Footwear Stocks Q1 Teardown: Crocs (NASDAQ:CROX) Vs The Rest

As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q1. Today, we are looking at footwear stocks, starting with Crocs (NASDAQ:CROX).

Before the advent of the internet, styles changed, but consumers mainly bought shoes by visiting local brick-and-mortar shoe, department, and specialty stores. Today, not only do styles change more frequently as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some footwear companies have made concerted efforts to adapt while those who are slower to move may fall behind.

The 6 footwear stocks we track reported a solid Q1; on average, revenues beat analyst consensus estimates by 5.1%. while next quarter's revenue guidance was in line with consensus. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, but footwear stocks have exhibited impressive performance, with the share prices up 11.8% on average since the previous earnings results.

Crocs (NASDAQ:CROX)

Founded in 2002, Crocs (NASDAQ:CROX) sells casual footwear and is known for its iconic clog shoe.

Crocs reported revenues of $938.6 million, up 6.2% year on year, topping analysts' expectations by 6.1%. It was a very strong quarter for the company, with an impressive beat of analysts' constant currency revenue and earnings estimates.

"We delivered an exceptional first quarter, led by mid-teens growth of our Crocs Brand, driven by robust consumer demand both in North America and in international markets." said Andrew Rees, Chief Executive Officer.

The stock is up 20.2% since the results and currently trades at $152.37.

We think Crocs is a good business, but is it a buy today? Read our full report here, it's free.

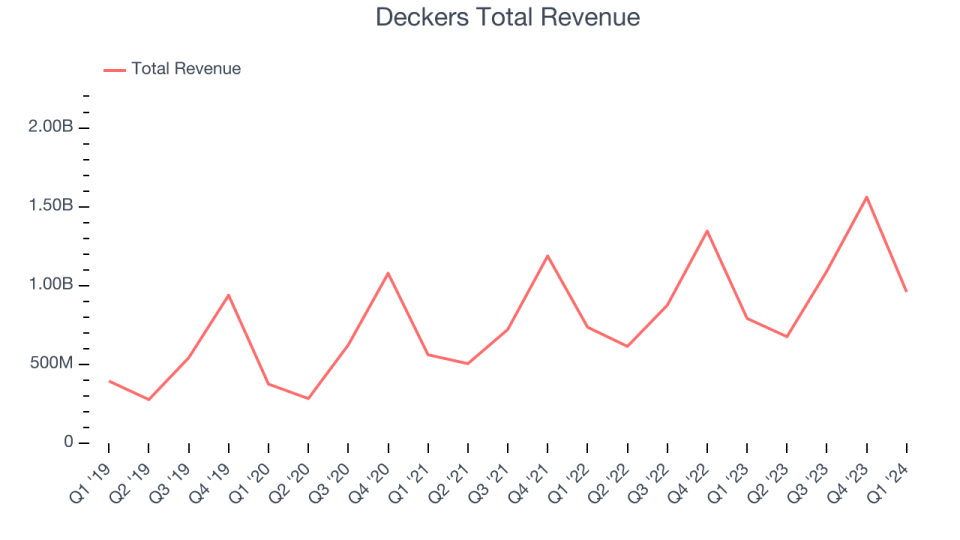

Best Q1: Deckers (NYSE:DECK)

Established in 1973, Deckers (NYSE:DECK) is a footwear and apparel conglomerate with a portfolio of lifestyle and performance brands.

Deckers reported revenues of $959.8 million, up 21.2% year on year, outperforming analysts' expectations by 8%. It was a very strong quarter for the company, with an impressive beat of analysts' constant currency revenue estimates, driven by huge outperformance at its Hoka ($533 million of revenue vs estimates of $496 million) and UGG ($361 million of revenue vs estimates of $318 million) brands.

Deckers achieved the fastest revenue growth among its peers. The stock is up 15.5% since the results and currently trades at $1,045.59.

Is now the time to buy Deckers? Access our full analysis of the earnings results here, it's free.

Slowest Q1: Wolverine Worldwide (NYSE:WWW)

Founded in 1883, Wolverine Worldwide (NYSE:WWW) is a global footwear company with a diverse portfolio of brands including Merrell, Hush Puppies, and Saucony.

Wolverine Worldwide reported revenues of $390.8 million, down 24.5% year on year, exceeding analysts' expectations by 8.1%. It was a mixed quarter for the company, with an impressive beat of analysts' earnings estimates but a miss of analysts' operating margin estimates. In addition, its full-year revenue guidance slightly fell short of Wall Street's estimates.

Wolverine Worldwide pulled off the biggest analyst estimates beat but had the slowest revenue growth and slowest revenue growth in the group. The stock is up 20% since the results and currently trades at $13.71.

Read our full analysis of Wolverine Worldwide's results here.

Nike (NYSE:NKE)

Originally selling Japanese Onitsuka Tiger sneakers as Blue Ribbon Sports, Nike (NYSE:NKE) is a global titan in athletic footwear, apparel, equipment, and accessories.

Nike reported revenues of $12.43 billion, flat year on year, surpassing analysts' expectations by 1.1%. It was a decent quarter for the company, with a narrow beat of analysts' revenue estimates.

Nike had the weakest performance against analyst estimates among its peers. The stock is down 9.4% since the results and currently trades at $91.35.

Read our full, actionable report on Nike here, it's free.

Skechers (NYSE:SKX)

Synonymous with "dad shoe", Skechers (NYSE:SKX) is a footwear company renowned for its comfortable, stylish, and affordable shoes for all ages.

Skechers reported revenues of $2.25 billion, up 12.5% year on year, surpassing analysts' expectations by 2.3%. It was a 'beat and raise' quarter you love to see. Skechers blew past analysts' constant currency revenue expectations this quarter. Looking forward to the full year, the company raised its revenue and EPS guidance for 2024 and both are comfortably ahead of analysts' expectations.

Skechers achieved the highest full-year guidance raise among its peers. The stock is up 18.8% since the results and currently trades at $69.83.

Read our full, actionable report on Skechers here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.