Japanese Funds Are Set to Buy Most Foreign Bonds Since 2007

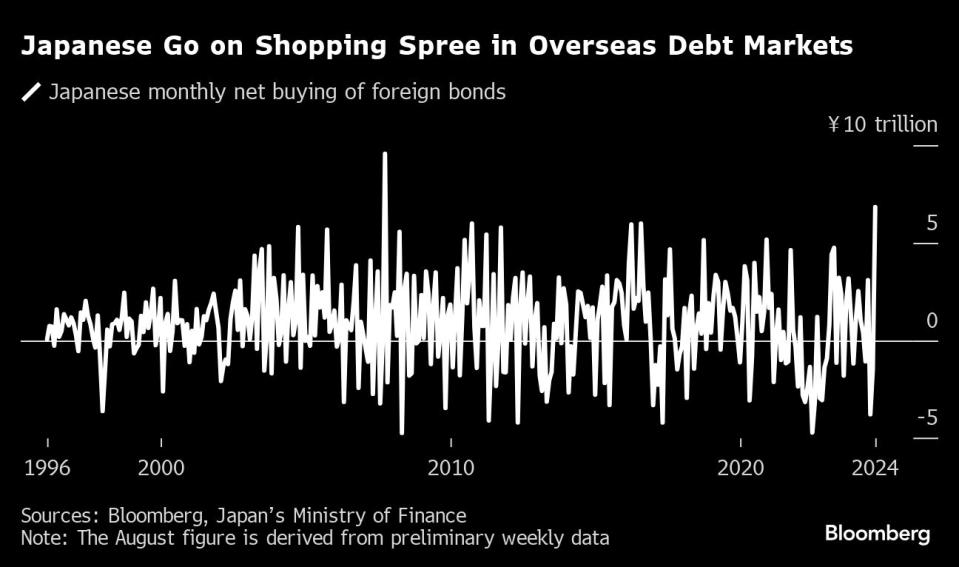

(Bloomberg) -- Japanese investors are set this month to buy the largest amount of foreign bonds in 17 years as the prospects for overseas monetary policies spur a rally in debt and a drop in currency hedging costs.

Fund managers in the Asian nation bought the securities for a fourth straight week through Aug. 23, a preliminary report from the Ministry of Finance showed on Thursday. Should the same pace of buying be maintained, monthly net purchases would total ¥6.83 trillion ($47.3 billion) in August, the most since buying reached a record ¥9.56 trillion in September 2007.

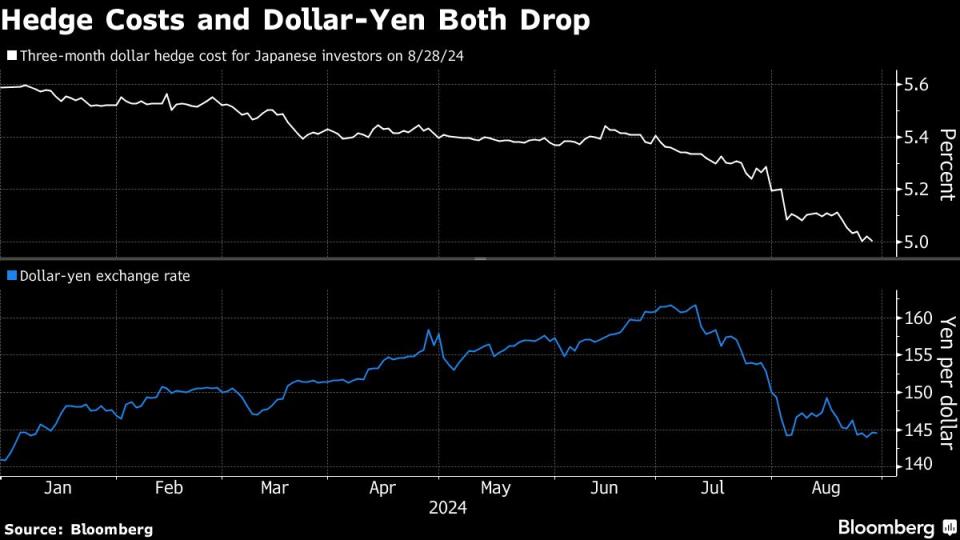

Global debt has gained almost 3% this month, adding to a similar return posted in July, as Federal Reserve Chair Jerome Powell signaled an upcoming interest-rate cut. Costs that Japanese investors incur when taking protection against a drop in foreign currencies have slid because they are closely linked to the difference in short-term interest rates between Japan and other economies.

“Foreign-exchange hedges, the move in spot FX and the yields still available to bond investors are proving attractive,” said Martin Whetton, head of financial markets strategy at Westpac Banking Corp. “Given the recent stability of global yields, albeit at the low end of the range, the stronger yen gives Japanese investors solid firepower to invest offshore.”

The yen has strengthened more than 10% against the dollar since sliding to a four-decade low in early July. Pension funds, banks and individual investors might have taken advantage of the stronger currency to buy foreign securities without hedging, said Tsuyoshi Ueno, a senior economist at NLI Research Institute in Tokyo.

“If a scenario of a soft landing for the US economy holds up, outward investment could continue due to expectations of rising stock and bond prices, curbing appreciation pressure for the yen,” he said.

(Adds second chart and economist comment)

Most Read from Bloomberg Businessweek

Hong Kong’s Old Airport Becomes Symbol of City’s Property Pain

Far-Right ‘Terrorgram’ Chatrooms Are Fueling a Wave of Power Grid Attacks

©2024 Bloomberg L.P.