New Hedge Fund Gains Backing for Bets on Japan Market Revival

(Bloomberg) -- Hong Kong-based Sengu Capital Ltd. is starting a new hedge fund focused on improving corporate management in Japan, tapping into the country’s financial market revival.

Most Read from Bloomberg

World's Second Tallest Tower Spurs Debate About Who Needs It

The Plan for the World’s Most Ambitious Skyscraper Renovation

UC Berkeley Gives Transfer Students a Purpose-Built Home on Campus

The company will start trading for the fund in early October, Chief Investment Officer Yoshihiko Ohira and Chief Operating Officer Xavier Fanjaud said in an interview. The Japan fund lured multiyear backing from HS Group (Hong Kong) Ltd., a provider of strategic capital to such fledgling managers in exchange for a cut of their fee revenue.

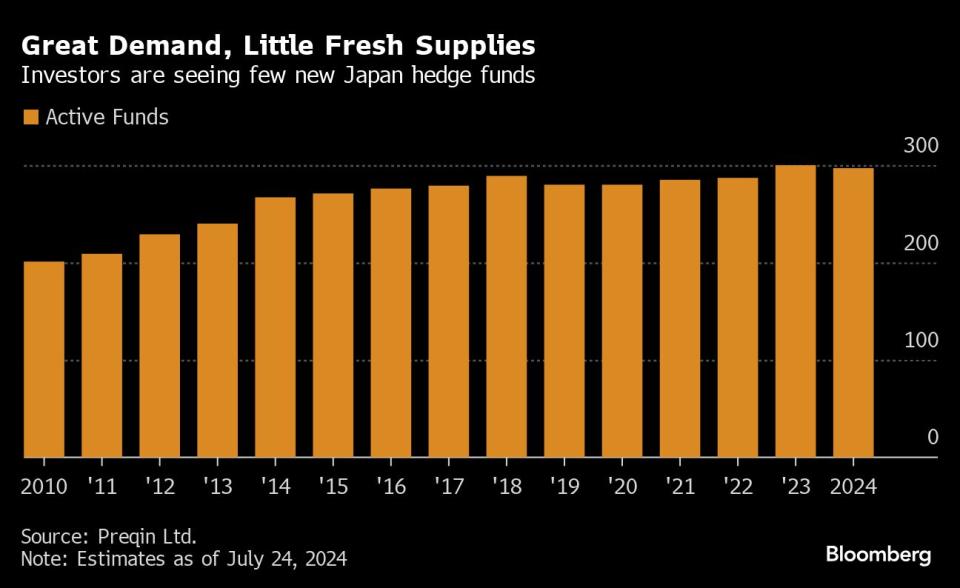

Investors have been trying to put more money to work in Japan, as the country emerges from more than a decade of deflation while China grapples with a domestic economic slowdown. Yet, the number of Japan-focused hedge funds in business has barely increased over the years, according to Preqin Ltd. estimates as of mid-July.

Historically Japanese companies were known for opaque succession planning, either promoting from within based on seniority, or picking candidates who often having familial or other ties to the controlling shareholders.

“More Japanese companies are improving corporate governance and selecting new management through nomination committees and in a more western way,” Ohira said. “There are more cases where CEOs are coming from outside the companies.”

By 2022, more than 80% of “prime market” listed companies had set up nomination and remuneration committees, according to a June 2023 presentation by the country’s Financial Services Agency.

Sengu will pick its investments from about 400 Japanese companies with medium-to-large market value and high liquidity, said Ohira. At any given time, it aims to have bullish and bearish wagers in about 50 stocks. On the long side, it will pick companies where it sees improving management quality helping lift efficiency and profit margins.

The bearish wagers will be against companies with deteriorating fundamentals, either because of inefficient management or shifting industry dynamics.

Sengu “speaks to the relevance of evaluating corporate strategy in Japan at a time of great advances in governance reforms, generational changes in corporate leadership,” said Michael Garrow, CIO of HS Group.

The return of inflation in Japan will benefit some companies while others suffer, creating opportunities for hedge funds betting on rising and falling stocks, Fanjaud said. The fund will aim for a 20% to 30% net exposure - the difference between the dollar value of long and short positions.

The approach stands out as “Japan’s hedge funds are dominated by activists with longer net approach and traders who tend to be very diversified and market neutral,” Fanjaud said.

Ohira was a Japan analyst for Turiya Advisors Asia Ltd. and Pleiad Investment Advisors Ltd., the latter also an HS-backed firm. He left Pleiad in 2019 to become CIO of Hong Kong’s Luxence Capital Ltd., leading a hedge fund focused on Japan and China.

The Japan investments of Luxence generated double-digit annualized returns over 4.5 years, a track record Sengu aims to match over a three- to five-year period.

Two of Ohira’s Luxence colleagues will join him: COO Fanjaud and Takayuki Natsume, a senior analyst with 32 years of experience in the investment industry.

Most Read from Bloomberg Businessweek

‘They Have Stolen Our Business’: When You Leave Russia, Putin Sets the Terms

How Local Governments Got Hooked on One Company’s Janky Software

The Average American Eats 42 Pounds of Cheese a Year, and That Number Could Go Up

Putting Olive Oil in a Squeeze Bottle Earned This Startup a Cult Following

Howard Lutnick Emerges as Trump’s No. 1 Salesman on Wall Street

©2024 Bloomberg L.P.