Is ExxonMobil a Millionaire Maker?

ExxonMobil (NYSE: XOM) is among the largest energy companies in the world. Whether it is using the Exxon, Mobil, or Esso nameplate, there's probably an ExxonMobil gas station somewhere near you. But being big and well known isn't enough to make the stock a millionaire maker. Here's what investors need to understand before they buy ExxonMobil.

1. ExxonMobil is an industry giant

ExxonMobil has a market cap of roughly $500 billion. That's a huge number for any company, and it definitely puts Exxon in the top tier of the energy sector. Notably, the company's business spans across the entire energy sector, including the upstream (oil and natural gas production), midstream (pipelines), and downstream (chemicals and refining) segments.

Being large and diversified, at least within the energy sector, is a good thing. It means that Exxon has the heft to invest heavily in the types of large projects that are common in the energy world. And, at the same time, that it has enough balance in its business to weather the ups and downs inherent in the energy sector. Oil and natural gas prices are still the main driver of performance, but the peaks and valleys aren't quite as dramatic for Exxon as they would be for a pure-play energy producer.

This makes ExxonMobil an attractive option for long-term investors with a more conservative approach.

2. ExxonMobil has a strong financial foundation

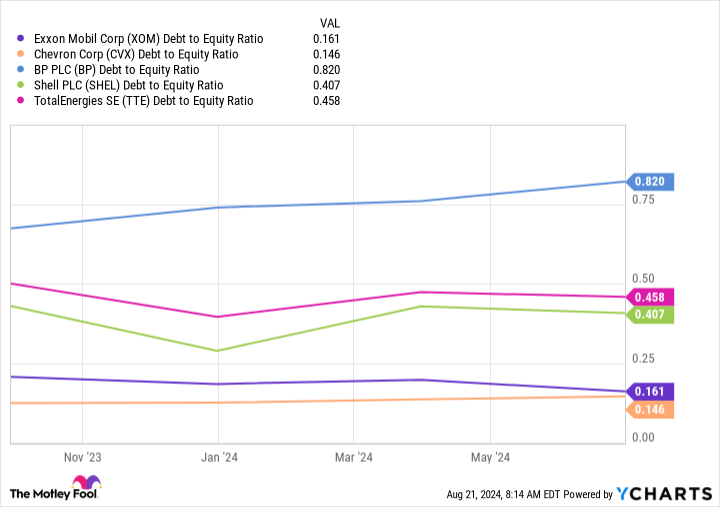

Of course, being big isn't really enough to ensure a company's business survives over the long term, which is why it is so important that ExxonMobil also has among the strongest balance sheets of its closest competitors. Its debt-to-equity ratio of 0.16 times would be low for any company, but it happens to be the second-best ratio among Exxon's peer group.

Low leverage gives Exxon the wherewithal to take on debt during industry downturns so that it can keep investing in its business and supporting its dividend. The dividend, notably, has been increased annually for over four decades despite the volatility of the energy sector.

This kind of flexibility is vital in a commodity-driven industry that is known for swift and dramatic commodity price swings.

3. ExxonMobil can change when it wants to

From a long-term perspective, the biggest headwind Exxon faces is not oil price volatility, it is the global shift toward cleaner energy sources. Although Exxon has been dabbling in clean energy, it has really chosen to stick to its oil and natural gas roots. The logic is sound, given that these fuels, despite being volatile commodities, are likely to remain vital energy sources for decades to come.

However, it is important for investors to understand how quickly Exxon could change if it wanted to change. The last acquisition Exxon made was its roughly $60 billion purchase of Pioneer Energy. The goal was to expand the company's footprint in the onshore U.S. energy sector, but there's no particular reason why Exxon couldn't spend just as much, or more, to buy a clean energy company. That, in one quick move, could vault Exxon into the upper echelon of the clean energy sector. For reference, Brookfield Renewable Partners, a large and globally diversified clean energy business, only has a market cap of around $15 billion.

Exxon's ability to make huge deals gives it a survival edge that most companies can't match.

4. The price you pay for ExxonMobil matters a lot

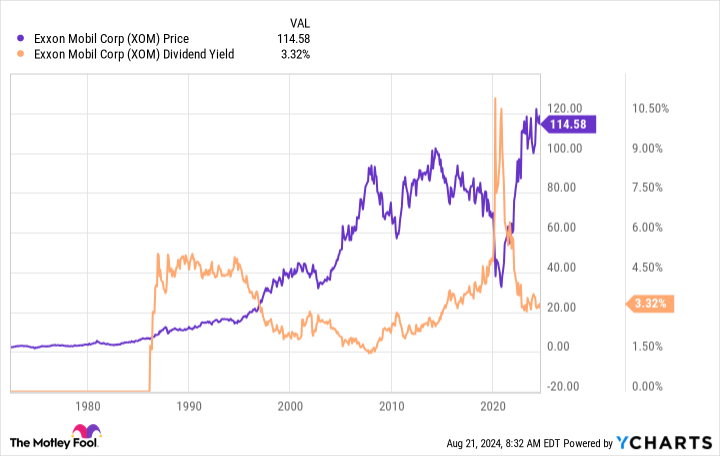

So far, ExxonMobil has all the makings of a company that could, over time, help you reach seven-figure status. But there's one problem that has percolated throughout the three points above -- volatile energy markets. Given that Exxon's top and bottom lines are heavily influenced by the frequently large swings in energy prices, its stock price tends to rise and fall in often dramatic fashion, too.

As the chart above shows, Exxon's stock price is fairly high today. Its dividend yield is a bit low, at around 3.3%. When energy prices go south, Exxon's stock price can crater, pushing the yield dramatically higher. If you are looking for Exxon to fill the energy component of a diversified, millionaire-making portfolio, you'll probably want to wait until the energy sector is out of favor before you buy it. That's when you'll likely get the best deal on the stock, giving it the most attractive opportunity to provide strong long-term returns and a robust income stream.

Timing matters when it comes to buying ExxonMobil, given the volatile nature of energy prices.

Is ExxonMobil a millionaire maker? Yes and no.

Exxon probably isn't the best investment to get you to millionaire status all on its own because of its concentration in the cyclical and highly volatile energy sector. However, given the company's size, diversification, financial strength, and ability to make big moves, it could be a vital piece of a larger portfolio, providing broad exposure to the energy sector that could, when appropriate, adjust along with changing global energy demand.

That said, to give yourself the best chance for success you'll probably want to make sure you buy Exxon when the energy sector is out of favor. That will require you to plan ahead, since it will mean buying when others are selling. However, history shows that oil downturns are followed by upturns. If you can be patient and think like a contrarian, Exxon could, indeed, help you reach seven figures.

Should you invest $1,000 in ExxonMobil right now?

Before you buy stock in ExxonMobil, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ExxonMobil wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Reuben Gregg Brewer has positions in TotalEnergies. The Motley Fool has positions in and recommends BP and Chevron. The Motley Fool recommends Brookfield Renewable Partners. The Motley Fool has a disclosure policy.

Is ExxonMobil a Millionaire Maker? was originally published by The Motley Fool