

Here are the key levels traders are watching:

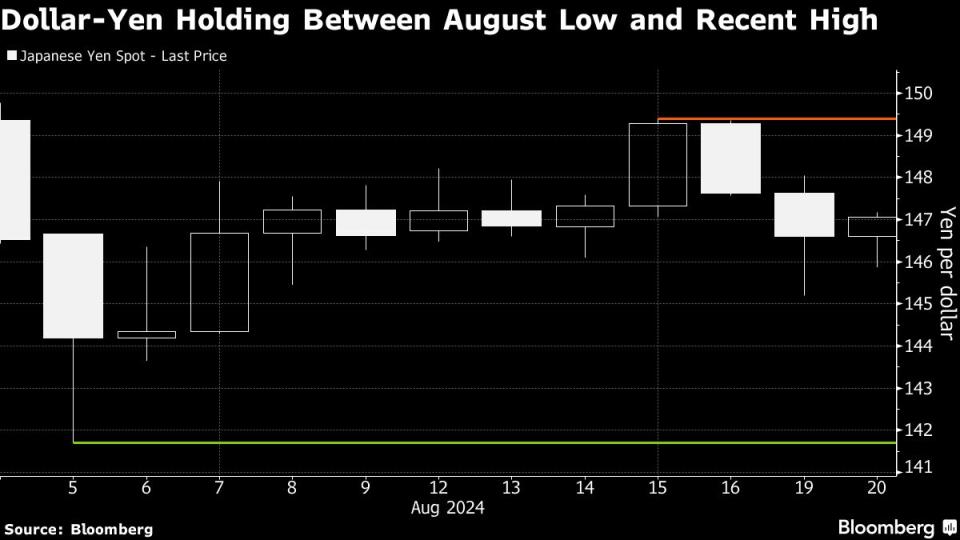

1. Yen

The dollar-yen has been consolidating between its August low of 141.70 and 149.39, the high it subsequently rebounded to. Whichever level is breached first may pave the way for an extended move in that direction. The yen is underperforming Asian currencies so far this year with a 4% decline against the dollar, even after rebounding from its lowest since 1986 following the BOJ’s latest rate hike.

2. Yuan

The offshore yuan has been boxed in a trading range this month. The currency surged to a 14-month high versus the dollar earlier in August but it’s still down about 0.2% this year. Investors will be looking to see if the dollar-offshore yuan currency pair breaks out of the 7.0838-7.1945 band.

3. Rupiah

The dollar-rupiah pair is eyeing test of support at its November low of 15,360. However, it’s already in oversold territory, at least according to a momentum indicator called slow stochastics. That may prompt it to jump back toward 15,843, its Jan. 26 high if downward momentum wanes. The rupiah has rallied nearly 5% versus the dollar this month and is close to wiping out its year-to-date losses.

4. Ringgit

With the dollar-ringgit already in oversold territory, as per the slow stochastics measure, there could be a pullback toward the March 9, 2023 high of 4.5317 if bearish momentum fades. But if conditions turn even more bleak for the greenback, the next support level for dollar-ringgit will be the Feb. 2, 2023 low of 4.2250. The ringgit has gained nearly 5% against the dollar this year to outperform Asian peers.

5. Baht

The dollar-baht is eyeing its next support level of 34.099, the Dec. 28 low. But if bearish dollar momentum wanes, the pair could meet resistance at Jan. 24 high of 35.885. The baht has rallied more than 3% each in July and August and is close to wiping out its year-to-date losses versus the dollar.

Most Read from Bloomberg Businessweek

‘I’m So Scared’: NFL Players on How Betting Changes the Sport

Inside Worldcoin’s Orb Factory, Audacious and Absurd Defender of Humanity

Singapore's Wooden Building of the Future Has a Mold Problem

Sports Betting Is Legal, and Sportswriting Might Never Recover

©2024 Bloomberg L.P.