Exploring 3 Premier Undervalued Small Caps With Insider Buying In The United Kingdom

The United Kingdom's FTSE 100 index has recently faced downward pressure, influenced by weak trade data from China and a broader global economic slowdown. Despite these challenges, the small-cap segment offers unique opportunities for investors seeking growth potential in undervalued stocks with insider buying. In this article, we will explore three premier undervalued small-cap stocks in the United Kingdom that have garnered attention due to recent insider purchases.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Bytes Technology Group | 24.5x | 5.5x | 13.17% | ★★★★★☆ |

Breedon Group | 14.9x | 0.9x | 49.74% | ★★★★★☆ |

Essentra | 846.0x | 1.6x | 47.42% | ★★★★★☆ |

GB Group | NA | 3.0x | 33.48% | ★★★★★☆ |

Norcros | 7.4x | 0.5x | 4.29% | ★★★★☆☆ |

NWF Group | 9.1x | 0.1x | 32.51% | ★★★★☆☆ |

CVS Group | 22.5x | 1.2x | 40.50% | ★★★★☆☆ |

Hochschild Mining | NA | 1.8x | 38.28% | ★★★★☆☆ |

Foxtons Group | 27.6x | 1.3x | 45.80% | ★★★☆☆☆ |

Franchise Brands | 115.2x | 2.9x | 49.53% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

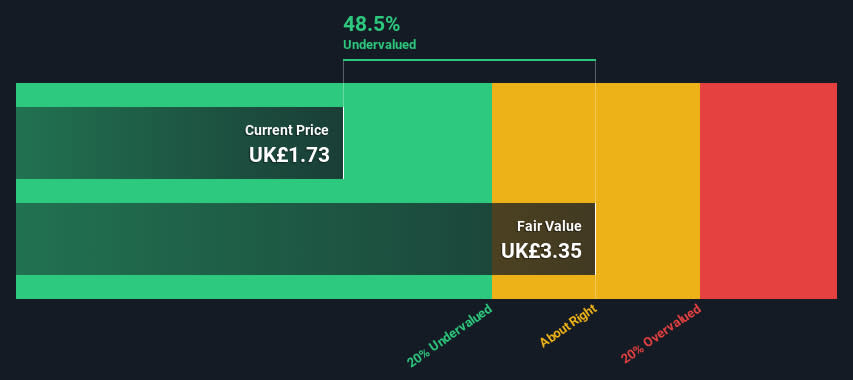

Essentra

Simply Wall St Value Rating: ★★★★★☆

Overview: Essentra is a global provider of essential components and solutions, specializing in three main divisions: Components, Packaging, and Filters, with a market cap of approximately £0.65 billion.

Operations: Essentra's revenue streams are primarily derived from its core operations, with a notable gross profit margin trend peaking at 46.14% in the most recent period. The company's cost of goods sold (COGS) and operating expenses have fluctuated, impacting net income margins which have varied significantly over the observed periods.

PE: 846.0x

Essentra, a UK-based company, reported half-year sales of £159.7 million as of June 30, 2024, down from £166.3 million the previous year. Net income dropped to £1.3 million from £6.9 million in the same period last year. Despite this dip in earnings, Essentra declared an interim dividend increase to 1.25 pence per share and has shown insider confidence with recent purchases by executives over the past six months. The company relies entirely on external borrowing for funding and forecasts a modest annual earnings growth of 2%.

Take a closer look at Essentra's potential here in our valuation report.

Examine Essentra's past performance report to understand how it has performed in the past.

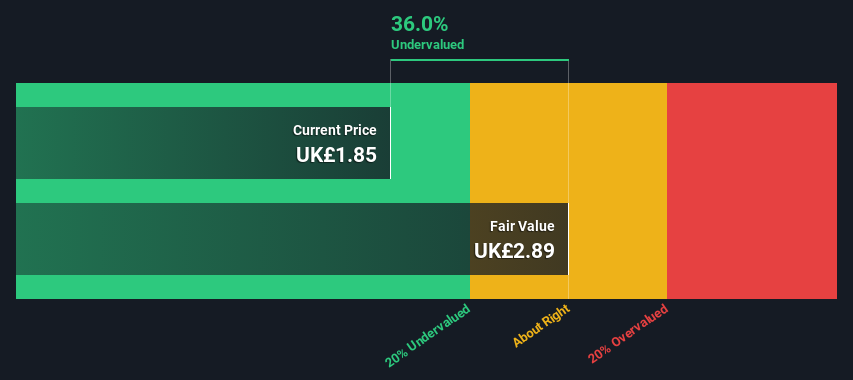

Hochschild Mining

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hochschild Mining is a precious metals company primarily engaged in the exploration, mining, processing, and sale of silver and gold with a market cap of approximately £0.58 billion.

Operations: Hochschild Mining generates revenue primarily from its Inmaculada, San Jose, and Pallancata operations. The company reported a gross profit margin of 26.46% for the period ending December 31, 2023. Operating expenses and non-operating expenses significantly impact net income, which was -$55.01 million for the same period on a revenue of $693.72 million.

PE: -23.0x

Hochschild Mining, a UK-based company, has shown promising signs of being undervalued. In Q2 2024, they reported silver production of 2,589 koz and gold production of 66.37 koz, with total silver equivalent at 8,097 koz and gold equivalent at 97.56 koz. Insider confidence is evident as Eduardo Navarro purchased 148,000 shares worth £235K in July 2024. The firm reiterated its annual production guidance of up to 360K gold equivalent ounces for the year.

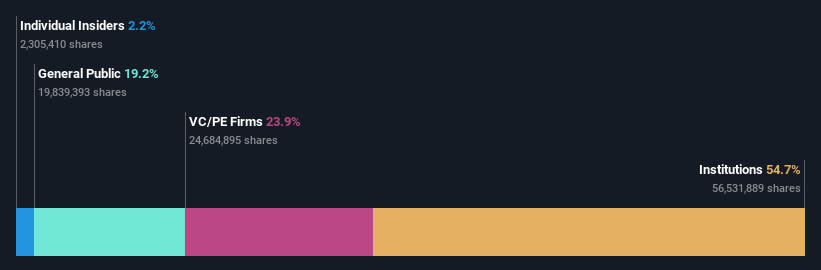

Wizz Air Holdings

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Wizz Air Holdings is a European low-cost airline operating an extensive route network with a market cap of approximately €2.50 billion.

Operations: Wizz Air Holdings generates revenue primarily from its entire route network, with significant costs attributed to COGS and operating expenses. The company's net income margin has shown variability, most recently at 6.27% for the period ending June 30, 2024. Gross profit margin has also fluctuated, reaching 22.49% in the same period.

PE: 4.9x

Wizz Air Holdings, a smaller UK airline, has seen insider confidence with significant share purchases in the past six months. Despite recent challenges, including a slight dip in passenger numbers and load factors for July 2024 compared to last year, the company remains optimistic. They forecast net income between €350 million and €450 million for fiscal 2025. Recent leadership changes aim to strengthen operational efficiency and commercial strategy under new senior executives starting October 2024.

Where To Now?

Take a closer look at our Undervalued UK Small Caps With Insider Buying list of 29 companies by clicking here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:ESNT LSE:HOC and LSE:WIZZ.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com