Household Products Stocks Q2 Highlights: Colgate-Palmolive (NYSE:CL)

The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Colgate-Palmolive (NYSE:CL) and the rest of the household products stocks fared in Q2.

Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options. These trends can be double-edged swords that benefit companies who innovate quickly to take advantage of them and hurt companies that don't invest enough to meet consumers where they want to be with regards to trends.

The 10 household products stocks we track reported a decent Q2. As a group, revenues beat analysts’ consensus estimates by 1% while next quarter’s revenue guidance was 0.5% above.

Stocks, especially growth stocks with cash flows further into the future, had a good end of 2023. On the other hand, this year has seen more volatile stock market swings due to mixed inflation data. Thankfully, household products stocks have been resilient with share prices up 9.7% on average since the latest earnings results.

Colgate-Palmolive (NYSE:CL)

Formed after the 1928 combination between toothpaste maker Colgate and soap maker Palmolive-Peet, Colgate-Palmolive (NYSE:CL) is a consumer products company that focuses on personal, household, and pet products.

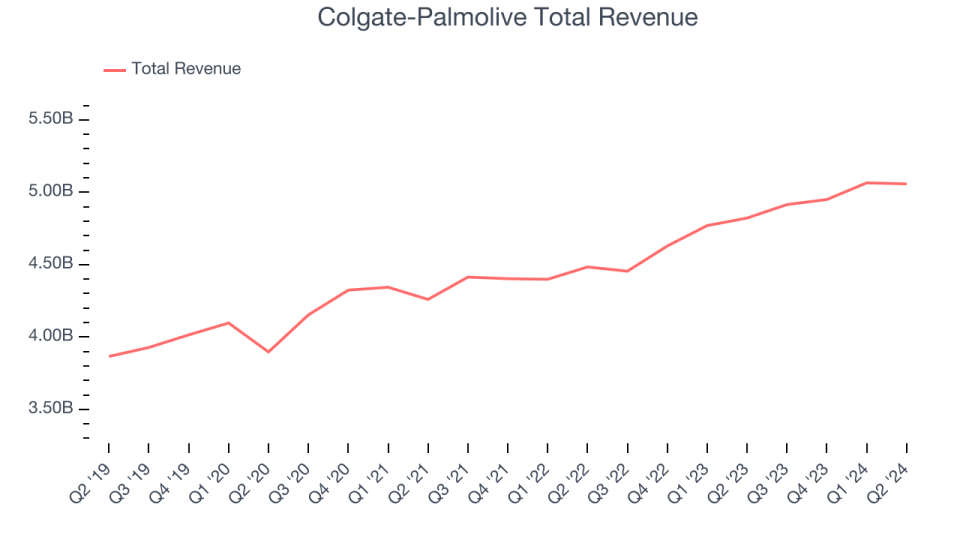

Colgate-Palmolive reported revenues of $5.06 billion, up 4.9% year on year. This print exceeded analysts’ expectations by 1.1%. Overall, it was a solid quarter for the company with an impressive beat of analysts’ organic revenue growth estimates and a narrow beat of analysts’ earnings estimates.

Colgate-Palmolive Company (NYSE:CL) Noel Wallace, Chairman, President and Chief Executive Officer, commented on the Base Business second quarter results, “We are very pleased to have delivered another quarter of strong top and bottom line results. Net sales increased 4.9% and organic sales grew 9.0% (on top of 8.2% organic sales growth in the year ago quarter) driven by a healthy balance of accelerated volume growth and higher pricing. We are particularly pleased that every operating division delivered positive volume growth in the quarter, as we look to increase brand penetration to drive category growth.

Interestingly, the stock is up 11.8% since reporting and currently trades at $107.86.

Best Q2: Spectrum Brands (NYSE:SPB)

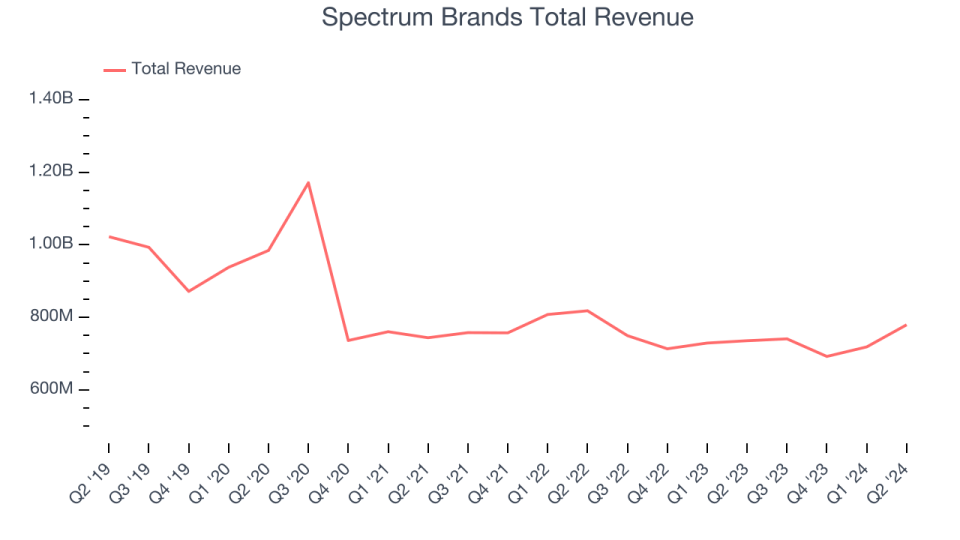

A leader in multiple consumer product categories, Spectrum Brands (NYSE:SPB) is a diversified company with a portfolio of trusted brands spanning home appliances, garden care, personal care, and pet care.

Spectrum Brands reported revenues of $779.4 million, up 6% year on year, outperforming analysts’ expectations by 3.8%. It was a very strong quarter for the company with an impressive beat of analysts’ operating margin estimates and organic revenue growth estimates.

The market seems happy with the results as the stock is up 15% since reporting. It currently trades at $94.19.

Is now the time to buy Spectrum Brands? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Kimberly-Clark (NYSE:KMB)

Originally founded as a Wisconsin paper mill in 1872, Kimberly-Clark (NYSE:KMB) is now a household products powerhouse known for personal care and tissue products.

Kimberly-Clark reported revenues of $5.03 billion, down 2% year on year, falling short of analysts’ expectations by 1.3%. It was a slower quarter for the company with a miss of analysts’ organic revenue growth estimates.

Interestingly, the stock is up 2% since the results and currently trades at $147.03.

Read our full analysis of Kimberly-Clark’s results here.

Central Garden & Pet (NASDAQ:CENT)

Enhancing the lives of both pets and homeowners, Central Garden & Pet (NASDAQ:CENT) is a leading producer and distributor of essential products for pet care, lawn and garden maintenance, and pest control.

Central Garden & Pet reported revenues of $996.3 million, down 2.6% year on year, in line with analysts’ expectations. Revenue aside, it was a mixed quarter for the company with an impressive beat of analysts’ organic revenue growth estimates but underwhelming earnings guidance for the full year.

The stock is up 1.6% since reporting and currently trades at $38.61.

Read our full, actionable report on Central Garden & Pet here, it’s free.

Church & Dwight (NYSE:CHD)

Best known for its Arm & Hammer baking soda, Church & Dwight (NYSE:CHD) is a household and personal care products company with a vast portfolio that spans laundry detergent to toothbrushes to hair removal creams.

Church & Dwight reported revenues of $1.51 billion, up 3.9% year on year, in line with analysts’ expectations. Zooming out, it was a decent quarter for the company with an impressive beat of analysts’ organic revenue growth estimates but underwhelming earnings guidance for the full year.

The stock is up 5.2% since reporting and currently trades at $105.18.

Read our full, actionable report on Church & Dwight here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.