Exploring Three Premier US Stocks With Intrinsic Discounts Ranging From 28.4% To 49.8%

Amidst a vibrant rebound in major U.S. stock indices, with the S&P 500 and Nasdaq Composite climbing sharply higher, investors are keenly watching the market's response to recent tech rallies and political shifts. In such a market environment, identifying stocks that appear undervalued relative to their intrinsic value could offer attractive opportunities for discerning investors.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

Name | Current Price | Fair Value (Est) | Discount (Est) |

Noble (NYSE:NE) | $47.02 | $93.33 | 49.6% |

UMB Financial (NasdaqGS:UMBF) | $95.66 | $189.12 | 49.4% |

Popular (NasdaqGS:BPOP) | $101.20 | $201.65 | 49.8% |

Oddity Tech (NasdaqGM:ODD) | $39.45 | $78.79 | 49.9% |

First Community (NasdaqCM:FCCO) | $21.61 | $43.14 | 49.9% |

AppLovin (NasdaqGS:APP) | $83.24 | $164.47 | 49.4% |

Sea (NYSE:SE) | $67.47 | $133.73 | 49.5% |

Smartsheet (NYSE:SMAR) | $48.55 | $95.82 | 49.3% |

Nutanix (NasdaqGS:NTNX) | $49.35 | $97.44 | 49.4% |

Genius Sports (NYSE:GENI) | $6.32 | $12.51 | 49.5% |

Let's take a closer look at a couple of our picks from the screened companies.

Popular

Overview: Popular, Inc. operates as a banking services provider offering retail, mortgage, and commercial banking products across Puerto Rico, the United States, and the British Virgin Islands with a market capitalization of approximately $7.16 billion.

Operations: The company generates revenue primarily through its segments, with $347.06 million from Popular U.S. and $2.21 billion from Banco Popular de Puerto Rico.

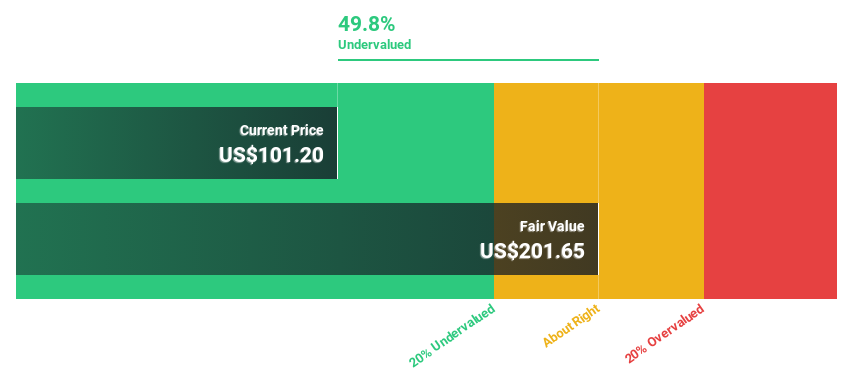

Estimated Discount To Fair Value: 49.8%

Popular, Inc. appears undervalued based on cash flow analysis, trading at 49.8% below its estimated fair value of US$201.65 with a current price of US$101.2. Despite this, the company faces challenges such as a low forecasted return on equity at 11.9% and unstable dividend track record, alongside significant insider selling over the past quarter. However, it benefits from expected earnings growth of 20.6% per year and revenue growth projected to outpace the U.S market average at 11.2% annually.

New Oriental Education & Technology Group

Overview: New Oriental Education & Technology Group Inc., operating in the educational services sector, has a market capitalization of approximately $12.26 billion.

Operations: The revenue segments for the company, operating in the educational services sector, are not specified in the provided text.

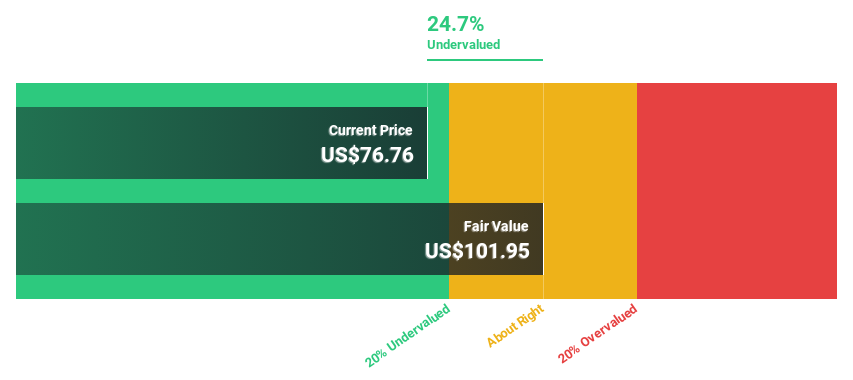

Estimated Discount To Fair Value: 28.4%

New Oriental Education & Technology Group is considered undervalued, trading at US$76.32 against a fair value of US$106.56 based on cash flow analysis. The company's earnings are expected to grow significantly at 27.7% annually, outpacing the U.S market forecast of 14.8%. Despite this promising growth, its revenue increase is slower than anticipated at 18.4% yearly compared to a higher market rate and has a low projected return on equity of 14%.

TAL Education Group

Overview: TAL Education Group is a provider of K-12 after-school tutoring services in the People’s Republic of China, with a market capitalization of approximately $6.11 billion.

Operations: The company generates approximately $1.49 billion in revenue from its K-12 after-school tutoring services.

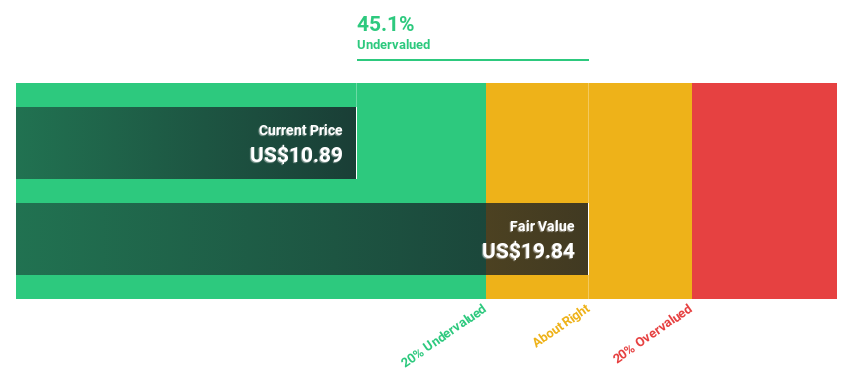

Estimated Discount To Fair Value: 45.1%

TAL Education Group's financial recovery is evident with a significant reduction in net loss and a shift to profitability in the recent quarter. Despite trading at US$10.89, well below the estimated fair value of US$19.84, TAL shows potential for growth. Analysts predict a 47.6% increase in stock price, supported by expected revenue growth outpacing the U.S market average and forecasted profit emergence within three years. However, its Return on Equity remains low at 7.5%, signaling cautious optimism for long-term investors focusing on cash flows.

Where To Now?

Unlock more gems! Our Undervalued US Stocks Based On Cash Flows screener has unearthed 178 more companies for you to explore.Click here to unveil our expertly curated list of 181 Undervalued US Stocks Based On Cash Flows.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:BPOP NYSE:EDU and NYSE:TAL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com