High Insider Ownership Growth Stocks On The TSX In May 2024

As the Canadian market navigates through an era of technological advancements and a broader economic bull market, investors may find new opportunities in sectors benefiting from artificial intelligence and other innovations. In this context, growth companies with high insider ownership on the TSX present a compelling narrative, as these entities often demonstrate alignment between management’s interests and those of shareholders, potentially offering stability amidst market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

goeasy (TSX:GSY) | 21.7% | 15.9% |

Payfare (TSX:PAY) | 15% | 57.7% |

Aritzia (TSX:ATZ) | 19.1% | 51.6% |

Allied Gold (TSX:AAUC) | 22.4% | 68.2% |

ROK Resources (TSXV:ROK) | 16.6% | 159.6% |

Aya Gold & Silver (TSX:AYA) | 10.2% | 51.6% |

Silver X Mining (TSXV:AGX) | 14.2% | 144.2% |

Ivanhoe Mines (TSX:IVN) | 12.4% | 37.8% |

Almonty Industries (TSX:AII) | 12.5% | 82.1% |

UGE International (TSXV:UGE) | 35.4% | 63.5% |

We'll examine a selection from our screener results.

Aya Gold & Silver

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aya Gold & Silver Inc. is a company that focuses on the exploration, evaluation, and development of precious metals projects in Morocco, with a market capitalization of approximately CA$1.99 billion.

Operations: The firm primarily generates its revenue from the exploration, evaluation, and development of precious metals in Morocco.

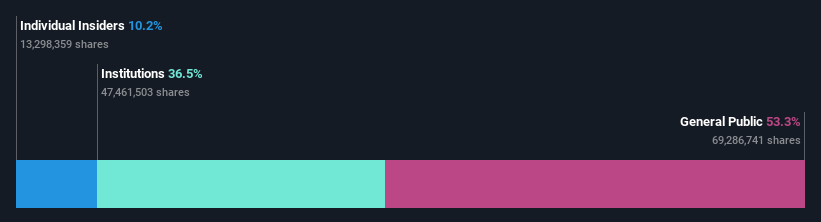

Insider Ownership: 10.2%

Aya Gold & Silver Inc. has experienced a challenging quarter with sales dropping to US$5.08 million from US$10.44 million the previous year and reporting a net loss of US$2.54 million, reversing last year's net income of US$1.07 million. Despite these setbacks, the company reported robust silver production and significant exploration successes, including extending the mineralized trend at Boumadine by 800m and securing rights to additional exploration areas totaling over 198 km², suggesting potential for resource expansion in highly prospective zones. This growth is underpinned by high insider ownership, aligning management interests with shareholders but is tempered by recent performance dips and shareholder dilution over the past year.

goeasy

Simply Wall St Growth Rating: ★★★★★☆

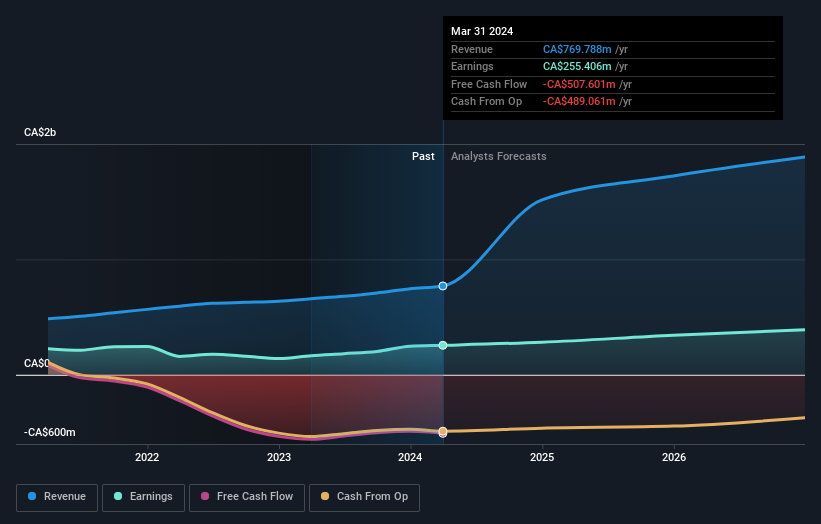

Overview: goeasy Ltd., operating under the easyhome, easyfinancial, and LendCare brands, offers non-prime leasing and lending services in Canada with a market capitalization of approximately CA$2.99 billion.

Operations: The company generates revenue through its easyhome and easyfinancial segments, with CA$153.99 million from leasing services and CA$1.17 billion from lending services.

Insider Ownership: 21.7%

goeasy Ltd., a Canadian firm with substantial insider involvement, recently appointed Patrick Ens as President of its easyfinancial and easyhome brands, signaling a strategic enhancement aimed at bolstering consumer credit services. Despite trading 44.4% below its estimated fair value and concerns over dividend coverage by cash flows, goeasy shows promising financial dynamics with revenue forecasted to grow at 32.7% annually—outpacing the market significantly. However, debt is not well covered by operating cash flow, posing potential risks amidst these growth prospects.

Ivanhoe Mines

Simply Wall St Growth Rating: ★★★★★☆

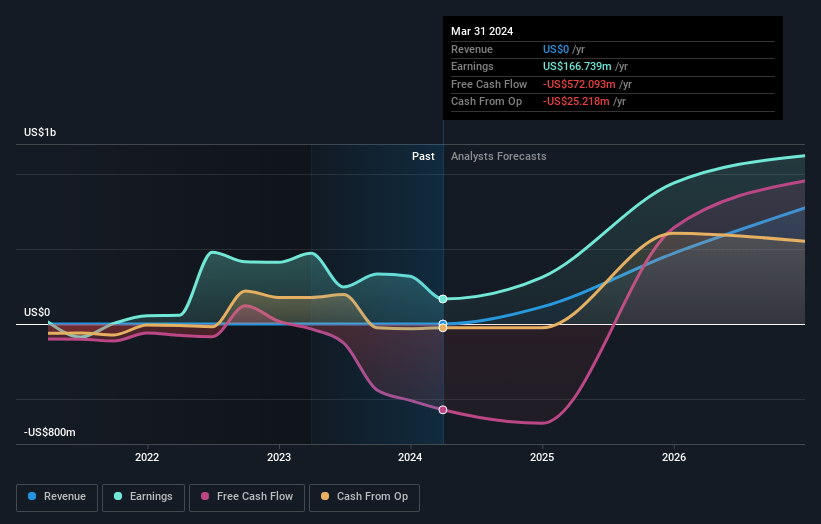

Overview: Ivanhoe Mines Ltd. is a company focused on the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market capitalization of approximately CA$26.04 billion.

Operations: The firm primarily generates revenue through the mining, development, and exploration of minerals and precious metals in Africa.

Insider Ownership: 12.4%

Ivanhoe Mines, actively pursuing mergers and acquisitions, emphasizes its role as a potential acquirer rather than a target, aiming to expand its copper production significantly in the Western Forelands. Despite recent financial setbacks with a net loss of US$65.55 million in Q1 2024, the company maintains robust revenue and earnings growth forecasts at 48.1% and 37.8% per year respectively, outpacing the Canadian market averages. Insider transactions have been mixed with notable buying activity over the past three months, aligning with strategic expansion efforts.

Summing It All Up

Take a closer look at our Fast Growing TSX Companies With High Insider Ownership list of 33 companies by clicking here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSX:AYA TSX:GSY and TSX:IVN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com