Should Investors Buy PepsiCo (PEP) Shares Before Earnings?

The Q3 earnings season is just around the corner, with the big banks’ results coming next Friday. But before we get to them, a consumer staples favorite, PepsiCo PEP, is on the reporting docket for next week (Tuesday, October 8th) before the market opens.

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

Let’s take a closer look at expectations for the consumer staples titan.

PepsiCo Expectations

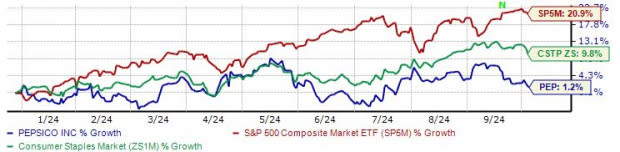

PEP shares have largely been disappointing in 2024, up a modest 1.2% and primarily trading sideways all year. It’s worth noting here that investors have increasingly decreased exposure to Consumer Staples stocks overall in 2024 thanks to the risk-on environment that’s been led by red-hot Technology.

Below is a chart illustrating the year-to-date performance of PEP shares relative to the Zacks Consumer Staples sector and the S&P 500.

Image Source: Zacks Investment Research

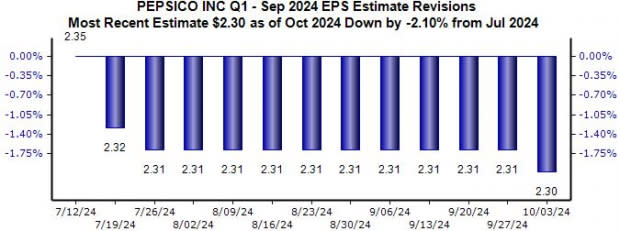

Analysts have taken their earnings expectations lower for the quarter to be reported over recent months, with the $2.30 Zacks Consensus EPS estimate down 2% since mid-July but suggesting 2.2% growth from the year-ago period.

Image Source: Zacks Investment Research

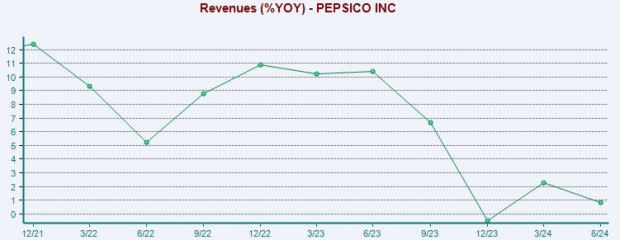

Revenue expectations have followed a similar path, with the $23.9 billion expected down a modest 1% over the same timeframe and reflecting a 1.9% increase from the year-ago period. It’s important to note that the company’s revenue growth pace has seen a notable decline over recent periods, as shown below.

Please note that the chart below tracks the YOY percentage change, not actual sales numbers.

Image Source: Zacks Investment Research

Shares aren’t expensive on a historical basis, with the current 19.6X forward 12-month earnings multiple well beneath the 23.6X five-year median and five-year highs of 27.8X. The lower multiple reflects investors’ slowing growth expectations, as mentioned above.

Are Shares a Buy?

The outlook heading into PepsiCo’s PEP quarterly release isn’t overly positive, with analysts modestly revising their earnings and sales expectations downwards. Shares have largely been disappointing in 2024, but a positive guide would likely breathe life back into shares.

This looks to be a ‘wait and see’ situation, particularly due to the downwards revisions. Still, being a more defensive stock, PEP shares likely won’t suffer a deep downwards move if results don’t match expectations.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report