Five Key Charts to Watch in Global Commodities This Week

(Bloomberg) -- From aluminum to zinc, base metals will be in the spotlight during the annual LME Asia Week gathering in Hong Kong. The electric vehicles that are poised to replace gas guzzlers in the coming decades will end up consuming a good chunk of energy themselves. And Russian natural gas still has a hold over Europe.

Most Read from Bloomberg

How Long Can High Rates Last? Bond Markets Say Maybe Forever

Jain Global Raises $5.3 Billion, Secures Cash From Abu Dhabi

BuzzFeed Struggles to Sell Owner of Hit YouTube Show ‘Hot Ones’

Tech Hits Stocks as Nvidia Extends Selloff to 13%: Markets Wrap

Here are five notable charts to consider in global commodity markets as the week gets underway.

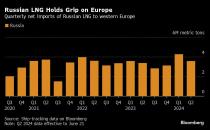

Natural Gas

While Europe has swiftly moved to diversify away from Russia’s gas delivered by pipelines, imports of tanker-borne fuel have held strong. Nations such as France, Spain and Belgium have increased purchases of Russian liquefied natural gas since the Kremlin started its war in Ukraine. That’s in part because of Europe’s overall drive to buy more LNG from the global market. The European Union allows imports of Russian LNG for security of supply, even if it banned transshipments of cargoes at its ports for consumers in other countries, such as China and India. European natural gas prices swung between gains and losses on Monday.

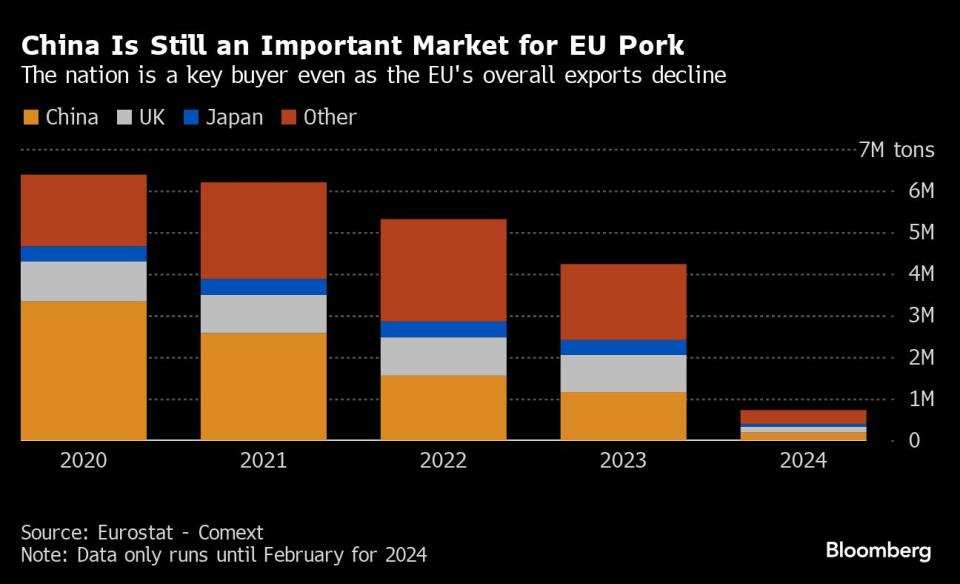

Pork

The threat of China slapping tariffs on the EU’s pork is the last thing the continent’s beleaguered industry needs. China’s probe into the industry could result in the European bloc shut out of the world’s largest pork import market. Overall EU exports have declined in recent years as African Swine Fever, increased input costs and reduced consumption hit European herd numbers, but China remained a key buyer.

Metals

Base metals have enjoyed an exciting few months after a relatively dull period for prices, and what happens next may depend on China. Consumption in the world’s biggest consumer of everything from copper to aluminum and zinc has been unusually subdued, contrasting with bullish global sentiment. The LMEX index of six metals powered to a multiyear high in May before softening, and whether it holds this year’s advance may depend on whether Chinese demand can recover. That’s the key question for traders, investors and buyers at LME Asia Week.

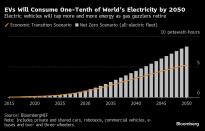

EVs

An all-electric vehicle fleet by 2050 is vital if the world is to hit the net zero goals of the Paris Agreement on climate change. That EV fleet of the future could require 8.3 petawatt-hours of electricity each year by then, BloombergNEF estimates in its latest Long-Term Electric Vehicle Outlook. That’s more than 10% of the global power demand forecast for mid-century, and 50 times as much power as the global EV fleet consumed last year. Even BNEF’s more conservative Energy Transition Scenario shows EV electricity demand in 2050 soaring past 5 petawatt-hours, or more electricity than the US consumed last year.

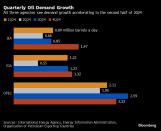

Oil

All three of the main oil forecasting agencies — the International Energy Agency, the US Energy Information Administration and the Organization of Petroleum Exporting Countries — expect oil demand growth in the second half of 2024 to be stronger than in the first half. But that’s about as far as their unity goes. The producer group sees consumption rising twice as fast as its consumer-side counterparts. The divergence comes amid bullish signals for oil demand, helped by strong US gasoline consumption during summer driving season and an air travel revival that’s giving a seasonal lift for jet fuel. Oil edged higher on Monday.

--With assistance from Doug Alexander and Martin Ritchie.

(Adds European natural gas prices in third paragraph, oil in seventh.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.