Exploring Three TSX Growth Companies With Strong Insider Ownership

The Canadian market continues to navigate through a landscape marked by evolving economic trends and shifting market conditions, as analyzed by experts like Craig Fehr. In this environment, understanding the nuances of growth companies with high insider ownership can offer investors a unique perspective on potential resilience and commitment to long-term success.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

goeasy (TSX:GSY) | 21.7% | 15.9% |

Payfare (TSX:PAY) | 15% | 57.7% |

Vox Royalty (TSX:VOXR) | 12.4% | 77.3% |

Aritzia (TSX:ATZ) | 19.1% | 51.6% |

Allied Gold (TSX:AAUC) | 22.4% | 68.2% |

ROK Resources (TSXV:ROK) | 16.6% | 159.6% |

Aya Gold & Silver (TSX:AYA) | 10.2% | 51.6% |

Silver X Mining (TSXV:AGX) | 14.2% | 144.2% |

Ivanhoe Mines (TSX:IVN) | 13.2% | 65.8% |

Almonty Industries (TSX:AII) | 12.4% | 82.1% |

We'll examine a selection from our screener results.

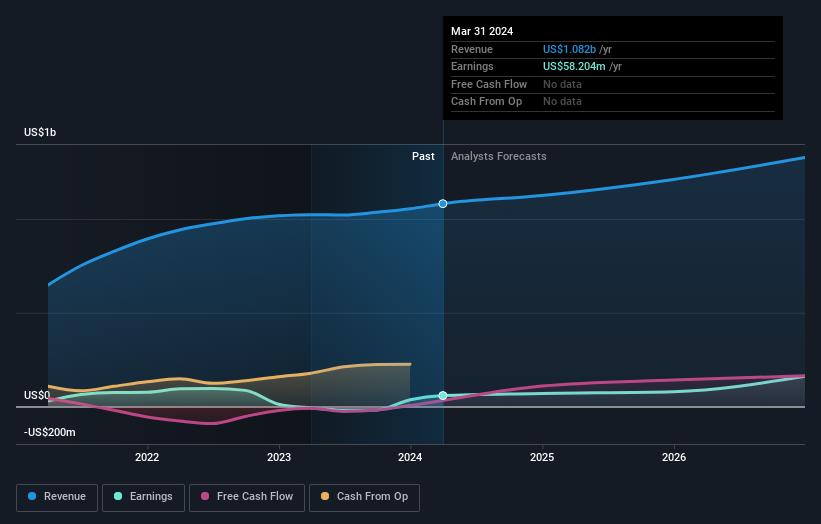

Green Thumb Industries

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Green Thumb Industries Inc., operating in the United States, focuses on the manufacturing, distribution, marketing, and sale of cannabis products for both medical and adult use, with a market capitalization of approximately CA$3.68 billion.

Operations: The company's revenue is primarily generated from two segments: Retail, which brought in $806.38 million, and Consumer Packaged Goods, contributing $583.78 million.

Insider Ownership: 10.9%

Earnings Growth Forecast: 23.5% p.a.

Green Thumb Industries has demonstrated notable financial growth, with a recent report showing a substantial increase in sales and net income for Q1 2024. Despite this, insider transactions have not been significant in the past three months. The company's revenue growth forecast of 10.3% annually outpaces the Canadian market prediction but remains below more aggressive growth benchmarks. While GTII's earnings are expected to grow significantly over the next three years, its return on equity is projected to be modest at 7.5%.

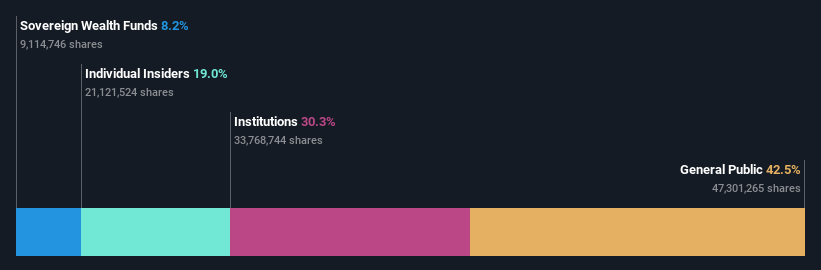

Aritzia

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aritzia Inc. operates as a fashion retailer specializing in women's apparel and accessories, primarily in the United States and Canada, with a market capitalization of approximately CA$3.79 billion.

Operations: The company generates its revenue primarily from the sale of women's apparel, totaling CA$2.33 billion.

Insider Ownership: 19.1%

Earnings Growth Forecast: 51.6% p.a.

Aritzia, a Canadian retailer, is trading significantly below its estimated fair value and analysts expect a notable price increase of 29.2%. The company's earnings are forecasted to grow by 51.62% annually, outpacing the Canadian market significantly. Despite this strong growth projection, recent financial results show a decline in net income from CAD 187.59 million to CAD 78.78 million year-over-year, with profit margins also decreasing. Aritzia has recently completed a share buyback program but provided conservative revenue guidance for fiscal 2025.

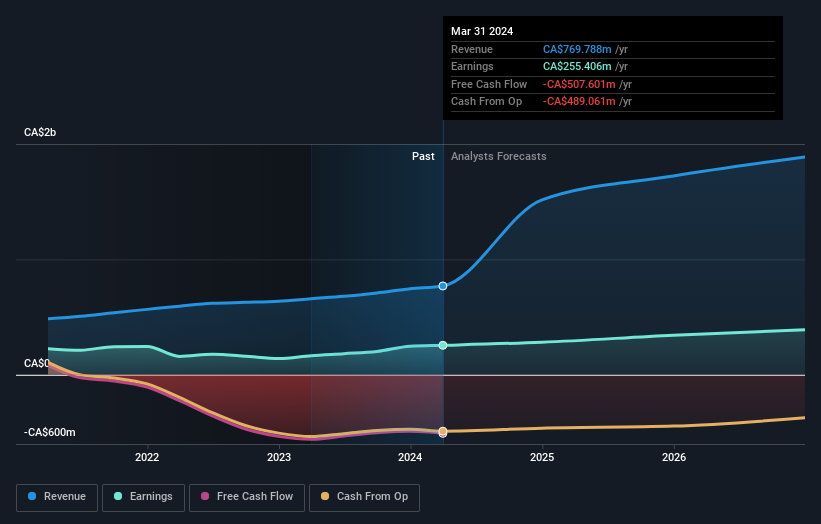

goeasy

Simply Wall St Growth Rating: ★★★★★☆

Overview: goeasy Ltd. operates in Canada, offering non-prime leasing and lending services through its easyhome, easyfinancial, and LendCare brands with a market cap of approximately CA$3.05 billion.

Operations: The company generates revenue through its easyhome and easyfinancial segments, totaling CA$153.99 million and CA$1.17 billion respectively.

Insider Ownership: 21.7%

Earnings Growth Forecast: 15.9% p.a.

goeasy Ltd., a growth company with high insider ownership, is positioned well below its fair value, offering potential for a 22.8% price increase. With revenue growth forecasted at 32.7% annually, it outpaces the Canadian market significantly. Despite challenges in covering debt with operating cash flow and dividends not well supported by cash flows, earnings are expected to grow by 15.95% annually. The recent appointment of Patrick Ens as President could further strengthen its strategic direction and operational efficiency.

Dive into the specifics of goeasy here with our thorough growth forecast report.

Upon reviewing our latest valuation report, goeasy's share price might be too pessimistic.

Make It Happen

Explore the 31 names from our Fast Growing TSX Companies With High Insider Ownership screener here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include CNSX:GTII TSX:ATZ and TSX:GSY.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com