High Growth Tech Stocks To Watch In September 2024

Over the last 7 days, the United States market has dropped 1.9%, though it is up 21% over the past year with earnings forecast to grow by 15% annually. In this context, identifying high growth tech stocks becomes crucial as they have the potential to outperform in a fluctuating market environment.

Top 10 High Growth Tech Companies In The United States

Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

Sarepta Therapeutics | 24.22% | 44.94% | ★★★★★★ |

Super Micro Computer | 20.62% | 27.13% | ★★★★★★ |

Ardelyx | 27.44% | 65.50% | ★★★★★★ |

G1 Therapeutics | 27.57% | 57.75% | ★★★★★★ |

Invivyd | 42.91% | 70.39% | ★★★★★★ |

Amicus Therapeutics | 20.45% | 61.85% | ★★★★★★ |

Clene | 73.06% | 62.58% | ★★★★★★ |

Seagen | 22.57% | 71.80% | ★★★★★★ |

ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 249 stocks from our US High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Travere Therapeutics

Simply Wall St Growth Rating: ★★★★★☆

Overview: Travere Therapeutics, Inc. is a biopharmaceutical company focused on identifying, developing, and delivering therapies for rare kidney and metabolic diseases, with a market cap of $724.37 million.

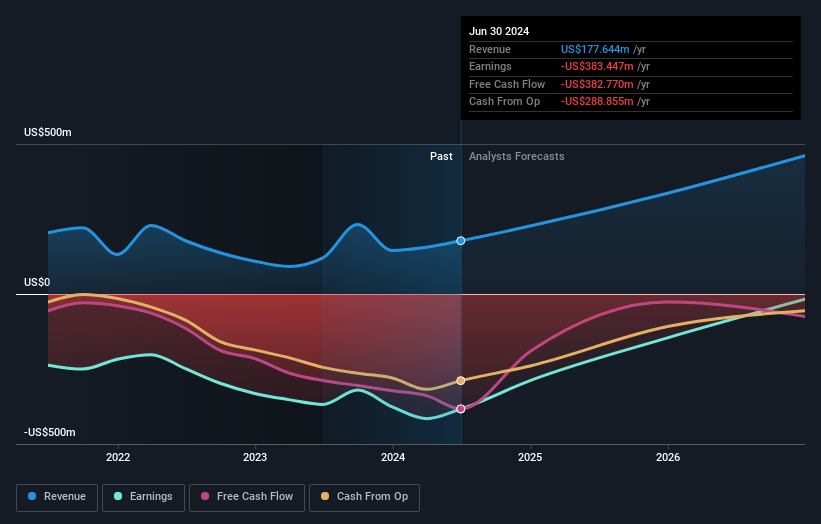

Operations: Travere Therapeutics generates revenue of $177.64 million from the development and commercialization of innovative therapies for rare kidney and metabolic diseases. The company focuses on creating specialized treatments to address unmet medical needs in these areas.

Travere Therapeutics has demonstrated significant revenue growth, with a 26.4% annual increase expected to outpace the broader U.S. market's 8.7% growth rate. Despite reporting a net loss of $70.41 million for Q2 2024, down from $85.63 million in the previous year, its R&D expenses reflect a strong commitment to innovation and future profitability prospects within three years. The company’s recent presentations at high-profile conferences underscore its active engagement with industry stakeholders and potential investors.

Navigate through the intricacies of Travere Therapeutics with our comprehensive health report here.

Understand Travere Therapeutics' track record by examining our Past report.

Emerald Holding

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Emerald Holding, Inc. operates business-to-business (B2B) trade shows in the United States and has a market cap of approximately $1.13 billion.

Operations: Emerald Holding generates revenue primarily through its Connections segment, which accounts for $350.80 million. The company also has a smaller revenue stream of $42.60 million from other sources.

Emerald Holding's revenue is projected to grow at 11.3% annually, outpacing the broader U.S. market's 8.7% growth rate, while earnings are forecasted to surge by 179.67% per year over the next three years. The company's focus on acquisitions and new event launches aims to contribute an additional 1-2 percentage points of annual organic revenue growth, enhancing its overall growth profile. Despite a net loss of $2.8 million in Q2 2024 compared to $8.1 million a year ago, Emerald has shown resilience with improved financial metrics and strategic initiatives for future expansion.

LiveRamp Holdings

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LiveRamp Holdings, Inc. is a technology company that operates a data collaboration platform across the United States, Europe, the Asia-Pacific region, and internationally with a market cap of $1.73 billion.

Operations: LiveRamp generates revenue primarily from its data collaboration platform, with total revenue amounting to $681.55 million. The company operates across multiple regions including the United States, Europe, and the Asia-Pacific.

LiveRamp Holdings is poised for significant growth with earnings expected to surge 76.3% annually, far outpacing the broader U.S. market's 15% rate. Despite a substantial one-off loss of $13.7M impacting recent financial results, the company's revenue is forecasted to grow at 9.2% per year, slightly above the market average of 8.7%. Notably, LiveRamp has invested heavily in R&D, spending $59.95M recently to bolster its capabilities in data collaboration and AI-driven solutions, which could drive future innovation and client acquisition across tech sectors.

Get an in-depth perspective on LiveRamp Holdings' performance by reading our health report here.

Assess LiveRamp Holdings' past performance with our detailed historical performance reports.

Key Takeaways

Unlock our comprehensive list of 249 US High Growth Tech and AI Stocks by clicking here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGM:TVTX NYSE:EEX and NYSE:RAMP.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com