JP Morgan Expected To Report Flay YoY Earnings, Revenue

JPMorgan Chase & Co. (NYSE: JPM) is scheduled to announce its second quarter financial results Tuesday before the market opens. Expectations point towards pretty much flat year-over-year earnings and revenue.

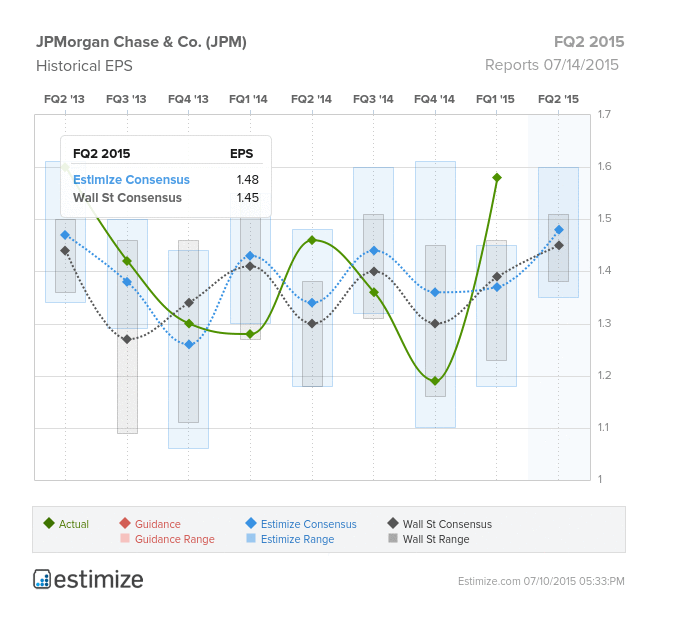

In the second quarter of 2014, the company delivered earnings of $1.46 per share on revenue of $24.454 billion. For the current quarter, the Street is modeling consensus earnings of $1.45 per share on sales of $24.425 billion, while the crowd is projecting consensus earnings of $1.48 per share on revenue of $24.716 billion (Estimize).

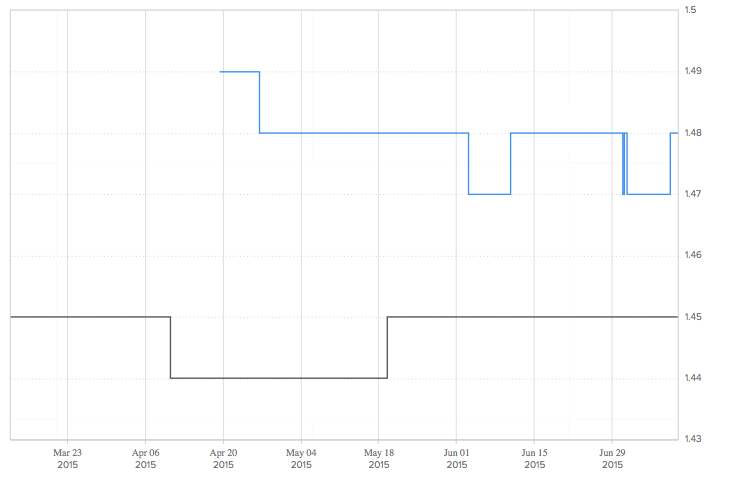

The second chart illustrates the evolution of sentiment over time. While the Street’s expectations remain in the same level as they were at the beginning of the quarter, the crowd became less bullish between April and June, before consensus established at $1.48.

Analyst Ratings & Institutional Support

Several major Wall Street research firms have weighed in on JP Morgan recently. Oppenheimer maintains a Perform rating, same as Keefe, Bruyette & Woods, which accompanies its Market Perform rating with a $69.00 price target. MKM Partners issued a Neutral rating a couple of months ago.

Other analysts are more bullish on the stock. Macquarie maintains an Outperform rating and $72.00 price target. Bernstein rates the stock an Outperform.

Harris Associates last disclosed having added 476,084 shares to its position, taking it to 32,396,811 shares worth almost $2 billion, and Lansdowne Partners, managed by Paul Ruddock and Steve Heinz, boosted its exposure to the stock by 10 percent over the last reported quarter, to 20,683,232 shares.

Latest Ratings for JPM

Jun 2015 | Oppenheimer | Downgrades | Outperform | Perform |

May 2015 | MKM Partners | Downgrades | Buy | Neutral |

Apr 2015 | Keefe Bruyette & Woods | Maintains | Market Perform |

View More Analyst Ratings for JPM

View the Latest Analyst Ratings

See more from Benzinga

© 2015 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.