Fed’s Preferred Price Gauge Is Set to Reinforce Rate Cuts

(Bloomberg) -- US inflation figures in the coming week will reinforce that long-awaited interest-rate cuts are coming soon, while a reading on consumer spending is seen indicating that the central bank has been successful at keeping the expansion intact.

Most Read from Bloomberg

Sydney Central Train Station Is Now an Architectural Destination

Nazi Bunker’s Leafy Makeover Turns Ugly Past Into Urban Eyecatcher

How the Cortiços of São Paulo Helped Shelter South America’s Largest City

Economists see the personal consumption expenditures price index excluding food and energy — the Fed’s preferred measure of underlying inflation — rising 0.2% in July for a second month. That would pull the three-month annualized rate of so-called core inflation down to 2.1%, a smidgen above the central bank’s 2% goal.

Economists in the Bloomberg survey also expect consumer outlays, unadjusted for price changes, to climb 0.5% — the strongest advance in four months — in Friday’s report.

Speaking at the Jackson Hole symposium, Fed Chair Jerome Powell acknowledged recent progress on inflation, saying he’s gained confidence it’s on a path back to 2% and that “the time has come for policy to adjust.”

Friday’s comment marked a key turning point in the Fed’s two-year battle against price pressures and underscored how the focus has shifted toward risks in the labor market — the other part of the central bank’s dual mandate. Employment growth has helped keep consumers spending — a key to ensuring expansion of the economy.

On Thursday, the government will issue its first revision of second-quarter gross domestic product. Economists’ median projection calls for a 2.8% annualized rate of growth, unchanged from the prior reading.

Other US data in the coming week include July durable goods orders on Monday and separate indexes of consumer confidence on Tuesday and Friday.

San Francisco Fed President Mary Daly, an FOMC voting member in 2024, will appear on Bloomberg Television on Monday. Another voter, Atlanta Fed President Rafael Bostic, speaks on the economic outlook on Wednesday.

What Bloomberg Economics Says:

“Powell’s very dovish address at Jackson Hole was music to market players’ ears. He pledged the Fed would do ‘everything’ it can to support a strong labor market, providing a floor for the economy. We think a bit of a reality check is in order.”

— Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou. For full analysis, click here.

Further north, Canadian second-quarter GDP data will be the final major economic release before the central bank is expected to lower rates for a third straight meeting on Sept. 4.

Preliminary data suggested 2.2% annualized quarterly growth — higher than the central bank’s forecast of 1.5% — bolstering its efforts to engineer a soft landing while continuing to lower borrowing costs.

Investors will be also watching for the latest developments to resolve a Canadian railway dispute that has snarled North American supply chains.

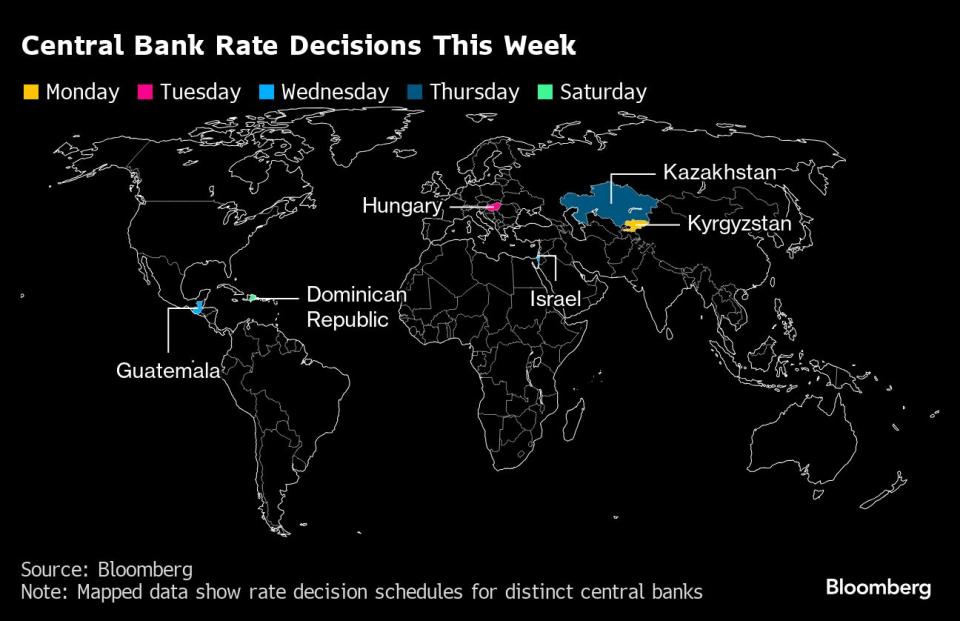

Elsewhere, the euro zone will report inflation for August less than two weeks before the European Central Bank next decides on monetary policy, while China’s central bank will set the rate on its one-year policy loans. Rate decisions include Hungary and Israel.

Click here for what happened in the past week, and below is our wrap of what’s coming up in the global economy.

Asia

The week starts with a renewed focus on China’s new monetary framework, as the People’s Bank of China sets the rate on its one-year policy loans. After a surprise cut in July, authorities are expected to hold the rate steady at 2.3%.

Monday’s decision comes after the PBOC signaled this month that it’s de-emphasizing the medium-term lending facility’s role as a policy tool, while elevating the seven-day reverse repurchase rate to greater prominence.

A day later, China gets industrial profit figures that may spur calls for more policy steps to boost the economy, and Beijing sees official PMI numbers on Saturday.

Elsewhere, prices will be a theme.

Australia’s trimmed mean inflation gauge for July will give its central bank fresh evidence to weigh as it considers whether or not to retain its hawkish rhetoric.

Japan also gets a consumer inflation update for the capital, a leading indicator for national trends. Data on Friday may show India’s year-on-year economic growth slowed a tad in the second quarter, and trade figures are due during the week from Thailand, Sri Lanka and Hong Kong. Kazakhstan’s central bank meets Thursday to decide whether to cut its key rate for a third consecutive meeting.

For more, read Bloomberg Economics’ full Week Ahead for Asia

Europe, Middle East, Africa

Inflation data will be in focus for Europe as well, with August numbers due from the region’s big economies — Germany, France, Italy and Spain — along with a reading for the 20-nation euro zone as a whole.

A slowdown is expected for the bloc from July’s 2.6%, paving the way for the ECB to lower interest rates for the second time this cycle when it meets in September.

Such expectations have been reinforced by the continent’s economic predicament. While August’s Purchasing Managers’ Index got an unexpected boost from the Paris Olympics, underlying weakness is likely to persist beyond that temporary lift. The start of the week will see updates on output and sentiment in Germany — the region’s current weak spot.

Speakers likely to comment on monetary policy and the latest shifts in the economy include ECB Governing Council members Joachim Nagel and Klaas Knot, as well as Executive Board member Isabel Schnabel.

In Eastern Europe, Hungary is expected to keep interest rates on hold at 6.75%. It’s a similar story in the Middle East, where Israel’s central bank is seen keeping benchmark borrowing costs at 4.5%.

In Africa, there’ll be August inflation readings from Kenya and Uganda, along with second-quarter GDP figures from Nigeria.

For more, read Bloomberg Economics’ full Week Ahead for EMEA

Latin America

Brazil’s central bank on Monday posts its weekly survey of economists. Bank President Roberto Campos Neto this month said inflation expectations are unmoored and that officials are ready to tighten monetary policy if needed.

Brazil’s mid-month inflation data on Tuesday may show a slight easing from July’s 4.45%, still well above the 3% target. Analysts are marking up their interest-rate forecasts while traders are pricing in a hike as soon as next month.

Fiscal slippage has put Brazil’s budget data — the July figures are slated for publication in the coming week — in the spotlight. Economists surveyed by the central bank don’t see an annual nominal or primary budget surplus to the 2027 forecast horizon.

The main event in Mexico will be the central bank’s quarterly inflation report. New forecasts are unlikely so soon after revisions made in the bank’s Aug. 8 post-decision communique, but policymakers may re-examine GDP estimates.

Chile’s June retail sales figures will likely show a seventh consecutive positive year-on-year print after nearly two years of declines.

For more, read Bloomberg Economics’ full Week Ahead for Latin America

--With assistance from Robert Jameson, Laura Dhillon Kane, Zoe Schneeweiss, Paul Richardson and Brian Fowler.

(Updates with Fed speakers in eighth paragraph.)

Most Read from Bloomberg Businessweek

Losing Your Job Used to Be Shameful. Now It’s a Whole Identity

FOMO Frenzy Fuels Taiwan Home Prices Despite Threat of China Invasion

©2024 Bloomberg L.P.