Forget Nvidia: Billionaires Are Buying Up This Artificial Intelligence (AI) Stock Instead

Artificial intelligence (AI) is the year's story on Wall Street. Case in point: Five of the six top-performing stocks year to date in the Nasdaq 100 are connected to the AI sector.

Yet investors looking for an outstanding AI stock should consider something other than Nvidia (NASDAQ: NVDA). Indeed, many billionaires are already buying a different AI stock hand over fist: Oracle (NYSE: ORCL).

Here's what's happening and why.

These billionaires can't get enough of Oracle

Thanks to SEC filings, the public can track sizable stock purchases made by individuals or hedge funds each quarter. As of this writing, the most recent filings occurred in mid-May and reflect positions held as of March 31, 2024.

During the first quarter this year, several billionaires (or their respective hedge funds) increased their positions in Oracle:

Billionaire | Hedge Fund | Shares Added | Percentage Increase in Shares | Value of Shares Held |

|---|---|---|---|---|

David Shaw | D.E. Shaw | 3,340,000 | 345% | $541,000,000 |

David Tepper | Appaloosa | 975,000 | 74% | $289,000,000 |

Ken Griffin | Citadel Advisors | 382,000 | 51% | $143,000,000 |

Paul Tudor Jones | Tudor Investments | 24,000 | 59% | $8,000,000 |

Ray Dalio | Bridgewater | 2,000 | 64% | $1,000,000 |

As noted in the table, David Shaw, founder of the investment management firm D.E. Shaw, added the most shares, more than tripling his total holdings to more than $500 million worth of Oracle stock.

Similarly, David Tepper, the billionaire founder of Appaloosa Management, added nearly a million shares of Oracle during the first quarter, bringing his total holdings in the company to 2.3 million shares -- worth roughly $290 million.

Many other billionaires, including Ken Griffin, Paul Tudor Jones, and Ray Dalio, also increased their holdings of Oracle.

This is why billionaires are so bullish on Oracle

So why is it that many of the world's richest people are buying Oracle stock hand over fist? The answer lies in one of the hottest trends around: artificial intelligence.

That's because developing and running cutting-edge AI applications requires massive computing power and data storage -- the sort that few organizations have. For the AI models to function correctly, organizations must train them using gigantic data sets encompassing everything from ancient history to pop culture to theoretical physics. The only way to accomplish this is to link hundreds of thousands of advanced semiconductors together in a data center.

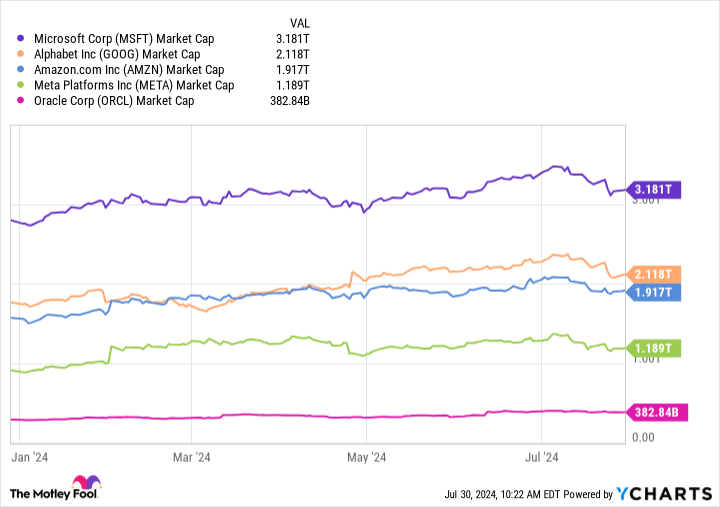

Many companies operating these data centers already boast market caps well over $1 trillion: Microsoft, Amazon, Alphabet, and Meta Platforms. But Oracle does not. With a market cap of less than $400 billion, Oracle is America's 19th-largest company, but its market cap is still only 12% of Microsoft's.

Granted, Oracle's data center business is much smaller. According to one estimate, the company controls roughly 2% of the global cloud services market, compared to 31% for Amazon and 25% for Microsoft. However, the reason billionaires are showing such interest in Oracle is the company's rapid growth in its cloud business. It's growing like a weed, and it is poised to support the skyrocketing demand for cloud services and AI.

For example, following the release of the company's latest quarterly results (for the three months ending on May 31, 2024), Oracle CEO Safra Catz noted that the company had reached "a tipping point" and that the most recent quarter marks the "full emergence of [Oracle's] high-growth cloud business." Later in the call, Catz revealed that ChatGPT-maker OpenAI has decided to run deep learning and AI workloads on Oracle's Cloud Infrastructure. In addition, Catz said that Google Cloud has partnered with Oracle to facilitate direct access to Oracle Database services for Google Cloud customers by September.

The addition of new customers is encouraging for potential investors, as it demonstrates the company is executing a successful pivot toward higher-growth segments like cloud computing, machine learning, and AI. This change in strategy offers Oracle a chance to boost its revenue and increase its profits, making its stock more attractive to long-term investors.

In summary, Oracle is ramping up its efforts to support the rapidly expanding cloud services and AI market. Billionaires have taken notice and are piling into the stock. Investors looking for an under-the-radar AI play should take notice -- Oracle is once again a stock worth considering.

Should you invest $1,000 in Oracle right now?

Before you buy stock in Oracle, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Oracle wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $657,306!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Jake Lerch has positions in Alphabet, Amazon, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Oracle. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Forget Nvidia: Billionaires Are Buying Up This Artificial Intelligence (AI) Stock Instead was originally published by The Motley Fool