Here's the Best Unknown Dividend Stock to Buy Right Now With $500

Investing $500 a year, or roughly $10 a week, can be a life-changing proposition. I like to view this opportunity through the eyes of my 8-year-old daughter.

A mere $10 invested weekly would balloon to just over $1 million by the time she turns 55, assuming 10% returns. Should we dare to dream of beating the market by 2 percentage points via outperforming stocks like the one included in today's article, this $1 million would spike to $2.4 million.

These returns are all from $500 a year, or about $10 weekly.

Keeping in mind the power of this $500 invested annually over the long haul, let's examine a market-beating, yet largely unknown, dividend stock that could help generate these returns.

Meet Graco

Turning 100 years old in 2026, Minnesota-based Graco (NYSE: GGG) is a leading manufacturer of equipment that "moves, measures, mixes, controls, dispenses and sprays fluid and powder materials." To get an idea of what this description means, let's analyze the company's three key business segments:

Contractor (45% of sales): Graco's largest unit consists of paint sprayers used by professional contractors, home builders, and do-it-yourself homeowners alike. While this spray equipment costs more up front, it is much more efficient (in both time and cost savings) than traditional paint rollers. In addition to paint, the company also has systems that can dispense spray foam for insulation purposes.

Industrial (25% of sales): Whether for cars, military vehicles, airplanes, farm equipment, or other heavy-duty products, Graco's systems apply the paints, coatings, sealants, and adhesives needed in numerous manufacturing processes. This segment holds Graco's highest operating margin and is home to an array of systems designed with the Internet of Things in mind. As the industrial world continues its shift toward automation and the connectedness of devices, the company's increasingly tech-dense systems offer the promise of higher efficiencies through better monitoring.

Process (20% of sales): Graco's smallest segment sells pumps, meters, valves, and accessories to food and beverage, cosmetic, pharmaceutical, semiconductor, oil and gas, and wastewater customers, among many others. Two of its more interesting applications are misting oil onto Doritos for spices to adhere to and selling the dispensers that fill Pop-Tarts with flavoring.

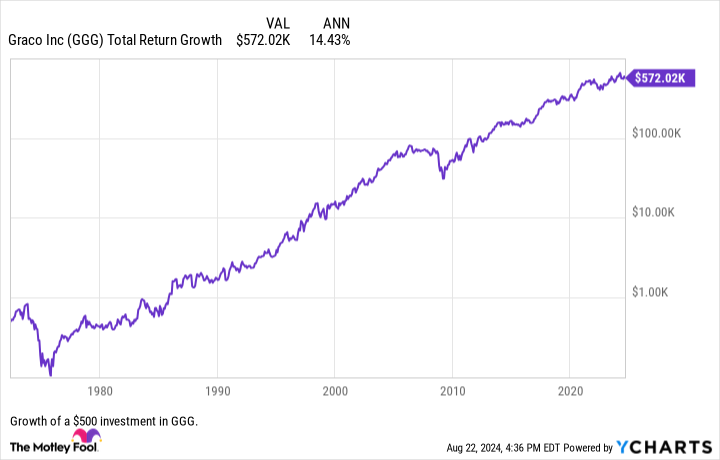

Powered by its niche focus on complex applications across the fluid handling process, Graco would have turned a single $500 investment in 1972 into $572,000 today -- making it more than a 1,000-bagger.

The dominant force behind these incredible returns is Graco's relentless focus on continuous innovation. Home to over 60,000 stock keeping units (SKUs), the company has historically spent roughly 4% of its revenue on research and development (R&D) -- a level more than 2 times higher than its peer group's average.

By outspending its peers on R&D, Graco works hand in hand with its customers, building exactly the right product or accessory for their unique situation. This cooperation creates long-lasting relationships, which in turn creates a wide moat around the company's operations. Best yet for investors, despite this outsize spending on R&D -- not to mention the company's persistent appetite for acquisitions to further diversify its product base -- Graco has a history of delivering a top-tier return on invested capital (ROIC).

Graco's market-beating qualities

Graco has generated an average ROIC of 27% since 1990, demonstrating a long-standing ability to create immense profitability from the debt and equity used to fund its operations. This high ROIC shows that management has done an excellent job identifying and integrating new companies (15 of them since 2012) that strengthen Graco's position in the market.

Between 2003 and 2019, stocks with higher ROICs among The Motley Fool's investable universe nearly doubled the total returns of their lower-ranked peers, highlighting Graco's first market-beating quality. Armed with $660 million in cash and no long-term debt, Graco is well-funded to continue its acquisitive ways, potentially extending its run of generating market-beating returns as it goes.

Graco's second market-beating quality is its dividend payments, which have been raised for 22 consecutive years. While the company's dividend may only yield 1.2%, it has averaged 10% annualized growth over the last decade. To put this growth in perspective, if an investor had bought Graco 10 years ago, these payments would already be yielding a respectable 4% compared to the investor's original purchase price.

The benefit of investing in stocks with growing dividends is that they have outperformed an equal-weighted S&P 500 index by 2.5 percentage points annually since 1973, according to a study from Hartford. Using only one-third of its net income to fund these dividend payments, Graco has ample room to continue raising its payments far into the future, regardless of the macroeconomic environment. Even during the Great Recession -- which hit the company's contractor segment hard -- Graco plowed ahead and extended its streak of dividend increases without risking its financial well-being.

Despite being home to these two market-beating indicators and a unique, hard-to-disrupt, and resilient business, Graco trades at 28 times earnings, which nearly matches the S&P 500 average of 27. Trading at this market-average valuation, Graco appears to be a largely unknown yet premium business trading at a fair price, more than worthy of a $500 investment today.

Should you invest $1,000 in Graco right now?

Before you buy stock in Graco, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Graco wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Josh Kohn-Lindquist has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Here's the Best Unknown Dividend Stock to Buy Right Now With $500 was originally published by The Motley Fool