KB Home (NYSE:KBH) Reports Strong Q2

Homebuilder KB Home (NYSE:KBH) reported Q2 CY2024 results topping analysts' expectations , with revenue down 3.1% year on year to $1.71 billion. It made a GAAP profit of $2.15 per share, improving from its profit of $1.95 per share in the same quarter last year.

Is now the time to buy KB Home? Find out in our full research report.

KB Home (KBH) Q2 CY2024 Highlights:

Revenue: $1.71 billion vs analyst estimates of $1.65 billion (3.4% beat)

EPS: $2.15 vs analyst estimates of $1.80 (19.5% beat)

Full year housing revenue guidance: $6.8 billion at the midpoint, raised from $6.7 billion previously (1.2% beat)

Full year housing gross and operating margin guidance also slightly raised

Gross Margin (GAAP): 21.5%, down from 21.9% in the same quarter last year

Backlog: $6,270 at quarter end, down 13.9% year on year

Market Capitalization: $5.28 billion

“We produced solid results in our 2024 second quarter, with our key metrics above the high end of our guidance ranges,” said Jeffrey Mezger, Chairman and Chief Executive Officer.

The first homebuilder to be listed on the NYSE, KB Home (NYSE:KB) is a homebuilding company targeting the first-time home buyer and move-up buyer markets.

Home Builders

Traditionally, homebuilders have built competitive advantages with economies of scale that lead to advantaged purchasing and brand recognition among consumers. Aesthetic trends have always been important in the space, but more recently, energy efficiency and conservation are driving innovation. However, these companies are still at the whim of the macro, specifically interest rates that heavily impact new and existing home sales. In fact, homebuilders are one of the most cyclical subsectors within industrials.

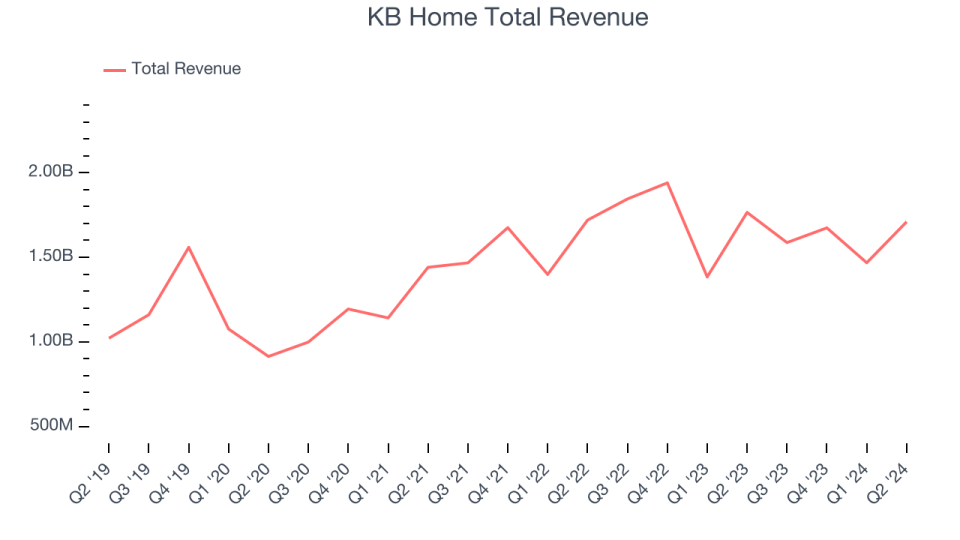

Sales Growth

A company's long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Luckily, KB Home's sales grew at a decent 7.9% compounded annual growth rate over the last five years. This shows KB Home was successful in expanding its business, a useful starting point for our quality assessment.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. KB Home's recent history shows its demand slowed as its annualized revenue growth of 1.4% over the last two years is below its five-year trend.

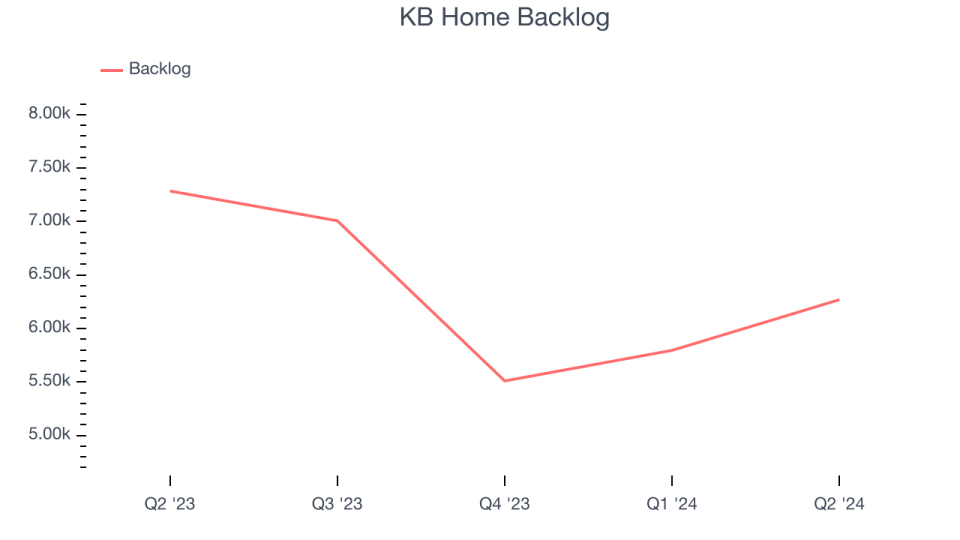

We can better understand the company's revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. KB Home's backlog reached $6,270 in the latest quarter and averaged 25.4% year-on-year declines over the last two years. Because this number is lower than its revenue growth, we can see the company didn't secure enough new orders to accelerate its sales in the future.

This quarter, KB Home's revenue fell 3.1% year on year to $1.71 billion but beat Wall Street's estimates by 3.4%. Looking ahead, Wall Street expects sales to grow 5% over the next 12 months, an acceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

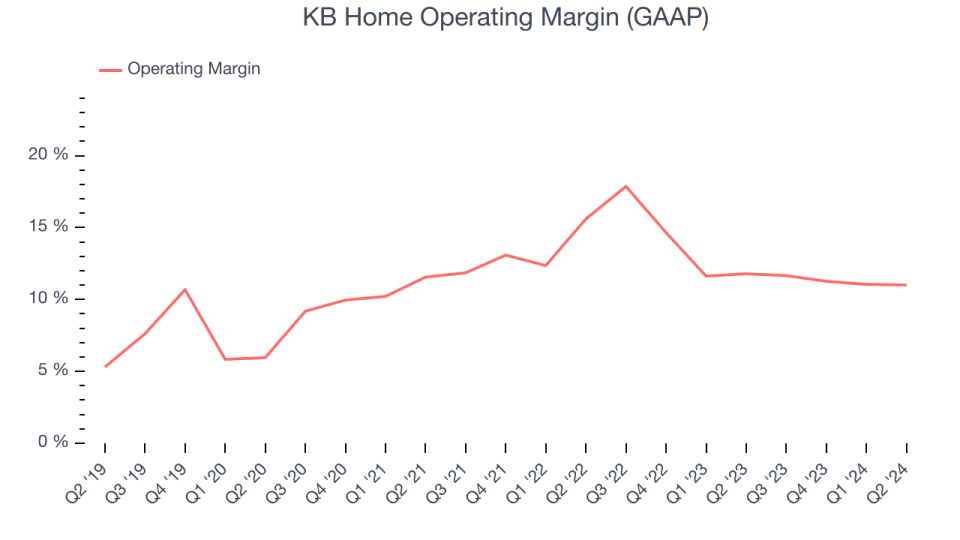

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

KB Home has managed its expenses well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 11.7%. This is quite impressive relative to its low gross margin and is a reason why we look at both margins together.

Analyzing the trend in its profitability, KB Home's annual operating margin rose by 3.3 percentage points over the last five years, showing its efficiency has improved.

This quarter, KB Home generated an operating profit margin of 11%, in line with the same quarter last year. This indicates the company's cost structure has recently been stable.

Key Takeaways from KB Home's Q2 Results

We liked that revenue and operating margin both outperformed Wall Street's estimates. The real bright spot was that KB Home raised its full year outlook for housing revenue. The company also raised its full year margin outlook, showing that not only is topline growth better but it's coming in more profitable as well. On the other hand, its backlog missed, but the market seems to be forgiving this. Zooming out, we think this was a fantastic quarter that should have shareholders cheering. The stock is up 4.7% after reporting and currently trades at $71.30 per share.

KB Home may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.