Here's Why We Think Universal Music Group (AMS:UMG) Is Well Worth Watching

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Universal Music Group (AMS:UMG), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Universal Music Group

Universal Music Group's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years Universal Music Group grew its EPS by 12% per year. That's a good rate of growth, if it can be sustained.

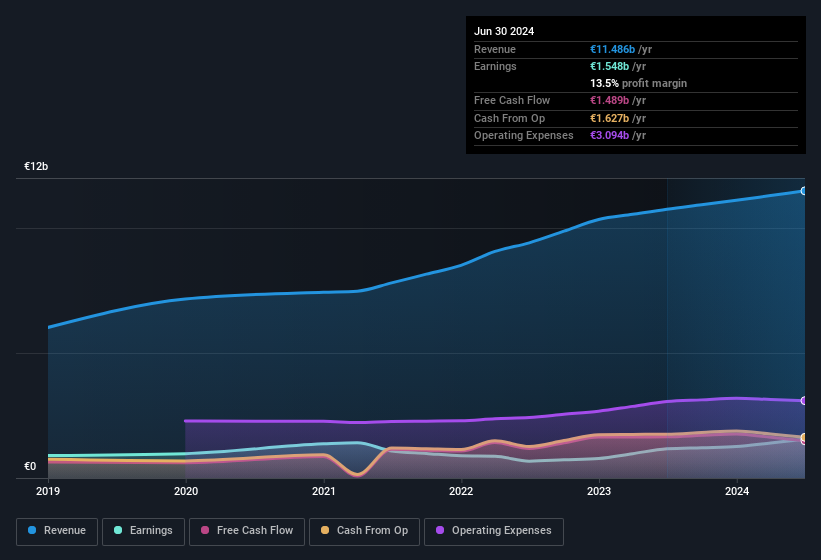

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for Universal Music Group remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 6.8% to €11b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Universal Music Group?

Are Universal Music Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One gleaming positive for Universal Music Group, in the last year, is that a certain insider has buying shares with ample enthusiasm. Specifically, in one large transaction Non-Independent & Non-Executive Director William Ackman paid €6.4m, for stock at €23.34 per share. Big insider buys like that are a rarity and should prompt discussion on the merits of the business.

Along with the insider buying, another encouraging sign for Universal Music Group is that insiders, as a group, have a considerable shareholding. We note that their impressive stake in the company is worth €15b. That equates to 28% of the company, making insiders powerful and aligned with other shareholders. Very encouraging.

Should You Add Universal Music Group To Your Watchlist?

One positive for Universal Music Group is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. We should say that we've discovered 1 warning sign for Universal Music Group that you should be aware of before investing here.

Keen growth investors love to see insider activity. Thankfully, Universal Music Group isn't the only one. You can see a a curated list of Dutch companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com