History Says These 2 Stocks Will Thrive in the Next Recession. Here's Why.

Markets are turning volatile again. But there's no reason your portfolio needs to share in this volatility. Even during sharp market downturns, there are certain stocks that can protect your nest egg.

Looking for investments that will insulate your savings from a potential recession but still want to profit if markets head higher? These two companies are for you.

Wise investors keep betting on this market guru

There has almost never been a bad time to bet on Warren Buffett. Over the decades, you could have repeatedly bought stock in his holding company, Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B), at its peak valuation and still made money over the long term. Even if you purchased shares immediately before a recession, your portfolio would still be far ahead of the competition.

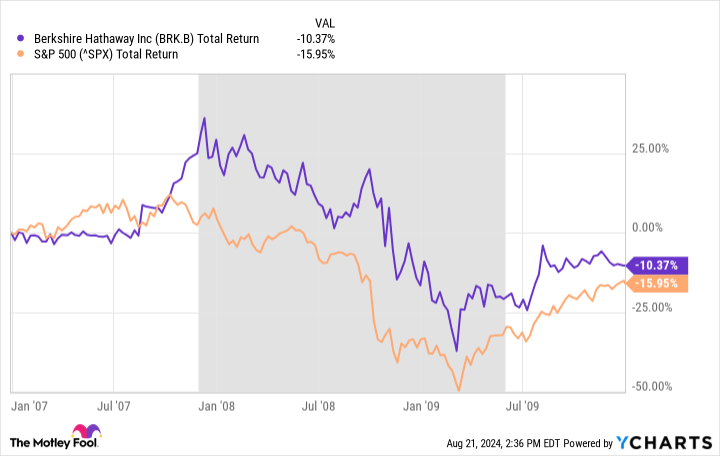

Let's take a closer look at one of the bigger recessions in U.S. history: The financial crisis of 2008. During that time, financial stocks led the market lower. Many major insurance and banking outfits went bankrupt, or required emergency loans from the government. Berkshire stock, meanwhile, outperformed the S&P 500 at a time when most of its peers were heavily underperforming.

It wasn't a perfect performance. Berkshire shares still shed value throughout the worst of the crisis. But the amazing thing is what happened next. From 2010 to 2015, Berkshire stock outperformed the S&P 500 by more than 20%. So not only did the stock beat the market during a difficult recession, it also outperformed the market once conditions improved.

One major reason for this double outperformance is Berkshire's ability to maintain profitability throughout various economic conditions. This allows it to make investments even as competing capital dries up. For example, the company made a $5 billion investment in Goldman Sachs at the lowest point of the crisis, with incredibly advantageous terms.

Berkshire's diversified business model, backed by insurance subsidiaries that generate investable cash throughout every economic cycle, allows it to not only outperform the market during a recession, but also position itself for success once markets head higher. These drivers should prove similarly valuable during the next downturn.

Love Warren Buffett? Then you'll love this stock, too.

There's another stock very similar to Berkshire that nervous investors should consider. It's so similar to Berkshire that Warren Buffett started buying shares of this company late last year. This May, it was revealed that Buffett's secret position was none other than property and casualty insurer Chubb (NYSE: CB).

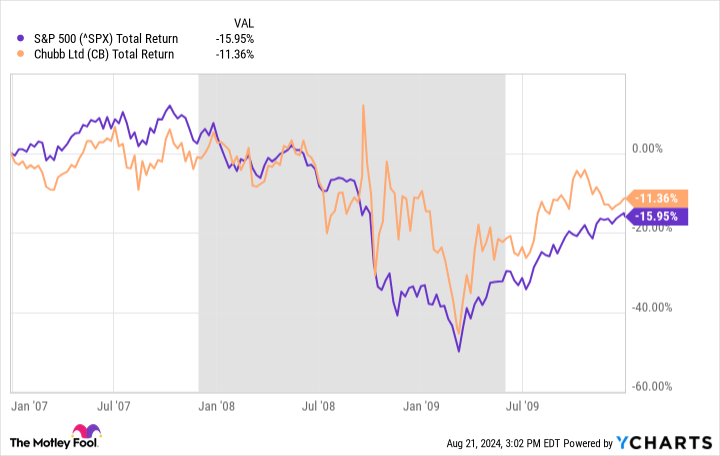

Right now, Berkshire's position in Chubb is worth around $7 billion, and there's little doubt that Buffett is likely comfortable owning shares no matter where the market heads. Like Berkshire, Chubb stock outperformed the S&P 500 during the financial crisis, though by a slightly slimmer margin. In the five-year period after the recession, however, Chubb stock gained 157% in value. That compares to a 128% gain for Berkshire and just a 105% gain for the S&P 500 over the same time period.

How can Chubb outperform the market during a recession, and then build back even stronger once conditions become more bullish? Like Berkshire, the company has a long history of prudent capital allocation. While some insurers like AIG over-leveraged themselves with risky financial instruments, Chubb has consistently maintained a much more conservative approach. Its return on invested capital, for example, remained positive throughout the financial crisis. AIG's, meanwhile, dipped as low as negative 35%.

Maintaining consistent profitability has allowed Chubb to invest throughout market cycles. For a number of years, insurance pricing softened due to rising competition from hedge funds and other large capital pools. While some insurers raced to compete, others like Chubb took a longer-term approach. For instance, Chubb has repeatedly made multi-billion-dollar acquisitions as other insurers looked to pull back from weak segments of the market. Now, the company is posting record profits. "Our P&C underwriting results in the quarter were simply excellent," Chubb's CEO commented after the company posted its best quarterly results in history last month.

Will Chubb shares fall in value if another recession hits? History suggests this will likely be the case. And with its long-term approach to capital management, though, expect Chubb to take advantage of the next downturn to set shares up for another multi-year stretch of outperformance.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway and Goldman Sachs Group. The Motley Fool has a disclosure policy.

History Says These 2 Stocks Will Thrive in the Next Recession. Here's Why. was originally published by The Motley Fool