Israel’s Inflation Jumps More Than Expected as War Continues

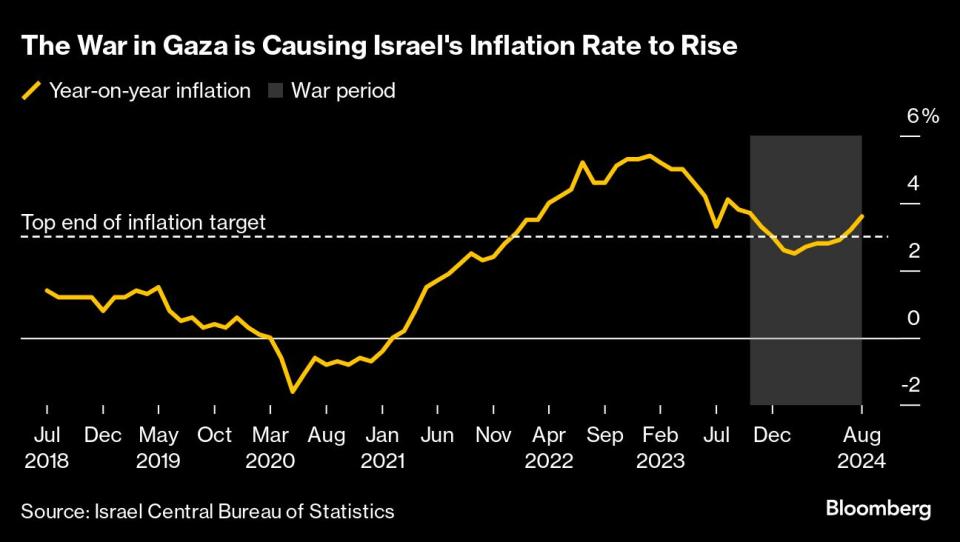

(Bloomberg) -- Israel’s inflation accelerated more than expected last month, to 3.6% year on year, as the war in Gaza strains the economy and the government’s spending soars.

Most Read from Bloomberg

Housing’s Worst Crisis in Decades Reverberates Through 2024 Race

An Affordable Nomadic Home Design Struggles to Adapt to Urban Life

The Hague Is World’s First City to Ban Oil and Air Travel Ads

The figure rose from 3.2% in July, the Israeli Central Bureau of Statistics said on Sunday. It’s now at the highest since October last year and significantly above the country’s official inflation target of between 1% and 3%. Analysts were forecasting that the rate would remain steady, according to a Bloomberg survey.

Month-on-month inflation quickened from 0.6% to 0.9%, the highest reading in more than two years. The survey respondents expected a dip to 0.5%.

The Israeli government’s local-currency bond yields have risen significantly over the course of this year, indicating nervousness among investors. Yields on 10-year shekel bonds are up almost 90 basis points and their spreads over US Treasuries are at an 11-year high.

Prices for travel abroad and vegetables were among the items that rose the most in August. Many foreign airlines have stopped flying to Israel on security grounds, while fewer ships are calling at the key Israeli port of Eilat because of Houthi attacks in the Red Sea. The construction and agriculture sectors have been hit by a shortage of Palestinian workers, who are no longer allowed into Israel from the West Bank and Gaza.

Foreign travel prices surged more than 22% last month, while tomatoes cost 37% more.

Add to the pressures is the governments increased spending to fund the conflict against Hamas in Gaza and cope with skirmishes between Israeli forces and Hezbollah, a militant group based in Lebanon.

The central bank has regularly voiced its concern about the impact of the Gaza war on inflation in recent months. Despite the economy weakening, the bank’s deputy governor told Bloomberg in late August that interest rate cuts were probably off the table until next year.

That will be the case, according to Andrew Abir, the deputy governor, even if the US Federal Reserve lowers rates on Wednesday, as most analysts expect it will.

“Inflation’s become unusually high even from a historical point of view,” said Yonie Fanning, a strategist at Mizrahi Tefahot Bank. “The effects of the war on the economy in general and the price index in particular continue to be prominent.”

(Updates with markets context.)

Most Read from Bloomberg Businessweek

College Football Players Learn an Ugly Truth About Getting Paid

EV Leases Go as Low as $20 a Month to Help Dealers Clear Their Lots

©2024 Bloomberg L.P.