Insider Buying: CEO Jonathan Cohen Acquires Shares of Oxford Lane Capital Corp (OXLC)

On May 28, 2024, Jonathan Cohen, CEO of Oxford Lane Capital Corp (NASDAQ:OXLC), purchased 4,630,000 shares of the company, as reported in a recent SEC Filing. Following this transaction, the insider now owns a total of 4,864,728 shares of Oxford Lane Capital Corp.

Oxford Lane Capital Corp is a management investment company that primarily invests in debt and equity tranches of collateralized loan obligation vehicles. Shares of Oxford Lane Capital Corp were priced at $5.4 each on the day of the transaction, resulting in a market cap of approximately $1.34 billion.

The company's current price-earnings ratio stands at 5.02, which is below both the industry median of 13.295 and the historical median for the company. This valuation metric is a critical factor in assessing the company's stock price relative to its earnings.

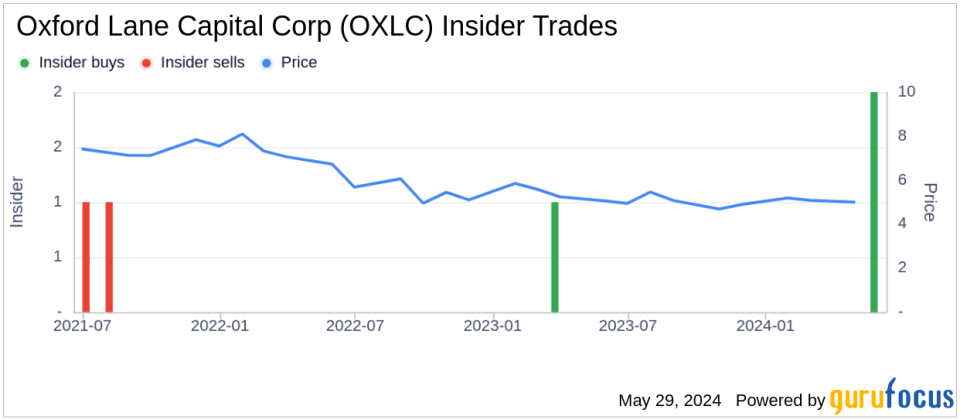

Over the past year, the insider has made significant investments in the company, purchasing a total of 4,630,000 shares. There have been 2 insider buys and 0 insider sells during the same period. This trend in insider transactions can be visualized in the following chart:

This recent purchase by the CEO underscores a continuing confidence in the company's future prospects. Insider buying is often regarded as a positive signal about the future performance of a company's stock, as insiders may buy shares based on their expectations of future growth or undervaluation relative to key financial metrics such as GF Value, price-sales ratio, price-book ratio, and price-to-free cash flow.

Investors and stakeholders of Oxford Lane Capital Corp will continue to monitor insider transactions and other financial indicators to gauge the trajectory of the company's stock performance in the coming months.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.