Exploring Three TSX Growth Companies With High Insider Ownership

Amidst a backdrop of economic normalization and shifting central bank policies, the Canadian market presents a unique landscape for investors, particularly in sectors less sensitive to commodity price fluctuations. In this context, growth companies with high insider ownership can offer compelling opportunities as they often signal confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

Payfare (TSX:PAY) | 15% | 57.7% |

goeasy (TSX:GSY) | 21.7% | 15.9% |

Vox Royalty (TSX:VOXR) | 12.4% | 77.3% |

Aritzia (TSX:ATZ) | 19% | 51.2% |

Allied Gold (TSX:AAUC) | 22.5% | 68.2% |

ROK Resources (TSXV:ROK) | 16.6% | 159.6% |

Aya Gold & Silver (TSX:AYA) | 10.2% | 51.6% |

Silver X Mining (TSXV:AGX) | 14.2% | 144.2% |

Ivanhoe Mines (TSX:IVN) | 13.1% | 65.3% |

Artemis Gold (TSXV:ARTG) | 31.8% | 48.8% |

We're going to check out a few of the best picks from our screener tool.

Aritzia

Simply Wall St Growth Rating: ★★★★★☆

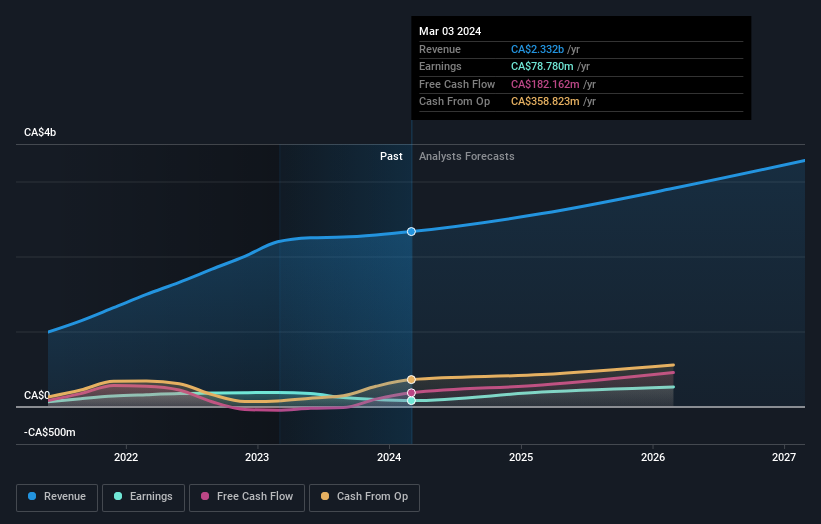

Overview: Aritzia Inc. is a company that designs, develops, and sells women's apparel and accessories in the United States and Canada, with a market capitalization of approximately CA$4.17 billion.

Operations: The company generates CA$2.33 billion in revenue from its apparel and accessories segment.

Insider Ownership: 19%

Aritzia has shown a robust growth trajectory with expected annual revenue and profit increases outpacing the Canadian market average, projected at 11% and 51.2% respectively. Despite a recent dip in net profit margins from 8.5% to 3.4%, the company maintains strong insider ownership, enhancing its appeal as a growth-oriented investment. Additionally, Aritzia's strategic share repurchases underscore confidence in its valuation, currently deemed significantly below fair value by analysts.

goeasy

Simply Wall St Growth Rating: ★★★★★☆

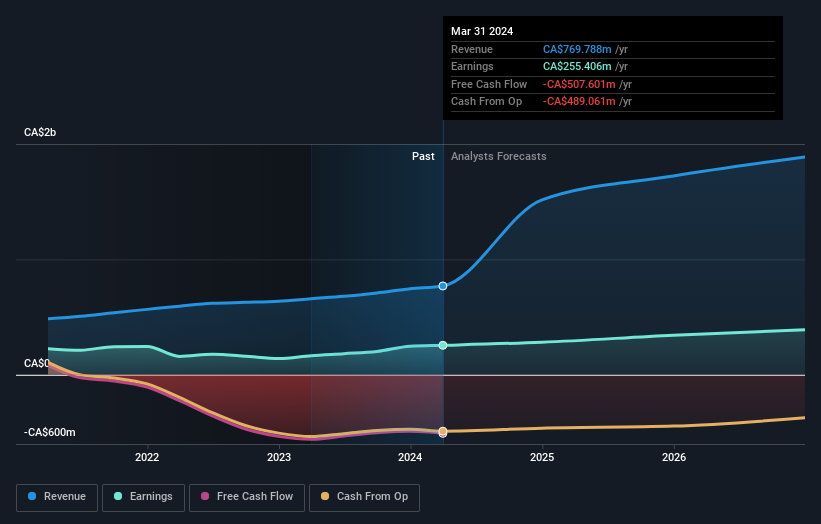

Overview: goeasy Ltd. operates in Canada, offering non-prime leasing and lending services through its easyhome, easyfinancial, and LendCare brands with a market cap of CA$3.22 billion.

Operations: The company generates revenue through its leasing services branded as easyhome, which brought in CA$153.99 million, and its lending services under easyfinancial, contributing CA$1.17 billion.

Insider Ownership: 21.7%

goeasy Ltd. has demonstrated substantial growth, with a recent earnings increase of 54.3% year-over-year and revenue growth projected at 32.7% annually, outpacing the Canadian market's 7.1%. Despite challenges in covering debt with operating cash flow, the company benefits from high insider ownership and strategic leadership changes, including appointing Patrick Ens to enhance its consumer credit divisions. This positions goeasy as an attractive entity in the high-growth sector, though it trades at 39.6% below estimated fair value.

Take a closer look at goeasy's potential here in our earnings growth report.

Our expertly prepared valuation report goeasy implies its share price may be lower than expected.

Ivanhoe Mines

Simply Wall St Growth Rating: ★★★★★☆

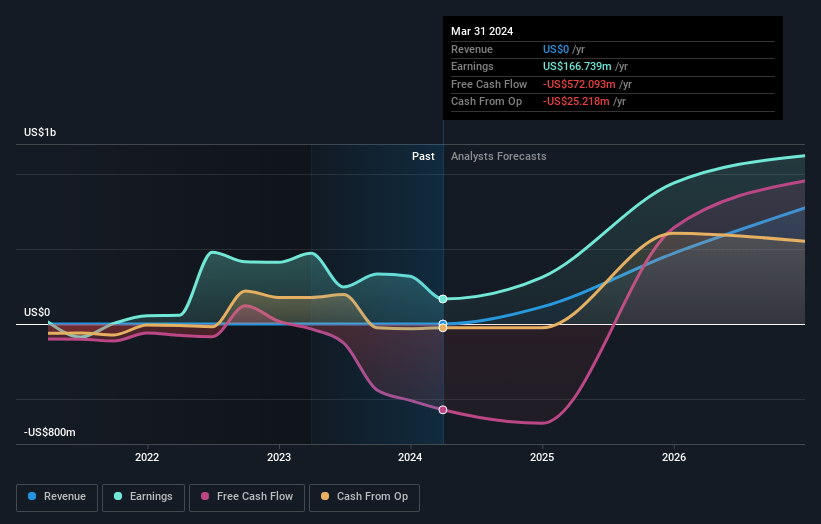

Overview: Ivanhoe Mines Ltd. is a company focused on the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market capitalization of approximately CA$23.26 billion.

Operations: The firm primarily generates revenue through the mining, development, and exploration of minerals and precious metals in Africa.

Insider Ownership: 13.1%

Ivanhoe Mines showcases robust growth prospects, with earnings expected to rise by 65.3% annually, outpacing the Canadian market significantly. Despite generating less than US$1m in revenue currently, forecasts indicate an 83.6% yearly increase in revenue, well above the market average. Insider transactions have not been substantial recently; however, more shares were purchased than sold by insiders over the past three months. The company's recent completion of the Phase 3 concentrator at Kamoa-Kakula ahead of schedule enhances its production capabilities and positions it for increased output and efficiency.

Unlock comprehensive insights into our analysis of Ivanhoe Mines stock in this growth report.

The valuation report we've compiled suggests that Ivanhoe Mines' current price could be inflated.

Seize The Opportunity

Access the full spectrum of 30 Fast Growing TSX Companies With High Insider Ownership by clicking on this link.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSX:ATZ TSX:GSY and TSX:IVN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com