History shows investors should keep a tight leash on risk once the Fed cuts rates, strategist says

It’s expected that a week from today, Federal Reserve Chair Jerome Powell will use his Jackson Hole speech to signal that the central bank is very likely to trim borrowing costs after its policy meeting on September 18.

Recall, that only about 10 days ago some market observers were arguing for an intra-meeting emergency 50 basis point rate cut as a U.S. growth scare contributed to a plunge in global stocks.

Most Read from MarketWatch

That wobble seems to be over. Now a 25 basis point September cut from the Fed is considered much more likely by markets. In response, the S&P 500 SPX has just registered a six-day winning streak of 6.6%, while the CBOE VIX VIX, a volatility measure known as Wall Street’s fear gauge, has slumped from a spike above 60 on August 5th, to around 15, below its long-term average of 19.5.

But with the stock market already once again not far off its highs, some investors may be asking whether they should sell stocks at the first rate cut and adopt a defensive posture, notes Salvatore Ruscitti, U.S. equity strategist at MRB Partners.

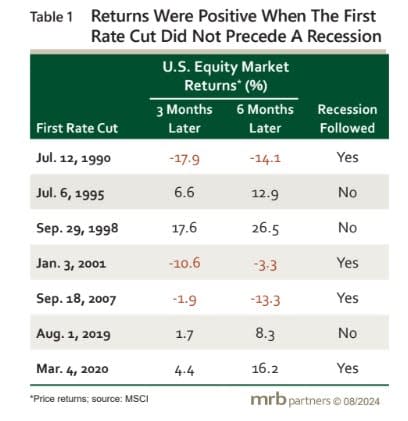

“The answer depends on the reasons for the rate cuts and the outlook for the economy,” says Ruscitti, as he presents the handy table below.

It shows when the first rate cuts occurred in the previous seven easing cycles and how U.S. equity markets performed over the next three and six months.

“History is very clear,” writes Ruscitti. “In instances where the initiation of Fed easing was followed by the onset of a recession (i.e. July 1990, January 2001, and September 2007), stock prices were lower 3 and 6 months after the first rate cut.”

In contrast, when the first rate cut did not precede a recession, in July 1996, September 1998, and August 2019, investors saw good returns over the following months.

An outlier are the gains seen when rates were cut at the outbreak of COVID, “but the pandemic-driven economic downturn was unique in its magnitude, brevity, and the massive policy response that it unleashed,” says Ruscitti.

All this shows that deciding on whether it’s a good idea to sell the news of the first Fed rate cute very much depends on whether an investor thinks that Powell and colleagues are doing so just because benign inflation allows it, or they have to do so because a severely weakening economy demands it — as were the cases, for differing causes, in 1990, 2001 and 2007.

The recent market slide suggests traders were concerned the Fed’s easing was for the latter reason, but Ruscitti reckons that’s too pessimistic: “The fears about a U.S. recession are overblown, and the Fed is not behind the curve in addressing the softening in labor demand. Economic growth has cooled from the rapid pace of earlier quarters, but it is still a safe distance from stalling or contracting.”

Still, Ruscitti accepts that stocks are unlikely to resume climbing steadily from here until there is even more confidence in a soft-landing scenario. In addition, seasonal headwinds may make investors less willing to increase exposure to equities for now, while anxiety over geopolitical tension and the looming U.S. election may also weigh on sentiment.

“These factors argue for keeping a tight leash on risk in the near run and being patient in deploying new capital into the equity market,” he says. “However, aggressively selling stocks on the notion that Fed rate cuts are bad for risk assets is premature based on the weight of the economic evidence.”

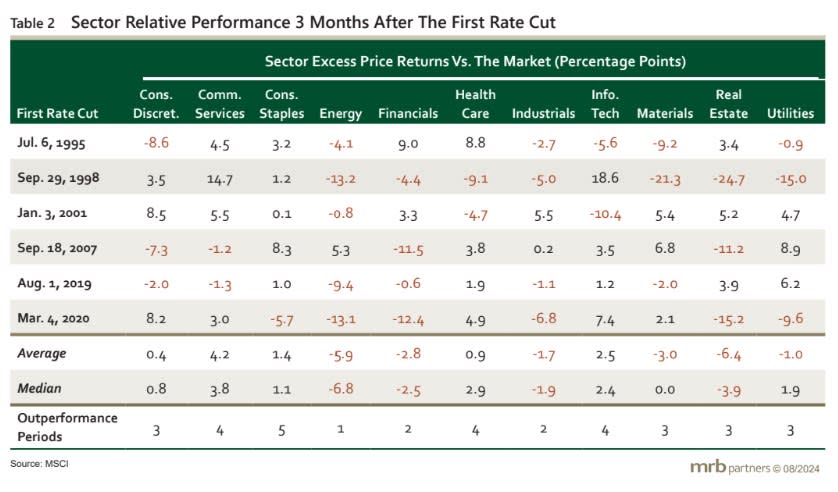

That said, here’s a table showing how sectors performed over three months following the start of those seven rate-cutting cycles.

Markets

U.S. stock-index futures ES00 YM00 NQ00 are lower as benchmark Treasury yields BX:TMUBMUSD10Ydip. The dollar index DXY is lower, while oil prices CL.1 fall and gold GC00 is trading around $2,487 an ounce.

Key asset performance | Last | 5d | 1m | YTD | 1y |

S&P 500 | 5543.22 | 4.21% | -0.02% | 16.21% | 26.84% |

Nasdaq Composite | 17,594.50 | 5.61% | -1.55% | 17.21% | 32.12% |

10-year Treasury | 3.899 | -4.70 | -34.30 | 1.81 | -35.36 |

Gold | 2500.5 | 1.21% | 4.07% | 20.69% | 30.34% |

Oil | 77.07 | 0.12% | -1.95% | 8.05% | -4.53% |

Data: MarketWatch. Treasury yields change expressed in basis points | |||||

For more market updates plus actionable trade ideas for stocks, options and crypto, .

The buzz

New-home construction in July plunged to lowest level since May 2020, data released Friday showed.

The preliminary reading of August consumer sentiment will be released at 10:00 a.m. Eastern.

Chicago Fed President Austan Goolsbee will make a speech at 1:25 p.m.

Shares of Applied Materials AMAT are down 3% in premarket action after the semiconductor equipment maker’s better-than-expected results failed to support the stock.

H&R Block HRB shares are jumping 10% after the tax preparer reported better-than-expected quarterly earnings and guided for another year of revenue growth.

Best of the web

U.S. oil services group SLB expands in Russia as competitors withdraw.

Gamblers are dumping stocks to bet on sports.

Citadel’s Ken Griffin has remade the hedge-fund industry, with himself on top.

The chart

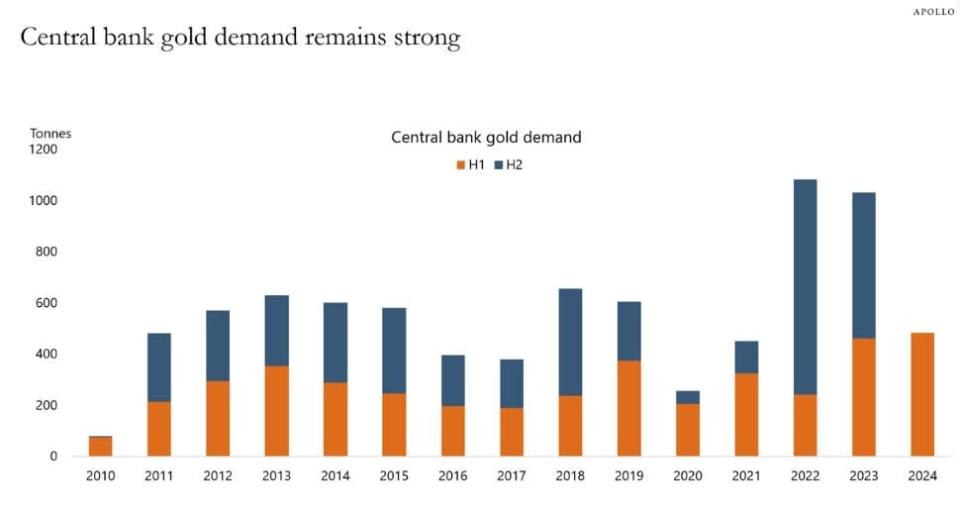

The price of gold sits just shy of the record high around $2,500 an ounce. Little wonder when, as the chart from Apollo chief economist Torsten Slok shows, central banks have just bought a record amount of the bullion for the first half of a year.

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

Ticker | Security name |

NVDA | Nvidia |

TSLA | Tesla |

GME | GameStop |

AAPL | Apple |

ASTS | AST SpaceMobile |

TSM | Taiwan Semiconductor Manufacturing |

PLTR | Palantir |

AMZN | Amazon.com |

SMCI | Super Micro Computer |

AMD | Advanced Micro Devices |

Random reads

Applebee’s ‘all YOU can eat’ abuse.

Hey oh, let’s go! Celebrating the 50th anniversary of NY’s punk princes.

Need to Know starts early and is updated until the opening bell, but to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.